3.20 Break Identification Process

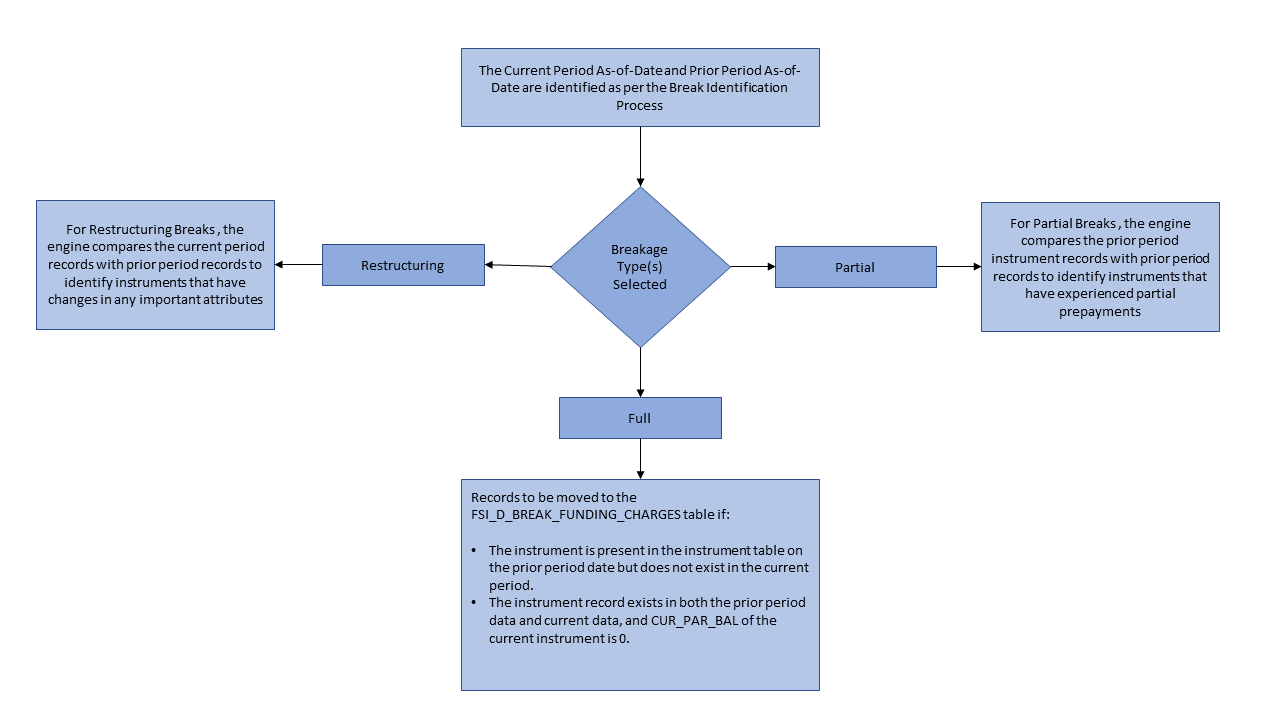

Breaks are associated with Assets and Liabilities that have fixed maturities and have experienced a full prepayment or pre-closure, partial prepayment, or restructuring. Any event that causes the bank to receive a change to scheduled contractual cash flows on a fixed maturity instrument results in a Break Funding Event and should be evaluated. Transactions that could cause a change in future cash flows would include full loan prepayments, partial loan prepayments, early withdrawal of term deposits, or a change in maturity tenor, payment amount, payment frequency, or other contractual terms.

The Break Identification Process allows you to perform the following tasks:

- Determine the data that you want to process (Product Selection block).

- Specify the parameters for the process. The parameters include break types like a full break, partial break, and change in attributes.

- Execute or Run the Break Identification Request and generate results (Break Identification Process Summary Page).

Break Identification processing should be run if automatic break detection is the preferred approach to populating the break events table (FSI_D_BREAK_FUNDING_CHARGES). The Break Funding Charges table is the source table for calculating breakage charges.

Figure 3-106 Break Identification Process Flow