8.2.10.2 Module Usage

Oracle ALM and Funds Transfer Pricing cash flow methodologies use AMRT_

TYPE_CD to determine the calculation method of the record's amortization of

principal and the resulting calculation of interest. The following are the supported

AMRT_TYPE code values.

Table 8-4 List of Conventionally Amortization Type Code Values

| Conventionally Amortizing | Description |

|---|---|

| 100 | Conventional Fixed |

| 400 | Balloon |

| 500 | Adjustable Conventional |

| 600 | Adjustable Negative Amortizing |

| 840 | Lease |

Table 8-5 List of Non-Conventionally Amortization Type Code Values

| Non Conventionally Amortizing | Description |

|---|---|

| 700 | Simple Interest |

| 710 | Rule of 78s |

| 800 - 802 | Payment Schedules |

| 820 | Level Principal |

| 850 | Annuity |

| 999 | Default Value |

| 1000 - 69999 | User-Defined Payment Patterns |

| 70000-99999 | User-Defined Behavior Patterns |

The following are the explanations of each of the amortization type codes.

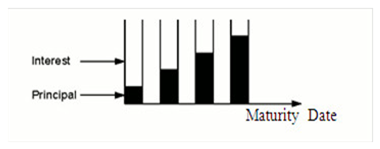

Figure 8-1 100, 400, 500, 600, 840 - Conventionally Amortizing AMRT_TYPE_CDs

Description of amortization type codes follows:

The conventional amortization loan types have loan payments that are unevenly divided between principal balance and interest owed. The total payment amount (principal + interest) is generally equal throughout the life of the loan. The interest portion (non-shaded portion) of each payment is calculated based on the record's interest rate and the remaining balance of the loan. Therefore, close to the loan's origination, a higher portion of the payment consists of interest rather than principal. As the loan is paid down, an increasing portion of each payment is allocated to the principal until a zero balance is reached at maturity.

Note:

For Lease amortization, the principal is reduced to the amount defined in the RESIDUAL_AMOUNT column rather than zero.

For these five AMRT_TYPE_CDs, the amount in the

CUR_PAYMENT and/or ORG_PAYMENT_AMT fields should

equal the principal plus interest.

Following is a breakout of these four conventionally amortizing

AMRT_TYPE_CDs:

Table 8-6 Conventionally Amortizing AMRT_TYPE_CDs

| Conventional Loan Type | Description |

|---|---|

| 100 Conventional Fixed | (Described earlier) |

| 400 Balloon | A loan in which the amortization term (AMRT_ TERM) of an instrument exceeds the maturity term (ORG_TERM). For example, a loan with an original term of seven years is amortized conventionally as if it were a 30-year instrument. At the end of the 7th year, there exists a large balloon payment that represents 23 years of the non-amortized loan balance. |

| 500 Conventional Adjustable | Repricing instrument with conventional amortization. |

| 600 Adjustable Neg Am | In a negatively amortizing instrument, the principal of a loan increase when the loan payments are insufficient to pay the interest due. The unpaid interest is added to the outstanding loan balance, causing the principal to increase rather than decrease, as payments are made. For more details, see Negative Amortization Amount (NEG_AMRT_AMT) |

| 840 Lease | A lease instrument amortizes down to the amount specified in the RESIDUAL_AMOUNT column.The CUR_PAYMENT and/or ORG_PAYMENT_AMT for a fixed rate lease should be entered so the instrument will achieve the RESIDUAL_AMOUNT on the MATURITY_DATE of the lease contract.For an adjustable-rate lease, the CUR_PAYMENT will be re-calculated by the cash flow engine considering the MATURITY_DATE, RESIDUAL_AMOUNT, and Current Rate. |

The OFSAA Cash Flow Engine does not treat AMRT_TYPE_CD 100, 400, or 500

differently. For a given record, the use of any of these three types produces identical

results. The division is simply for product distinction purposes. For instance,

AMRT_TYPE_CD 100 can be used for a fixed-rate, adjustable-rate, or a balloon record.

However, only an AMRT_ TYPE 600 record uses the negative amortization fields.

The Cash Flow Engine does not use AMRT_TYPE_CD to identify whether a

record is adjustable or not. It instead uses REPRICE_FREQ (and in

Oracle ALM, ADJUSTABLE_TYPE_CD) for this purpose. Therefore, any

amortization type can be adjustable.

The Cash Flow Engine does not use AMRT_TYPE_CD to determine whether a

record is a balloon or not. It instead uses AMRT_TERM and

ORG_TERM for this purpose. Therefore, even a level principal

AMRT_TYPE_CD could be treated as a balloon instrument.

A record must be AMRT_TYPE_CD 600 for the cash flow engine to process the record using the negative amortization fields. A record must be AMRT_TYPE_CD 840 for the cash flow engine to process the record using the residual amount field.

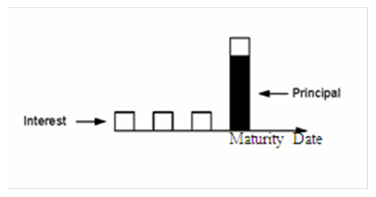

Figure 8-2 700 Simple Interest (Non-amortizing)

Description of amortization type codes follows

For simple interest amortization type, no principal is paid until maturity. If NEXT_ PAYMENT_DATE < MATURITY_DATE, OFSA calculates interim interest-only payments as shown in the earlier diagram. OFSA pays the entire record's principal balance on the maturity date along with the appropriate interest amount. For this AMRT_TYPE_CD, the CUR_PAYMENT and/or ORG_PAYMENT_AMT fields should equal 0.

710: Rule of 78s

An amortization type in which the following calculation is used in computing the interest rebated when a borrower pays off a loan before maturity.

For example, in a 12-month loan, the total is 78 (1 + 2 + ... 12 = 78). For the first month, 12/78 of the total interest is due.

In the second month, this amount is 11/78 of the total. For Rule of 78 AMRT_TYPE_CDs, the amount in the CUR_PAYMENT and/or ORG_PAYMENT_AMT field should equal the principal plus interest. For more details, see the Cash Flow Calculation Process.

800 - 802: Payment Schedule

The key to matching the instrument record with its corresponding payment schedule record is the INSTRUMENT_TYPE_CD and ID_NUMBER.

800:Conventional Payment Schedule

This AMRT_TYPE_CD conventionally amortizes a record whose cash flows are defined in the PAYMENT_SCHEDULE table. Payment amounts should contain both principal + interest. Engine calculates Interest on provided schedule dates. The principal amount gets calculated as the difference between the Payment amount provided – Interest cash flow calculated on that date.

For example, if for a specific Schedule Date Payment Amount provided is USD 55,000, and Interest calculated by the engine is USD 30,000. For this date, Principal amount populated would be = USD 55,000- USD 30,000= USD 25,000. The interest amount populated would be USD 30,000.

801: Level Principal Payment Schedule

This AMRT_TYPE_CD level principal amortizes a record whose cash flows are defined in the PAYMENT_SCHEDULE table. Payment amounts should contain the principal only. Engine calculates Interest on provided schedule dates.

For example, if for a specific schedule date Payment amount provided is USD 55,000, and Interest calculated by the engine is USD 30,000. For this date, the Principal amount populated would be equal to the payment amount provided, and the Interest amount populated would be USD 30,000.

802: Simple interest Payment Schedule

This AMRT_TYPE_CD simple interest amortizes a record whose cash flow dates are defined in the PAYMENT_ SCHEDULE table. Payment amounts should equal 0 (the engine calculates interest and ignores payment amount in the schedule records). The principal balance is paid on the maturity date as defined in the schedule.

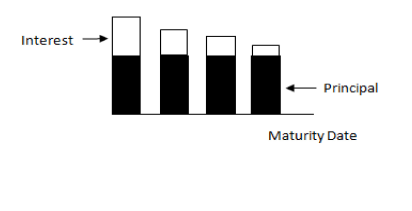

Figure 8-3 820 Level Principal Payments

Description of amortization type codes follows:

The level of principal payment is the amortization type in which the principal portion of the loan payment remains constant for the life of the loan. Interest (non-shaded portion) is calculated as a percentage of the remaining balance, and therefore, the interest portion decreases as the maturity date nears. Because the principal portion of the paymentis constant for life, the total payment amount (principal plus interest) decreases as the loan approaches maturity.

For this AMRT_TYPE_CD, the amount in CUR_PAYMENT and ORG_PAYMENT_AMT fields should equal the principal portion only.

850 Annuities

The Annuity Amortization type assumes the payment amount (CUR_PAYMENT and/or ORG_PAYMENT_AMT) will increase the principal balance rather than reduce it.

For this AMRT_TYPE_CD, the amount in the CUR_PAYMENT and/or ORG_PAYMENT_AMT fields should equal the amount of the regular / scheduled principal contribution. The CUR_PAYMENT and/or ORG_PAYMENT_AMT should be expressed as a positive value and the cash flow engine will multiply by -1 to reflect the principal contribution.

Users can also, optionally populate the MATURITY_AMOUNT column. If populated, this amount will be considered as the target amount and the required periodic payment will be calculated to achieve the Maturity Amount at the maturity of the instrument.

Interest from the origination of the Annuity Instrument is settled on maturity. On each payment date, the balance of the Annuity Instrument increases with the payment amount. Additionally, if the record is adjustable, rates will change from origination to As of Date. The engine does not look back to historical dates to calculate interest, considering the change in balance or rates, from origination. To obtain proper interest for both fixed and adjustable rates, we recommend providing accrued interest from the Origination Date and keep the actual Last Payment Date. When accrued interest is supplied, the engine would calculate Interest from as of date forward, and add provided accrued interest for proper total interest cash flow population. If the accrued interest is not available, and if you want to calculate interest from the Origination Date, you can set the Last payment date = Origination date, however, interest will vary based on past payments and or rate changes.

1000 - 69999: User-Defined Payment Patterns

Records with this range of AMRT_TYPE_CDs are matched to the user-defined amortizations in the Payment Pattern user interface. The key for matching is the AMRT_TYPE_CD value. These records can only be defined as conventionally amortizing, level-principal, or simple interest.

70000-99999: User-Defined Behavior Patterns

Records with this range of AMRT_TYPE_CDs are matched to the user-defined amortizations in the Behavior Pattern user interface. The key for matching is the AMRT_TYPE_CD value.

You can attach a Behavior Pattern Code to a Behavior Pattern Rule, if you do not want to update BP code at instrument level, and want to have scenario-based BP Runoff.

If Behavior Pattern Code is not attached to a Behavior Pattern Rule, then the engine behaves as in an existing manner. That is, the Amortization type of instrument will apply to current business and Behavior Pattern from Product Characteristics to new business. For more information, see the OFS ALM User Guide.

999: Other Amortization Type

If this value is used, the Cash Flow Engine uses the AMRT_TYPE_CD 700, Simple Interest Amortization Method. Using this AMRT_TYPE_CD for product identification purposes is not recommended. This should be reserved for indicating erroneous data extraction.