4.3.3.3.1.2 Defining Prepayment Model Method

Use this procedure to define prepayment assumptions using the Prepayment Model Calculation method. The Prepayment Model Method allows you to define more complex prepayment assumptions compared to the other Prepayment Methods. Under this method, prepayment assumptions are assigned using a custom Prepayment Model. You can build a Prepayment model using a combination of up to three Prepayment Drivers and define Prepayment Rates for various values of these drivers. Each driver maps to an attribute of the underlying transaction (age/term or rate) so that the Cash Flow Engine can apply a different Prepayment Rate based on the specific characteristics of the record. Note: All Prepayment Rates should be input as annual rate.

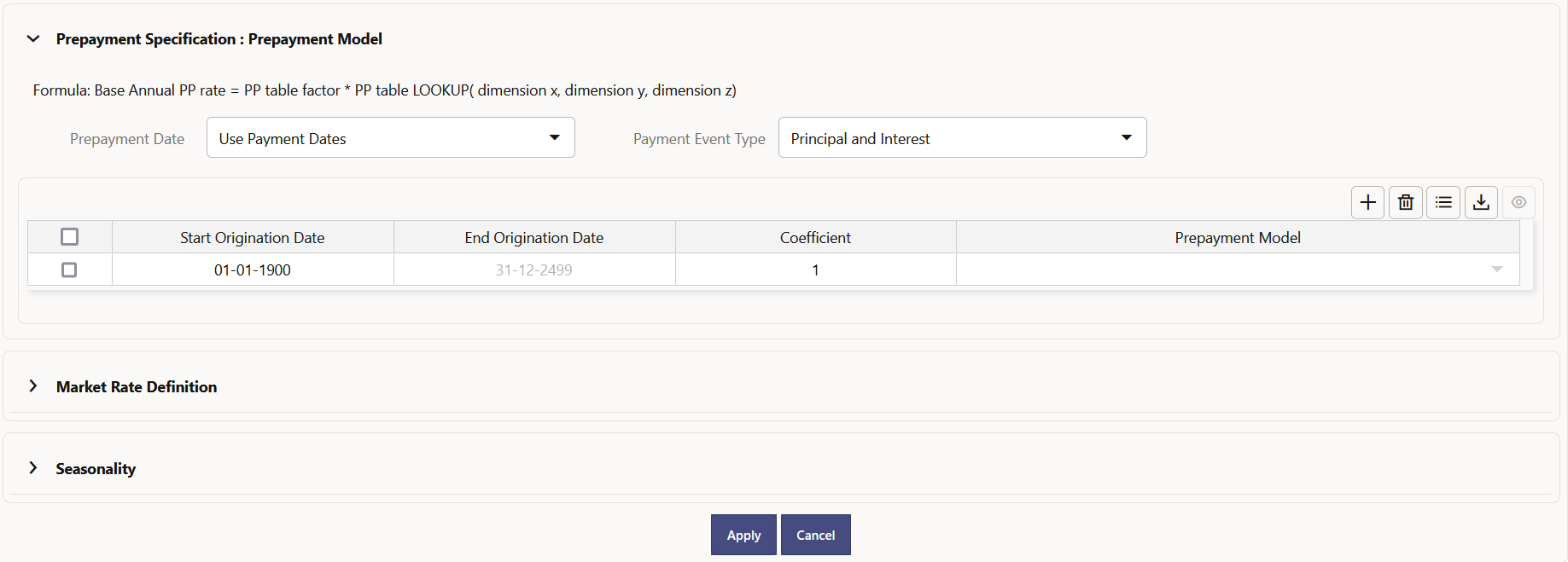

Figure 4-59 Prepayment Model Method

Prerequisites

- Prepayment Model must be created.

- Performing basic steps for creating or updating a Prepayment Rule.

Procedure

Users also have two options for determining the timing of the Prepayment Model assumption. The options include:

- Use Payment Dates: This is the default option. If this option is selected, then Prepayment Model Runoff will occur on scheduled payment dates only.

- User Defined Prepayment Tenors: If this option is selected, users can specify any runoff timing. For example, users might choose to define the Prepayment to the Runoff on the first day of the forecast.

The above options will be available only for Asset Instrument Types.

To define Prepayment Model within the Prepayment Rule, follow the steps given in below sections:

Use Payment Dates

- Select the Use Payment Dates Option.

- Select the Payment Event Type Option.

- Select the Start Origination Date using the date picker. Alternatively, you

can enter the Start Origination Date in the space provided.

The first cell in the Start Origination Date Column and all the cells in the End Origination Date Column are read-only. This ensures that all possible origination dates must support reference values when Prepayment assumption lookups occur.

Each row in the End Origination Date Column is filled in by the system when you click Add Row or save the Rule.

The first Start Origination Date (in row 1) has a default value of January 1, 1900. When you enter a Start Origination Date in the next row, the system inserts a date that is a day before the previous End Origination Date field.

- Enter the Coefficient (if needed) by which the Prepayment Rate should be multiplied and select a predefined prepayment model that you want to apply to the instruments having origination dates in a particular Start Origination-End Origination Date range

- Click Add Row to add additional rows and click the corresponding Delete Button to delete a row.

- You can add as many rows as possible in this table using Add Multiple Row Option. However, you need to enter relevant parameters for each new row.

- You can also use the Download Excel feature to export the Prepayment rate information that is displayed on screen, modify, and copy-paste it back in the grid.

- Define Market Rate Definition.

- Define the source for the Market Rate by Selecting an Index (Interest Rate Code) from the list of values.

- Enter the Spread. The spread is added to the rate from the underlying interest rate curve to determine the market rate.

- Select an Associated Term as Remaining Term, Reprice Frequency, or Original Term.

- Define Seasonality assumptions if required to model date-specific adjustments to the annual prepayment rate. Inputs act as a multiplier, For Example, an input of 2 will double the prepayment rate in the indicated month.

User Defined Prepayment Tenors

- Select the User Defined Prepayment Tenors Option. This option allows you to specify the term and multiplier to the prepayment date for the row.

- You can calculate the Prepayment Rate based on Current/Reducing Balance and Annual/De-annual Prepayment Rate.

- Select the Balance Type as Current Balance or Reducing

Balance.

- If the Balance Type is selected as Current Balance, then the Prepayment Amount will be calculated using CUR_PAR_BAL on As of Date. That is, without reducing the balance by any payment/prepayment that may have occurred between as of the date and prepayment date.

- If the Balance Type is selected as Reducing Balance, then the prepayment amount will be calculated using balance as on Prepayment Date. That is, after reducing the CUR_PAR_BAL by any payment/prepayment that may have occurred between As of Date and Prepayment Date.

- Select the Prepayment Rate Type as Annual Prepayment Rate or

De-annual Prepayment Rate.

When the Annual Prepayment Rate is selected then the prepayment rate entered in the screen is directly used.

In the other case, the rate entered in the screen is de-annualized before calculating the Prepayment Amount.

- Specify the Prepayment Model Parameters.

- Select the Start Origination Date using the date picker. Alternatively, you can enter the Start Origination Date in the space provided.

- Enter the Coefficient (if needed) by which the Prepayment Rate should be

multiplied.

This multiple is applied to the instruments for which the Origination Date lies in the range defined in the Start Origination Date-End Origination Date fields.

- Select a predefined prepayment model from the Prepayment model Rule list of values.

Click the View Prepayment Model icon to preview the selected Prepayment

Model.

The system uses the Prepayment Model assumptions to calculate the Prepayment Amounts for each period. You need to associate a prepayment model for every Start Origination-End Origination Date range.

- Click Add Another Row to add additional rows and click the corresponding Delete button to delete a row.

- You can add as many rows in this table using Add Multiple Row Option. However, you need to enter relevant parameters for each new row.

- You can also use the Download Excel feature to export the Prepayment Rate Information that is displayed on screen, modify, and copy-paste it back in the grid.

- Enter the term to runoff tenor and multiplier for each of the date ranges.

- Enter ‘Repeat' if you want the same prepayment to occurs multiple times. By default, it is set to 1.

- Define the source for the Market Rate by Selecting an Index (Interest Rate Code) from the list of values.

- Enter the Spread. The spread is added to the rate from the underlying Interest Rate Curve to determine the Market Rate.

- Select an Associated Term as Remaining Term, Reprice Frequency, or Original Term.

- Define Seasonality assumptions as required to model date specific adjustments to the annual Prepayment Rate. Inputs act as a multiplier, for example, an input of 2 will double the Prepayment Rate in the indicated month.