4.5.2.2 Creating Exemption on TIN

For some entities, such as non-profit organizations, financial institutions, and so on, there may be one Tax Identification Number (TIN) associated with many individual customers. Rather than having to review and approve multiple customer exemptions that result in multiple DOEP filings for one TIN, CTR allows you to identify exemptions and file one DOEP for the TIN.

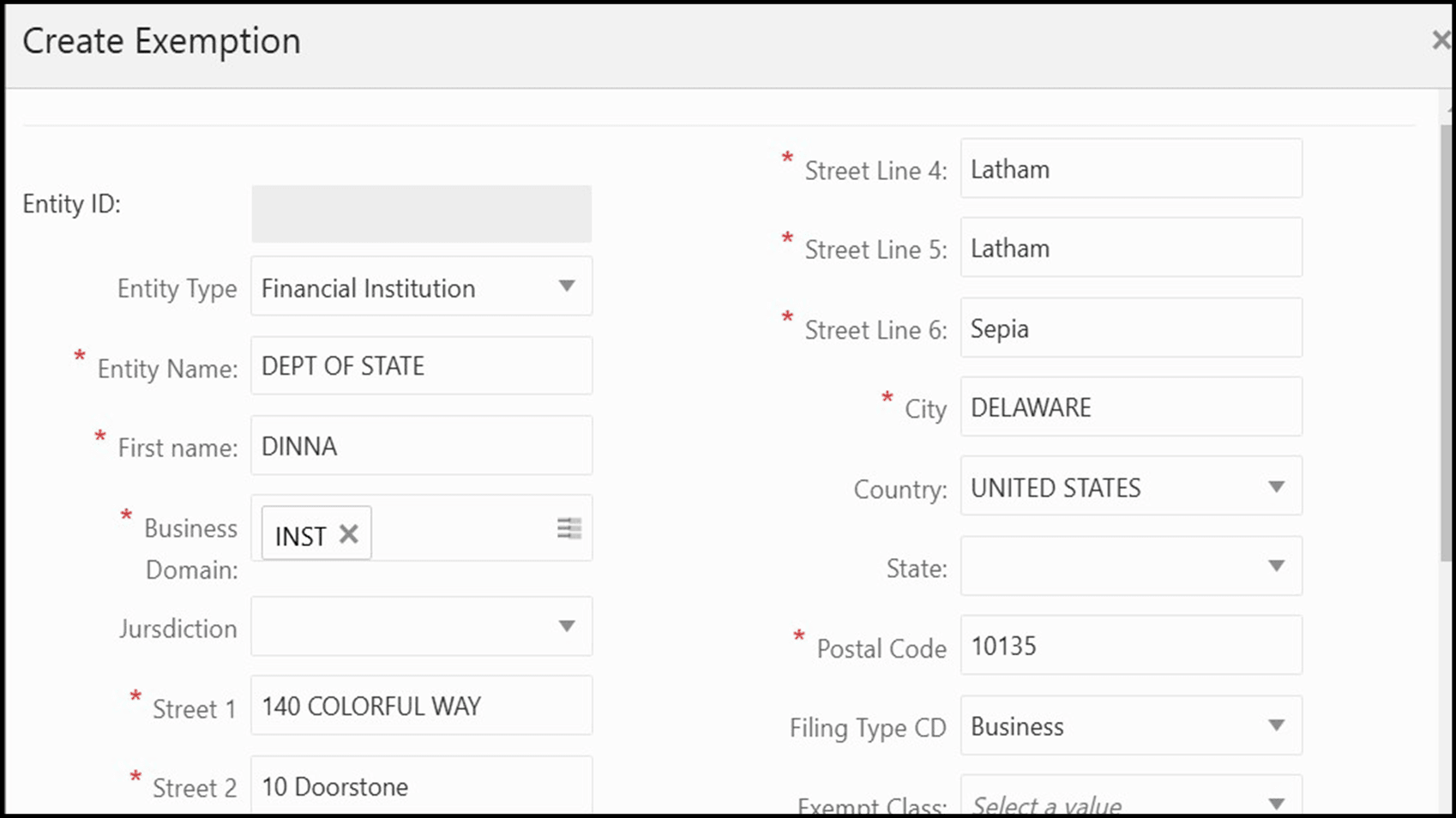

To create an Exemption on a TIN, follow these steps: