8.1.3.5 Accounts – Derivatives Summary

This pre-built report, based on the Accounts subject area, delivers a high-level snapshot of an institution’s derivative exposure and performance as of a specific date. It offers valuable insights into notional values, market positions, and counterparty risk, enabling stakeholders to monitor risk, performance, and portfolio health effectively.

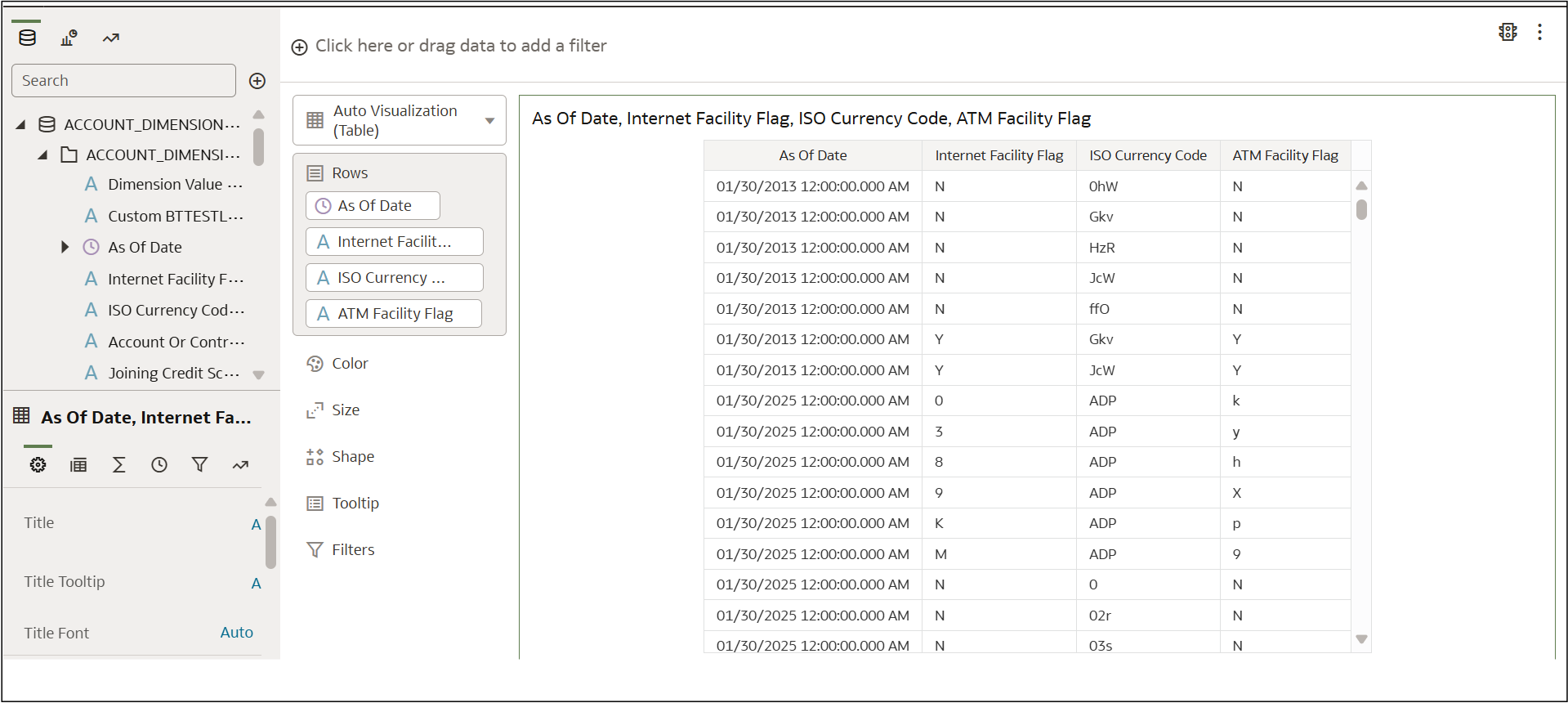

Account Dimension Derivatives

Figure 8-69 Account Derivatives - canvas 1

Derivative Performance Tracker

Figure 8-70 Derivative Performance Tracker

Derivative Performance Tracker

Figure 8-71 Derivative Performance Tracker by Instrument Type

- Identifies high-performing and underperforming derivatives

- Supports strategic decisions by visualizing product growth patterns

- Helps manage risk associated with volatility or declining instruments

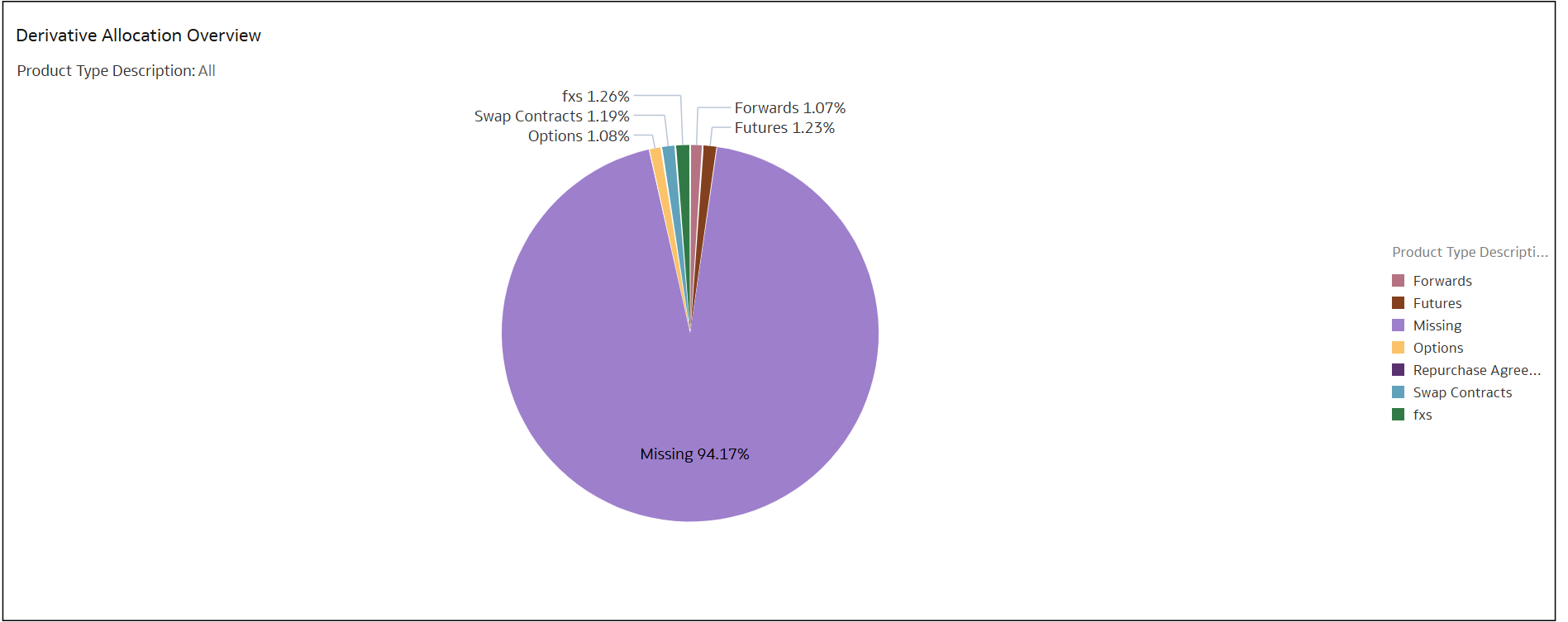

Derivative Allocation Overview

Figure 8-72 Derivative Allocation Overview

- Visual assessment of asset allocation

- Highlights concentration risks

- Supports diversification efforts and client transparency

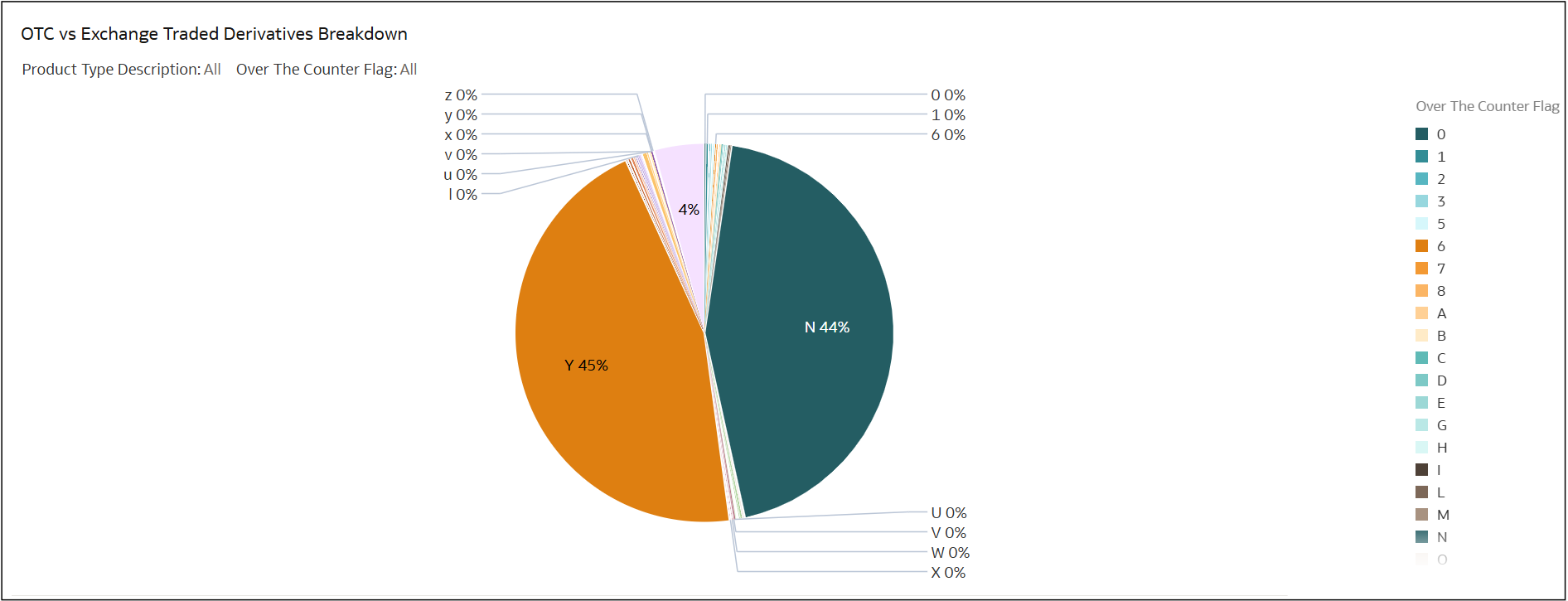

OTC vs. Exchange-Traded Derivatives Breakdown

Figure 8-73 OTC vs Exchange Traded Derivatives Breakdown

- Highlights potential credit and counterparty risks

- Informs regulatory compliance and transparency levels

- Aids in assessing market structure and risk mitigation needs

Instrument Type Distribution

Figure 8-74 Instrument Type Distribution

- Evaluates exposure across various instruments (e.g., swaps, options, forwards)

- Detects over-concentration and potential risk hotspots

- Enables proactive rebalancing and enhanced risk control