4.1.9.4.2 Payment Attributes

This section describes the new business fields used in the Payment Attributes tab of the Product Characteristics Rule.

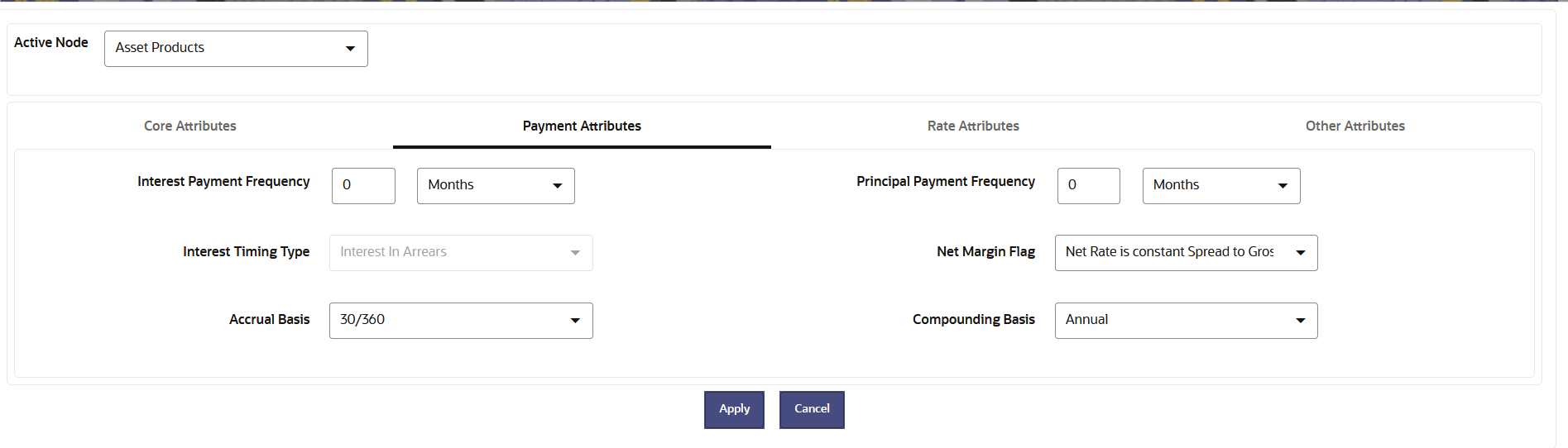

Figure 4-23 Payment Attributes Tab to Define the Product Characteristic Rule

Table 4-21 Fields to add the Payment Attributes for Product Characteristic Rule and their Descriptions

| Field | Description |

|---|---|

| Interest Payment Frequency | Frequency of Interest payment . |

| Principal Payment Frequency | Frequency of Principal payment. |

| Interest Timing Type |

Determines whether interest is calculated in arrears or advance or if the rate is set in arrears. There are three interest types: Interest in Arrears Interest in Advance Set in Arrears For conventional amortization products, interest in arrears is the only valid choice. |

| Net Margin Flag |

The setting of the net margin flag affects the calculation of the Net Rate. The two settings are: Floating Net Rate - the net rate reprices in conjunction with the gross rate, at a value net of fees. Fixed Net Rate - the net rate equals a fixed fee equal to the net margin. |

| Accrual Basis |

The basis on which the interest accrual on an account is calculated. The choices are as follows: 30/360 Actual/360 Actual/Actual 30/365 30/Actual Actual/365 Business/252 * |

| Compounding Basis |

Determines the number of compounding periods per payment period. The choices are as follows: Daily Monthly Quarterly Semi-Annual Yearly Continuous Simple At Maturity |

Note:

* A Holiday Calendar selection is required if Business/252 Accrual Basis is selected. Business/252 Accrual Basis is only applicable to the recalculate option of the Holiday Calendar Rule. If the user selects the shift payment dates, the payment will still be recalculated for the non-holiday or weekend date.