13.14.1 Merton Model

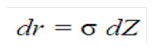

One simple assumption about interest rates is that they follow a simple random walk with a zero drift. In Stochastic Process terms, we would write the change in r as:

Figure 13-8 Merton Model Formula

Description of formula to calculate the dr for Merton Model follows:

The change in the short rate of interest r equals a constant sigma time a random shock term where Z represents a standard Wiener process with mean zero and standard deviation of 1.

This model has the following virtues and liabilities:

- It is a simple analytical formula.

- Zero-coupon bond prices are a quadratic function of time to maturity.

- Yields turn negative (and zero-coupon bond prices rise above one) beyond a certain point.

- If interest rate volatility is zero, zero-coupon bond yields are constant for all maturities and equal to r.

The Merton model gives us very important insights into the process of deriving a term structure model. Its simple formulas make it a useful expository tool, but the negative yields that result from the formula are a major concern.