5.3.2.5.1.1 Defining Rate-Spread Dependent Rate Dependency Patterns

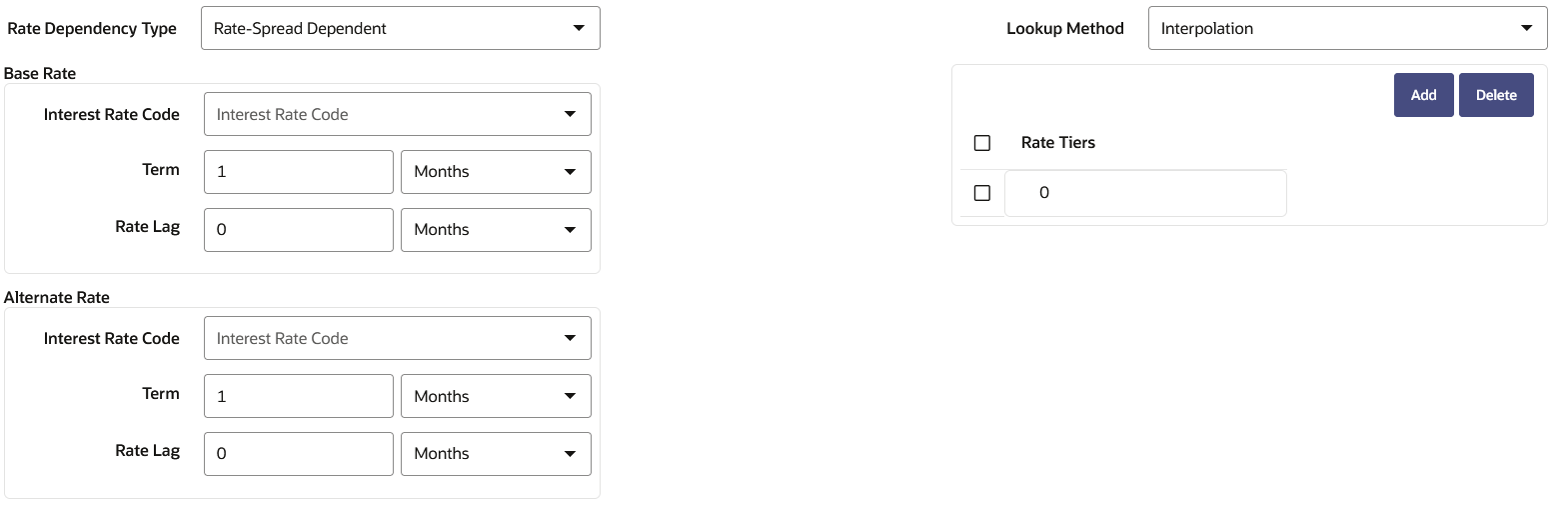

With the Rate-Spread Dependent Relationship, you can input assumptions for different spreads between two indicator interest rates. You define the first indicator interest rate, the Base Interest Rate, as described previously. The second indicator Interest Rate, the Alternate Interest Rate, also requires the selection of an Interest Rate Code, a Term Selection, and a Rate Lag.

Figure 5-185 Rate Dependency Pattern Rule after selecting Rate-Spread Dependent option

The rate spread equals to Alternate Interest Rate - Base Interest Rate

- Enter the following details:

Table 5-48 Form Fields to Create a New Rate-Level Dependent Rate Dependency Pattern Rule

Fields Description Interest Rate Code The Interest Rate Code identifies the reference yield curve or rate index whose forecasted value determines the assumptions to reference. You can select the Interest Rate Code from all available interest rate codes, as defined within Rate Management. Term Selection If the selected Interest Rate Code is a yield curve, you must also select a term. Your term choices depend on the definition of the Interest Rate Code within Rate Management. Note that the selection automatically defaults to the shortest available term. Rate Lag If you want the base interest rate calculation to perform a look back function, you can input a rate lag. The new business assumption lookup uses the forecasted interest rates as of a date within the current modeling bucket less the rate lag. If the timing of the new business is End of Bucket, the Lookup function uses the last day of the bucket less the rate lag. For all other cases, the mid-point of the bucket less the rate lag is used. Lookup Method

The lookup method determines which new business assumption is selected from the input values when the forecasted interest rate falls between two rate tiers. There are two methods to choose from:

Interpolate: If you select Interpolate, the assumption is an interpolated value, using straight line interpolation, calculated from the assumptions associated with the two nearest interest rate tiers. The interpolation uses a simple straight-line interpolation formula.

Range: If you select Range, Oracle ALM selects the new business assumption as the closest assumption associated with the rate tier which is less than or equal to the forecasted interest rate.

Note:

Range method is always used to interpret maturity mix forecast assumption.Note:

When the lookup method is “range” and the retrieved value is less than the lowest tier, then no rule is applied.Rate Tiers You must define rate tiers. Rate Tiers provide the lookup values for which different assumptions can be input.

Select Add Rows to add the number of Rate Tiers to include in your pattern.

Input the appropriate Rate Level for each Rate Tier.

Note:

You must enter minimum 2 tiers. The maximum limit is 10. - Define the Alternate Interest Rate details. These fields are the same as the Base Rate section.

- Select Save.