5.3.13 Account Audit

The Account Audit UI provides a tool to validate account attributes along with calculated FTP results and the related cash flows. You can use Account Audit to access following account details.

- Transfer Rates, Add-On Rates, and Economic Cost results.

- Audit information like method used for transfer rate or Add-On rate calculations.

- Interest rate curves used for calculations.

- Cash flows generated for the account, which are helpful to verify the rate calculations.

- Error messages.

You can verify all these details in a single UI without taking any technical help to query multiple Database tables. To open the Account Audit, follow these steps:

- From the LHS menu, click Funds Transfer Pricing Cloud

Service, and then select Account Audit.

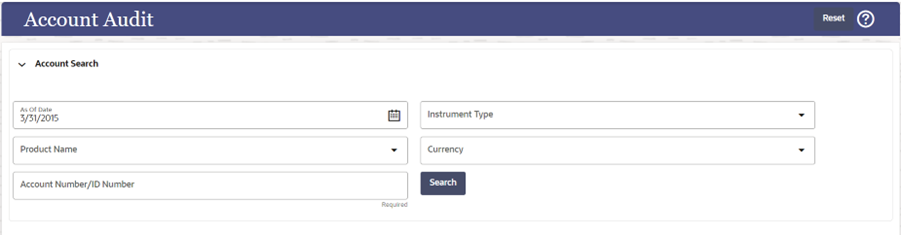

Figure 5-148 Account Audit page

- Enter the following details:

- As Of Date: By Default, this is the As Of Date set in the application preferences. However, select a different date using calendar if you want to pull records for another date, .

- Instrument Type: By Default, this is blank. Select

one value from available list of values like Loans, Deposits, etc.

There are multiple instrument tables to retain instruments like Assets, Liabilities, Off Balance Sheet items, and so on with millions of records. To speed up the process, you should select an instrument name from drop-down list.

- Product Name and Currency: Both are optional fields with a drop-down. You can select a value to narrow-down the search criteria and reduce the turnaround time.

- Account Number/ID Number (mandatory): You can enter either the ID Number or the Account number.

- After entering the relevant details, click Search.

If there are no records for the search criteria entered, then FTP displays a message No records found. Update the search criteria.

If the record is found, then the screen displays either the Account Number or ID Number based on your search criteria.

- Select the Account Number.

- Click Apply. The system displays the Account Attributes and Account details for the selected Account.

Account Attributes Tab

The account attributes tab displays account/deal attributes, so you can get an idea if the account is fixed or floating rate, rate of interest charged, original balance, remaining balance, account maturity etc., which would be required to verify the calculations in subsequent tabs.

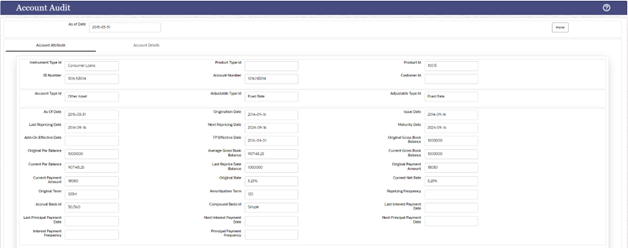

Figure 5-149 Account Attributes Tab

This tab contains following details:

- Instrument Type

- Product Details

- Customer Details (ID Number, Account Number, and Customer Number)

- Account Type, Adjustable Type, Amortization Type

- Dates (As of Date, Origination Date, Issue Date, Last Reporting Date.

- Balances, Payments, Terms, and Frequencies

- Customer Rate

Account Details Tab

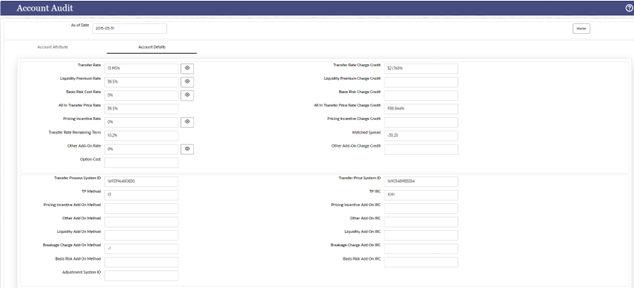

Figure 5-150 Account Details Tab

The account details tab contains two sections. The first section displays all the calculated rates, for example:

- Transfer Rate.

- Add-On rates if any (Basis Risk Cost, Liquidity Premium, Other Add-On or pricing incentive).

- Economic cost if any economic cost calculations are done.

- Corresponding charge credit details will also be displayed (if applicable).

Each rate has a view button next to it, if you want to verify what method, rule, IRC, and so on is being used for rate calculations. When you click on the View button the corresponding details are highlighted in the second section on the same screen.

For example, if you want to verify Transfer rate calculation, click the View button next to it and verify which TP method, IRC is used or if there is any prepayment assumption attached to it.