13.15 Term Structure Parameters Format

As mentioned in the preceding sections, speed of mean reversion, volatility, and long-run rate are the parameters the user will have to specify for the chosen model. Speed of Mean Reversion represents the long-run drift factor (1/mean reversion = interest rate cycle). Volatility is the standard deviation of the one-month rate, annually compounded on the equal-month timescale. Long Run Rate (b) represents the equilibrium value of the one-month rate, annually compounded.

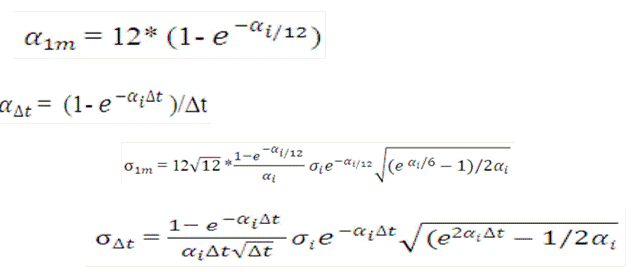

Sometimes α and σ are available from external sources, but they are quoted differently. The following equations show how to obtain the “one-month” speed of mean reversion and volatility from the values of α and s corresponding to:

Instantaneous Rate, αi(αi and σi hereafter)

Rate with term ∆t years (α ∆t and σ∆t hereafter)

(For clarity we write α1m and α1m for the one-month parameters)

Figure 13-12 Term Structure Parameters

Description of formula to calculate the Term Structure Parameters Format follows:

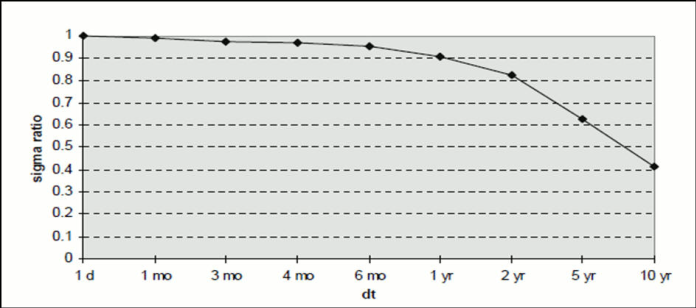

The following graph shows the change in the ratio σ1m/ σivarying Dt (αi = 0.1):

Figure 13-13 Graph of Change in the Ratio

Description of graph of change in the ratio σ1m/ σivarying Dt (αi = 0.1) follows:

Though the decision on the best choice for the term structure parameters is left to the user, the software imposes certain restrictions on those as follows:

0 < α<1

0.01%< σ <10%

0% < b < 200%

One more restriction has been set on the parameter combination for no-arbitrage models:

(σ-23α) > 0.7

If this inequality does not hold, the system outputs a warning message and continues processing. Be aware that the resulting rates may not be fully no-arbitrage if the yield curve is very erratic.