10.2 Theory

In this section, we show that the static spread is equal to margin and the OAS to the risk-adjusted margin of an instrument when the user selects the market value of the instrument to equate the discounted stream of cash flows. We assume in this section that the reader has a good knowledge of the no-arbitrage theory.

We first need some assumptions and definitions:

- To acquire the instrument, the bank pays an initial amount V(0), the current market value.

- The risk-free rate is denoted by r(t).

- The instrument receives a cash flow rate equal to C(t), with 0≤ t ≤ T. (= maturity)

- The bank reinvests the cash flows in a money market account that, with the instrument, composes the portfolio.

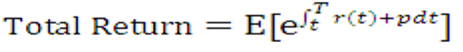

- The total return on a portfolio is equal to the expected future value divided by the initial value of the investment.

- The margin p on a portfolio is the difference between the rate of return (used to calculate the total return) and the risk-free rate r.

- The risk-adjusted expected future value of a portfolio is equal to its expected future value after hedging all diversifiable risks.

- The total risk-adjusted return of a portfolio is equal to the risk-adjusted expected future value divided by the initial value of the investment.

- The risk-adjusted margin m of a portfolio is the difference between the risk-adjusted rate of return (used to calculate the total risk-adjusted return) and the risk-free rate r.

More precisely:

Equation 11

Figure 10-12 Equation 11

Description of the Transfer Pricing Option Cost Equation 11 follows:

Equation 12

Figure 10-13 Equation 12

Description of the Transfer Pricing Option Cost Equation 12 follows: