4.1.7.3.1 Define Absolute Payment Patterns

Absolute payment patterns are commonly used for instruments that are on a seasonal schedule, such as agricultural or construction loans that require special payment handling based on months or seasons.

When working with absolute payment patterns, it is sufficient to define payments for one calendar year. Once the term exceeds a year, the payment schedule will loop until the instrument matures.

Prerequisites

Selecting Absolute as the pattern type.

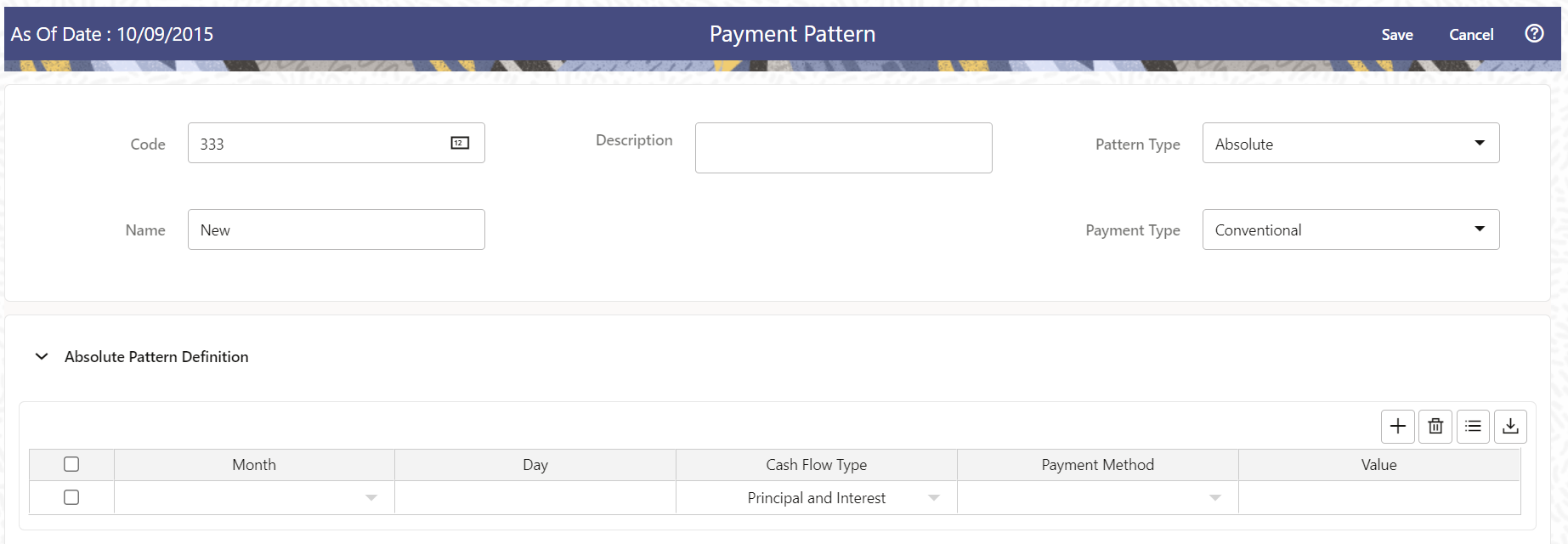

Figure 4-14 Absolute Payment Patterns

To define absolute payment pattern, do the following:

- In the Payment Patterns page, select Pattern Type as Absolute.

- Select the Payment Type from the drop-down list: Conventional, Level Principal, or Non-Amortizing. The Payment Type determines the type of information required to successfully define the Payment Phase.

- Define the Payment Phases. A Payment Phase is a set of payment

characteristics that defines the timeline of the instrument's amortization.

- Define the following parameters:

- Month: This drop-down list allows you to select the month of the payment phase being defined.

- Day: Used to specify the day of the month the payment is due.

- Select the Cash Flow Type. The available types depends on the Payment

Type. This do not apply to the Non-Amortizing Payment Type.

Table: Relationship between Cash Flow Type and Payment Types

Level Principal Non-Amortizing Conventional Principal and Interest Yes Yes Principal Only Yes Interest Only Yes Yes - Select the Payment Method. The available Payment Methods depend on the Payment Type. For more information, see: Relation between Payment Method and Payment Types. Payment Methods do not apply to the Non-Amortizing Payment Type.

- Enter the Value for the Payment Method you selected in the previous step for

applicable Payment Types.

If you selected the Interest Only Payment Method in the previous step, the Value field does not apply.

- Define the following parameters:

- Click the Add icon to add additional Payment Phases to the Pattern. Click Delete icon corresponding to the rows you want to delete.

- Click Add Multiple Row icon to enter the number of rows you want to add and click Go.

- The Download Excel icon helps you to export payment information, modify and

paste back in the UI.

Note:

A Payment Pattern must have at least one valid Payment Phase to be successfully defined. The system raises a warning if you try to save a Payment Pattern with an incomplete Payment Phase. - Click Apply and Save.

The Payment Pattern is saved and the Payment Pattern summary page is displayed.

The following table describes the relationship between Payment Phase properties and Payment Types.

Relationship between Payment Phase Properties and Payment Types

| Level Principal | Non-Amortizing | Conventional | |

|---|---|---|---|

| Month | Yes | Yes | Yes |

| Day | Yes | Yes | Yes |

| Payment Method | Yes | Yes | |

| Value | Yes | Yes |

The following table describes the relationship between Payment Method and Payment Types.

Relationship between Payment Methods and Payment Types

| Payment Method | Level Principal | Non-Amortizing | Conventional |

|---|---|---|---|

| Percentage of Original Balance | Yes | ||

| Percentage of Current Balance | Yes | ||

| Percentage of Original Payment | Yes | Yes | |

| Percentage of Current Payment | Yes | Yes | |

| Absolute Payment | Yes | Yes | |

| Interest Only | Yes | Yes |