13.14.3 Vasicek Model

Both the Merton model and its extended counterpart the Ho and Lee model are based on an assumption about random interest rate movements that imply that, for any positive interest rate volatility, zero-coupon bond yields will be negative at every single instant in time, for long maturities beyond a critical maturity t. The extended version of the Merton model, the Ho and Lee model, offsets the negative yields with an extension factor that must grow larger and larger as maturities lengthen. Vasicek proposed a model that avoids the certainty of negative yields and eliminates the need for a potentially infinitely large extension factor. Vasicek accomplishes this by assuming that the short rate r has a constant volatility sigma like the models as mentioned earlier, with an important twist: the short rate exhibits mean reversion:

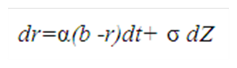

Figure 13-10 Vasicek Model Formula

Description of formula to calculate the dr for Vasicek Model follows:

Where:

r is the instantaneous short rate of interest

α is the speed of mean reversion

b is the long-run expected value for rate

σ is the instantaneous standard deviation of r

Z is the standard Wiener process with mean zero and standard deviation of 1. The Stochastic Process used by Vasicek is known as the Ornstein-Uhlenbeck process. This process enables us to calculate the expected value and variance of the short rate at any time in the future s from the perspective of current time t.

Because r(s) is normally distributed, there is a positive probability that r(s) can be negative. As pointed this is inconsistent with a no-arbitrage economy in the special sense that consumers hold an option to hold cash instead of investing at negative interest rates. The magnitude of this theoretical problem with the Vasicek model depends on the level of interest rates and the parameters chosen (In general, it should be a minor consideration for most applications). The same objection applies to the Merton and Ho and Lee models and a wide range of other models that assume constant volatility of interest rates, regardless of the level of short term interest rates. Very low-interest rates in Japan in early 1996, with short rates well under 0.5%, did lead to high probabilities of negative rates using both the Vasicek and Extended Vasicek models when sigma was set to match observable prices of caps and floors. Although the price of a floor with a strike price of zero was positive during this period (indicating that the market perceived a real probability of negative rates), the best fitting values of sigma for all caps and floor prices indicated a probability of negative rates that was unrealistically large.

Note:

Lehman Brothers were quoting a floor on six-month yen LIBOR with a three-year maturity and a strike price of zero at 1 basis point bid, 3 basis points offered during the fall, 1995.For most economies, Vasicek and Extended Vasicek models are very robust with wide-ranging benefits from practical use.