9.4 Rollover Accounts

For Rollover Accounts, the area under the curve is a function of the timing of runoff and the amount of principal runoff. By calculating an average day of run-off, the area under the new business curve can be matched by generating new bookings on the average date, as shown in the following figure:

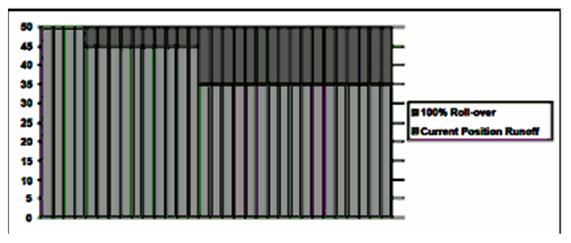

Figure 9-5 Flat Balance Sheet

Average day of runoff = ($5 * 5 days + $10 * 15 days)/$15 = 11 2/3 days Balance Plug: 1/3 * $15* 1.5 = $7.50 on the 11th 2/3 * $15* 1.5 = $15 on the 12th Ending Balance = $57.50 Average Balance=($50 * 4 days + $45 * 6 days + $52.50 * 1 day + $67.50 * 3 days + $57.50 * 17 days)/ 31 = 54.9193

When comparing the average and ending balance with the numbers generated from the above figure, note that the values are the same. This is because we have changed the shape of the new business curve, but matched the area under the curve.

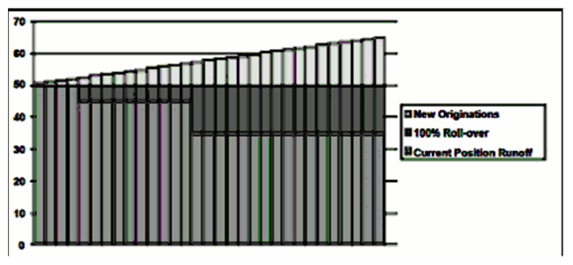

For new originations, the area under the curve is a function of the targeted change in the balance over the bucket, the timing of the runoff of the current position at the start of the bucket, and the amount of principal runoff.

This can be broken into two components:

A component of a new business that assumes a flat balance sheet. This is equal to 100% roll-over, as shown in the above figure.

The new origination component, which can be viewed as a gradually increasing balance over the flat balance sheet, as shown in the following figure:

Figure 9-6 New Originations Separated by Components

New Business is approximated by splitting the new business into the two components: the average day roll-over method displayed in example 3 to account for the 100% roll-over component of new business plus an additional method to account for the new originations.

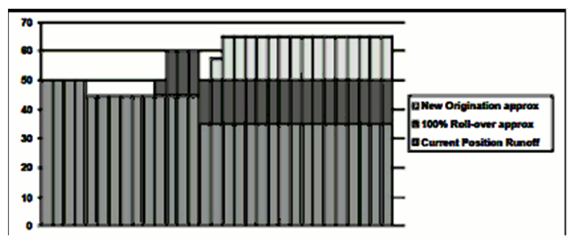

That is because, the shape of the new originations curve is a triangle, the area of this shape can be calculated as:

1/2 days in the bucket * new origination balance.

The same area can be achieved by booking the entire balance at the mid-point of the bucket. Because, in this case, the mid-point of the bucket falls between two days, the balance should be spread evenly over those two days: $7.50 on the 15th and $7.50 on the 16th, as shown in following figure:

Figure 9-7 New Origination Average Date Method

Ending Balance = $65

Average Balance = $50 * 4 days + $45 * 6 days + $50 * 1 day + $60 * 3 days + $50.00 *1 day + 57.50 * 1 day + 65 * 15 days = $57.50

These approaches assume that, after new business has been added, no payments will not occur within the same bucket. To avoid this issue, any payments that occur within the bucket must trigger a secondary set of new originations.