5.3.2.4.2.1 Defining Maturity Mix Using Node Level Assumptions

Node Level Assumptions allow you to define assumptions at any level of the Multi Dimensional Balance Sheet Structure (MDBSS) hierarchy. The MDBSS supports a hierarchical representation of your chart of accounts, so you can take advantage of the parent-child relationships defined for the various nodes of your MDBSS hierarchies while defining rules. Children of parent nodes on an MDBSS automatically inherit the assumptions defined for the parent nodes. However, assumptions directly defined for a child take precedence over those at the parent level. In an income simulation scenario, you may want to price new business for an account at a margin above or below a market interest rate code. For example, you can model a premium paid on CDs in relation to a market yield curve by adding a Maturity Mix to the interest rate code assigned to the product in the Product Characteristics rule. If you want a rate that is 25 bps above the market yield curve, you will type "0.25" as the Maturity Mix for the appropriate modeling period. The Maturity Mix rule uses the modeling period defined in the "active" Time Bucket rule. You should always verify that your modeling horizon and related assumptions are consistent with the As of Date and active Time Bucket rule before processing.

Prerequisites

Performing basic steps for creating or editing a Maturity Mix Rule.

Procedure

To define the Maturity Mix rule, follow these steps:

- Navigate to the Maturity Mix rule page.

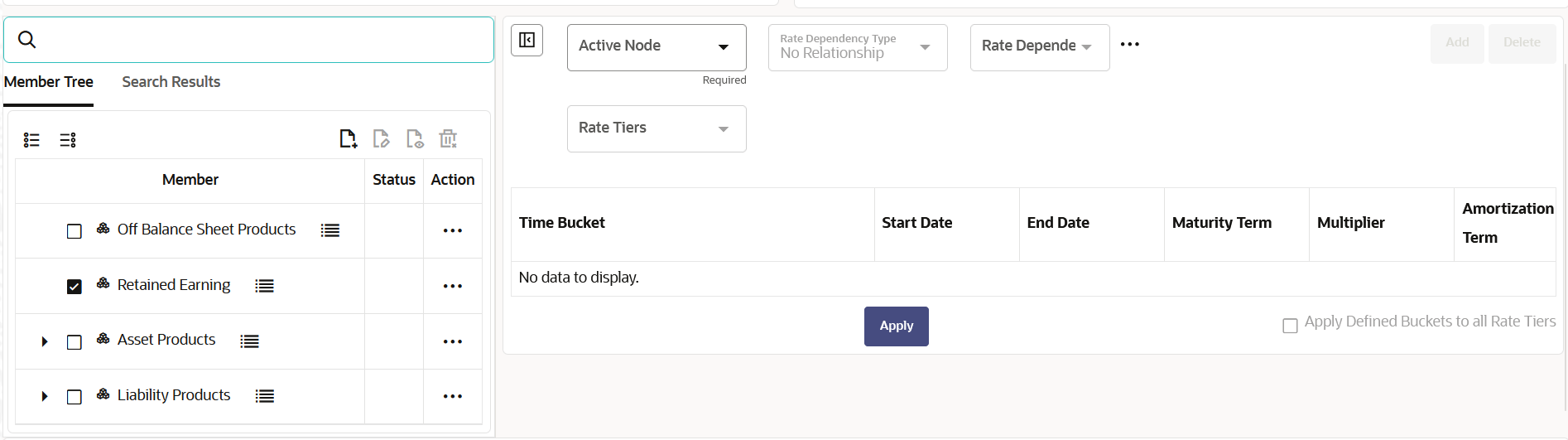

Figure 5-180 Maturity Mix Rule section

- Enter the following details:

Table 5-47 Maturity Mix

Fields Description Active Node Shows the name of the selected Active Node Rate Dependency Pattern Rate Dependency Patterns allow you to establish relationships between the level of interest rates, economic indicators or rate spreads and ALM forecast assumption rules. There are four rate dependency options to choose from: - No Relationship

- Rate Level Dependent

- Rate Spread Dependent

- Economic Indicator Dependent

View

Edit

New

Rate Tiers You must define rate tiers. Select Rate Tier from drop-down to add the number of Rate Tiers to include in your pattern. Input the appropriate Rate Level for each Rate Tier. Bucket Number Start and Bucket Number End The bucket number input allows you to select a range of buckets over which the Maturity Mix assumption will apply. Start Date and End Date values are updated automatically based on the Bucket Number input for each row. Start Date and End Date When the Maturity Mix detail page opens, the Start Date (min value) and End Date (max value) columns are automatically populated and are read-only values. The date ranges represent the Income Simulation Date buckets as defined in the "active" Time Bucket rule. Any new business originated within these dates is modeled using the Maturity Mix defined in the Maturity Mix rule. The new business added for each date bucket will have the same net and gross margin for its life. The margins for a particular instrument will not change as the instrument ages. Maturity Term In conjunction with the Multiplier, this field allows you to specify the value for the Term, for a given lookup tier. Multiplier The unit of time applied to the Maturity Term. The options are: Days, Months, and Years. Amortization Term Enter the Amortization Term. Term upon which amortization is based in units (days, months, years). Multiplier The unit of time applied to the Amortization Term. The options are: Days, Months, and Years. - You can add more Rows using the Add Row icon. You can add multiple rows at a time using the Add Multiple Row icon.

- Click Apply.

You can also use the Excel Export feature to download the data in Excel format.