9.3 New Originations

For New Originations, users could make several assumptions about the timing. For instance, they could assume that it occurs at a single date within the bucket, that it occurs evenly over the bucket, or that it accelerates over the bucket. For our purposes, we are assuming that new originations are booked evenly over the modeling bucket; the balance will grow gradually over the modeling period.

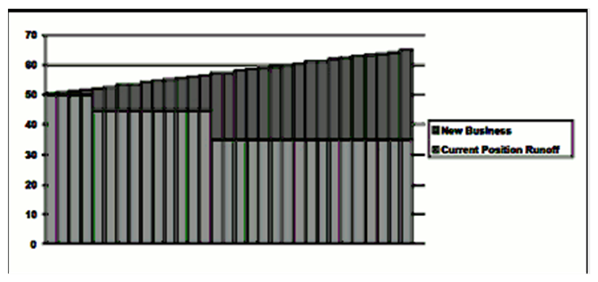

For new originations, the booking of new accounts is done in a manner that best approximates the user's assumptions about the timing of new business over the bucket. In the case of even bookings over the bucket, the balance in the account appears graphically as a straight, positively sloped line. To match this assumption in the model, a new business record must be generated for each day in the bucket, as shown in the following figure:

Figure 9-2 New Originations (30% Growth)

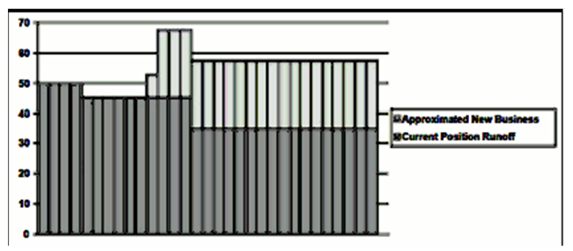

Figure 9-3 Average Date Roll-over Method

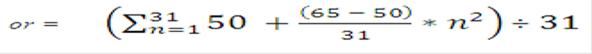

Ending Balance = $65

Average Balance = ($50 + $65)/ 2 = $57.50

Figure 9-4 Formula for Ending Balance and Average Balance

The problem with both of these approaches is performance. The more new business instruments generated per bucket, the longer the processing time will be. For processing efficiency, it is necessary to minimize the number of dates during the bucket when a new business is added.

To create the most accurate results, the new business should come as close as possible to matching the area between the new business curve and the current position curve. By matching the area under the curve, we generate the same ending balance and average balance as would be generated if new bookings were made every day.