10.1.2 Definitions

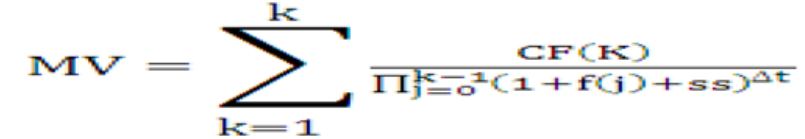

Neither the static spread nor the OAS can be defined directly as they are solutions of two different equations. We give hereafter a simplified version of the equations that the system solves, using the assumptions described earlier. The static spread is the value ss that solves the following equation:

Equation 1

Figure 10-1 Equation 1

Description of the Transfer Pricing Option Cost Equation 1 follows:

Where:

Table 10-1 Transfer Pricing Option Cost Equation 1

| :MV | market, or book, or par value of the instrument (as selected in the Transfer Pricing rule) |

|---|---|

|

CF(k) |

cash flow occurring at the end of month k along with the forward rate scenario |

|

:f(j) |

forward rate for month j |

|

∆t |

length (in years) of the compounding period; hard-coded to a month, such as 1/12 |

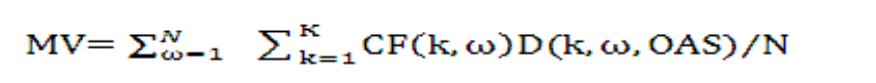

In the Monte Carlo Methodology, the option adjusted-spread is the value OAS that solves the following equation:

Equation 2:

Figure 10-2 Equation 2

Description of the Transfer Pricing Option Cost Equation 2 follows:

Where:

Table 10-2 Transfer Pricing Option Cost Equation

| : N | total number of Monte Carlo scenarios |

|---|---|

|

CF(K,ω) |

cash flow occurring at the end of month k along scenario ω |

|

D(k, ω,OAS) |

fstochastic discount factor at the end of month k along scenario ω for a particular OAS |

- Cash Flows are calculated up till maturity even if the instrument is

adjustable.

Note:

Otherwise, the calculations would not catch the cost of caps or floors. - In the real calculations, the formula for the stochastic discount factor is simplified.