5.3.2.6.2.1.3 Pricing Attributes

This section describes the new business fields used in the Pricing Attributes section of the Transaction Strategy Rule.

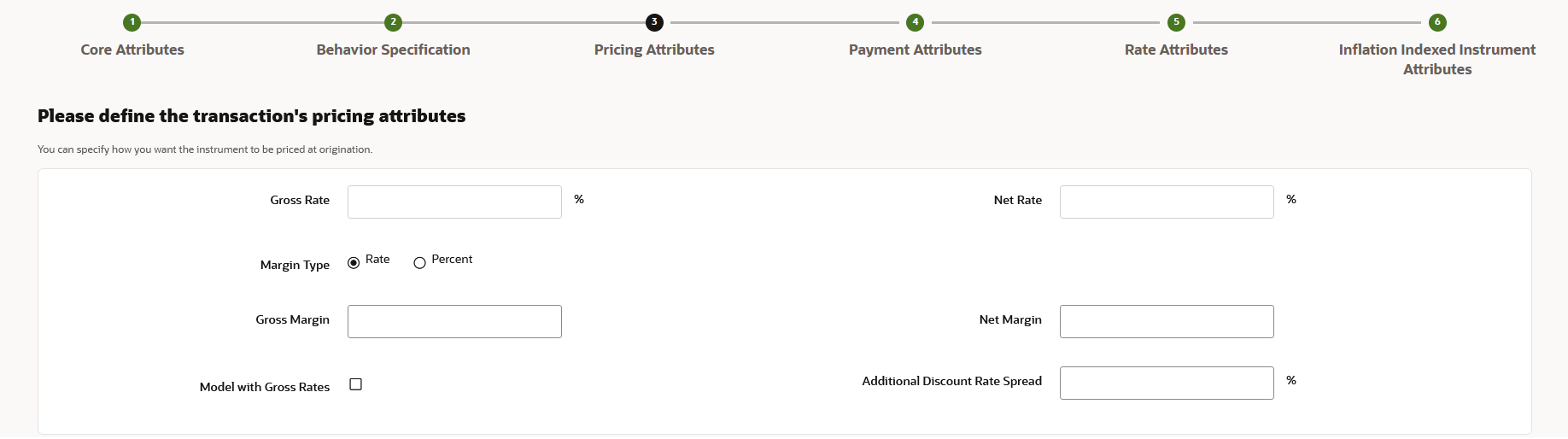

Figure 5-196 Pricing Attributes

Table 5-53 Fields to add the Pricing Attributes for Transaction Strategy Rule and their Descriptions

| Field | Description |

|---|---|

| Gross Rate | Gross rate on the instrument (such as, paid by the customer). |

| Net Rate | The nominal interest rate on instrument owed to or paid by, the financial institution. |

| Margin Type | The Margin Type can be selected as Rate or Percentage.

Rate- By default, Rate is selected. This is a fixed spread. Percent- Margin is calculated using the provided margin (as percent) and forecast rate. For example, if the forecast rate is 5% and the margin is 10%, then the margin calculated will be 10% of the forecasted rate. |

|

Gross Margin |

Contractual spread over interest rate code used in the calculation of the gross rate |

| Net Margin | The contractual margin over the interest rate code used in computing net rate. Gross margin minus any fees. |

| Model with Gross Rates | If the institution has outsourced loan serving rights for some of the assets (most typically mortgages), the rates paid by customers on those assets (gross rates) will be greater than the rates received by the bank (net rates). For these instruments, both a net and gross rate will be calculated within the cash flow engine and both gross and net rate financial elements will be output. The gross rate is used for prepayment and amortization calculations. The net rate is used for income simulation and the calculation of retained earnings in the auto-balancing process |

| Additional Discount Rate Spread | Enter Additional Discount Rate Spread in percentage. |