8.1.3.4 Placed Collateral Summary

This pre-built report, based on the Placed Collateral subject area, provides a comprehensive overview of collateral posted against derivative exposures. It includes details about the type, value, and distribution of collateral across counterparties, enabling effective counterparty risk monitoring and collateral management.

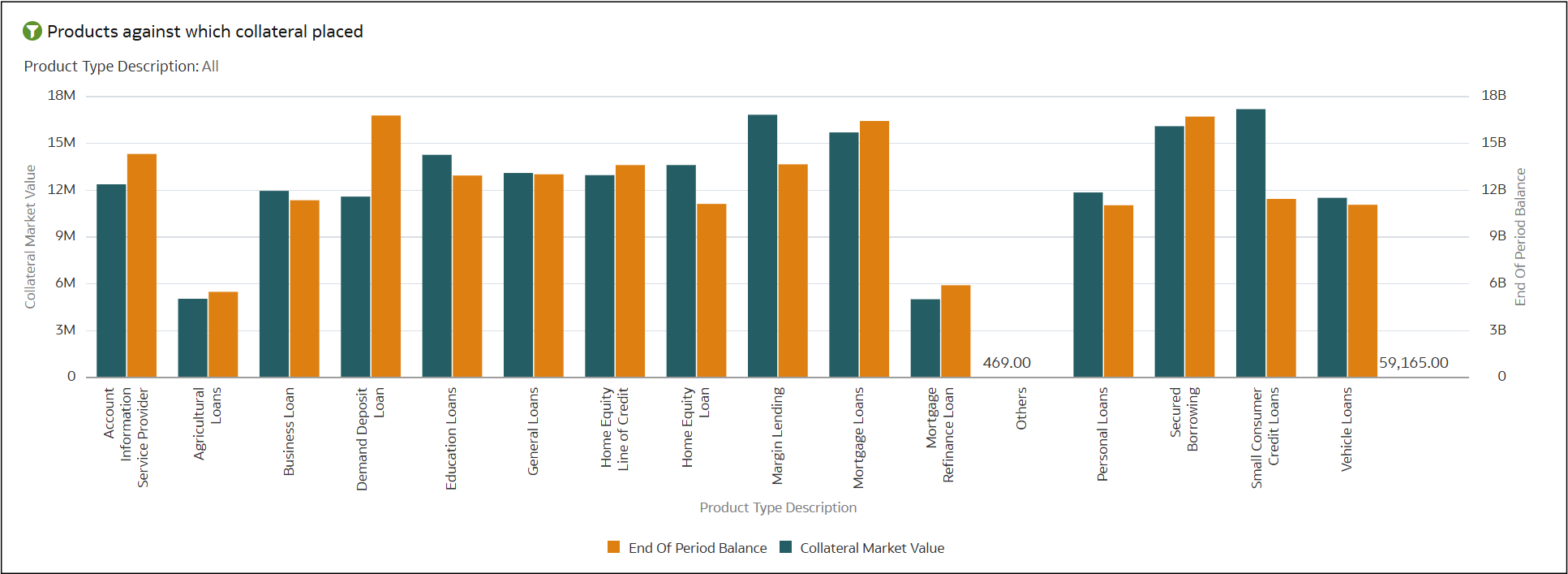

Product Risk Coverage Analysis

Figure 8-64 Product Risk Coverage Analysis

- Identification of uncovered exposures

- Effectiveness of applied mitigants

- Strategic input for risk-based resource allocation

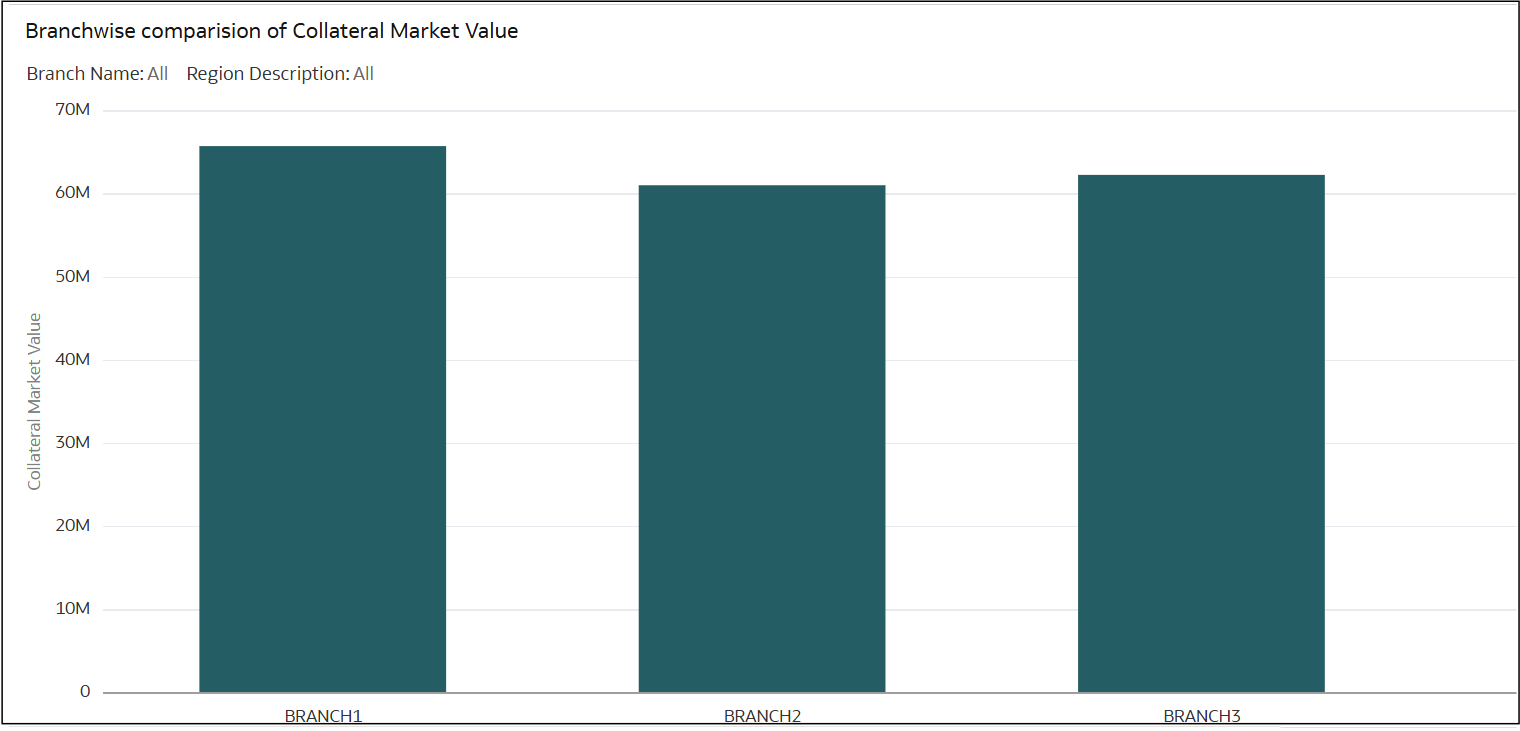

Branch Collateral Coverage Analysis

Figure 8-65 Branch Collateral Coverage Analysis

- Detection of under-collateralized or high-risk branches

- Valuation trends and anomalies

- Inputs for targeted audit planning and risk control

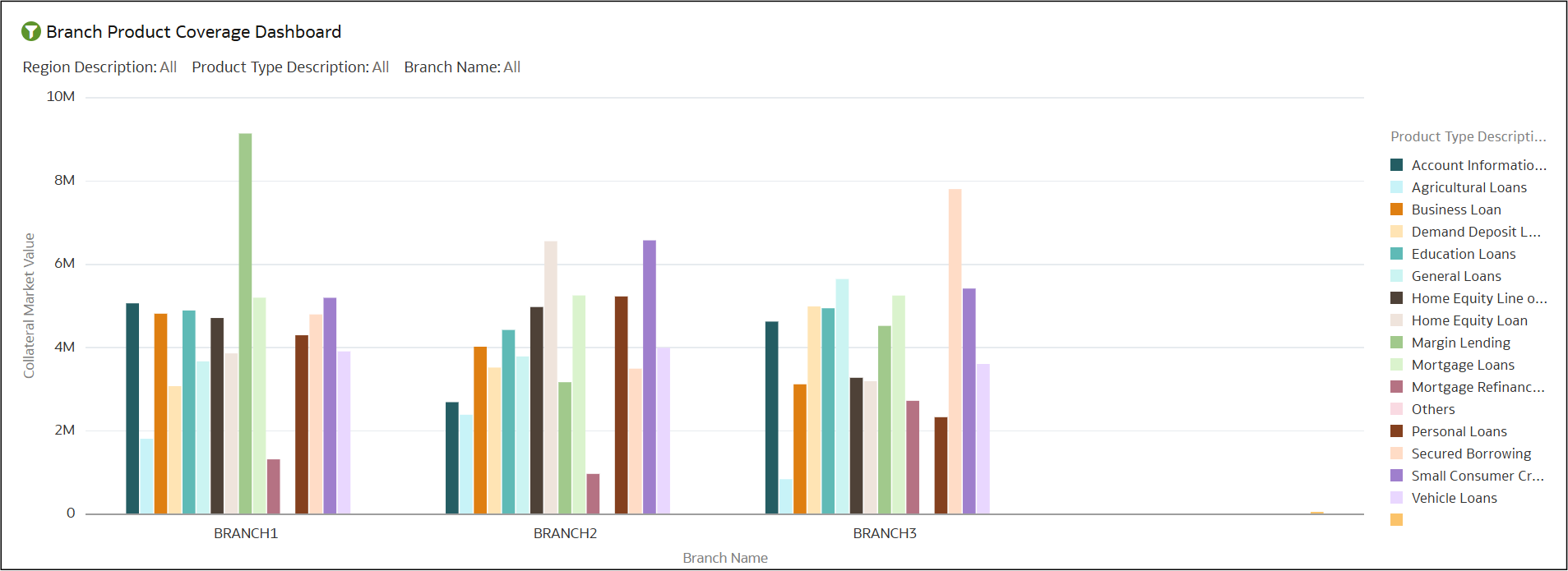

Branch Product Coverage Dashboard

Figure 8-66 Branch Product Coverage Dashboard

- Performance analysis of individual branches

- Product popularity and coverage efficiency

- Data to support product-specific strategies and investments

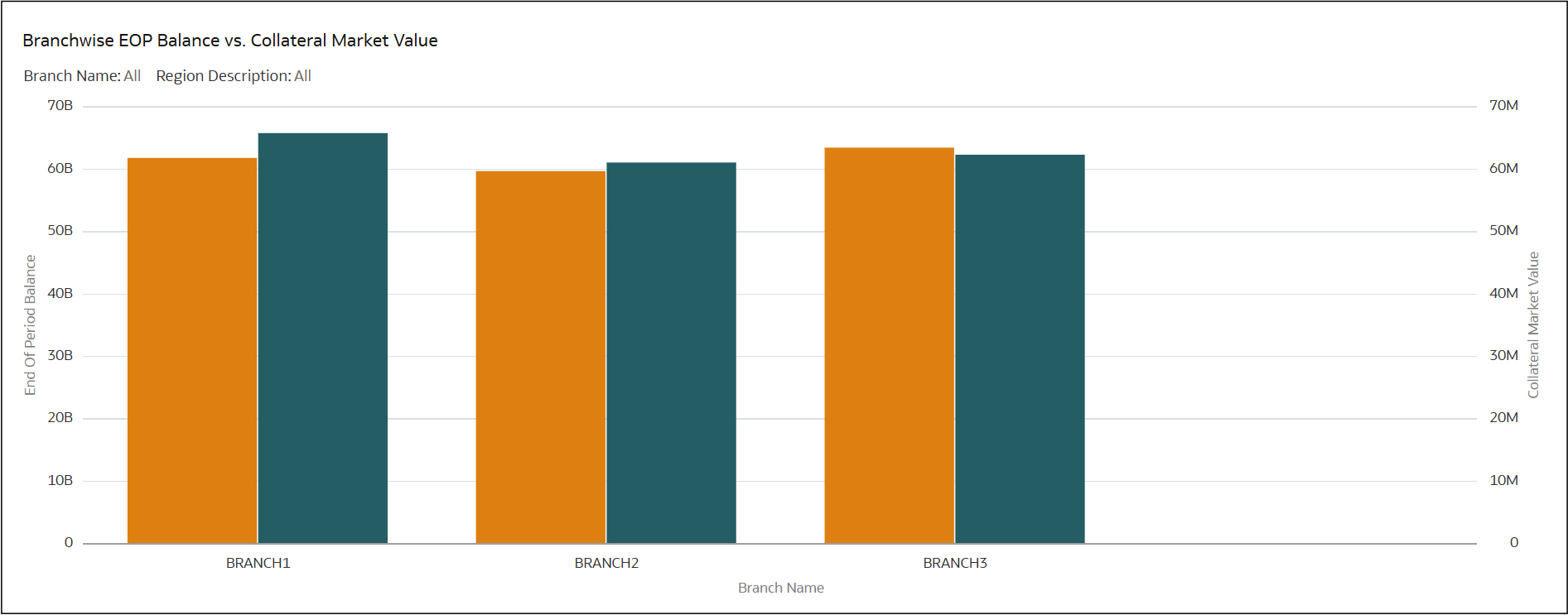

Branch-wise EOP Balance vs. Collateral Market Value

Figure 8-67 Branch-wise EOP Balance vs. Collateral Market Value

- Detection of over-leveraged branches

- Adequacy of collateral coverage

- Performance benchmarking across the branch network

Types of Collateral Received

Figure 8-68 Types of collateral placed

- Trends in collateral preference and effectiveness

- Changes in exposure and coverage adequacy

- Improved strategy development for managing counterparty and liquidity risk