13.14.4 Extended Vasicek (Hull and White) Model

Hull and White bridged the gap between the observable yield curve and the theoretical yield curve implied by the Vasicek model by extending or stretching the theoretical yield curve to fit the actual market data. A theoretical yield curve that is identical to observable market data is essential in practical application. A model that does not fit actual data will propagate errors resulting from this lack of fit into hedge ratio calculations and valuation estimates for more complex securities. No sophisticated user would be willing to place large bets on the valuation of a bond option by a model that cannot fit observable bond prices.

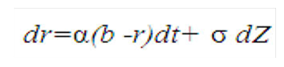

Hull and White apply the identical logic as described in the previous section, but they allow the market price of risk term to drift over time, instead of assuming it is constant as in the Vasicek model. This could be written as:

Figure 13-11 Extended Vasicek Model Formula

Description of formula to calculate the dr for Extended Vasicek Model follows:

Where:

r is the instantaneous short rate of interest

a is the speed of mean reversion

a is the instance standard deviation of r

e is the market price of risk for time t

As noted earlier, the Extended Vasicek (Hull and White) Model is currently the most popular term structure model. It has a clear economic meaning and is computationally very robust. Because of its popularity, numerous studies have documented and continue to document what parameters (speed of mean reversion and volatility) should be used. Another advantage of the Extended Vasicek Model is that bond prices have an easy closed-form formula. This closed-form formula leads to a very fast computation of rates for any term inside Monte Carlo simulation.