24.4 Defining a Maturity Mix Rule: An Example

The following procedure is an example of defining the Matrutity Mix Rule.

- Define a Maturity Mix rule using a Rate Dependency Pattern.

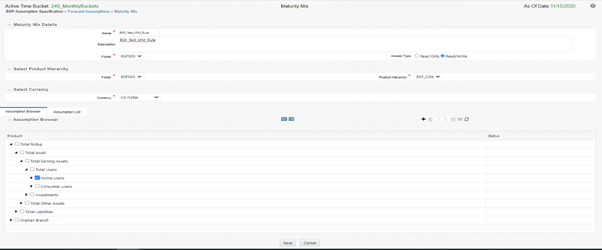

- From the Assumption Browser, select Currency (US Dollar) and a product from the

hierarchy browser.

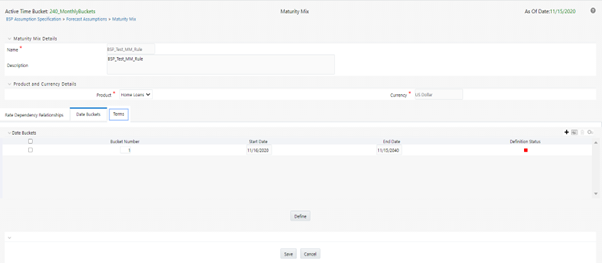

Figure 24-3 Creating Maturity Mix Rules

- Select the “Add New” icon to enter the Assumption Details page.

- Select the Rate Level Dependent – Rate Dependency option.

Figure 24-4 Creating Maturity Mix Rules – Rate Dependency

- Select the Rate Level – Rate Dependency Pattern from the drop list.

- Select Apply to navigate to the Date Buckets tab.

- Add bucket ranges to the page as needed. Optionally, select the “Apply Defined Buckets to All Rate Tiers” check box to copy the bucket structure across all rate tier pages.

- Select the check box for the first bucket range and select “Define” to navigate to the Terms tab.

- Add one or more rows based on the number of maturity terms needed for the selected product.

- Input Maturity Terms, Amortization Terms, and Percentage Weights for each row and select Apply to save your inputs for the selected bucket range. Notice the status column on the Date Buckets tab turns from Red to Green, indicating that you have successfully defined assumptions for the bucket range.

- Continue to define Maturity Mix assumptions for each Bucket Range.

- You can also use the Excel import/export feature to add the maturity information in the Terms tab.

- Select Apply to commit your assumptions for each Rate Tier. Repeat the process for

each rate tier. After you have defined assumptions for all Rate Tiers, you will

return automatically to the Assumption Browser page.

Note:

You can select more than one product at a time from the Assumption Browser page. - When Maturity Mix assumptions are defined for all required product/currency combinations, select SAVE from the Assumption Browser page.