5.3.4.1.4 Cash Flow: Zero Discount Factors

The Zero Discount Factors (ZDF) Method takes into account common market practices in valuing fixed-rate amortizing instruments. For example, all Treasury Strips are quoted as discount factors. A discount factor represents the amount paid today to receive $1 at maturity date with no intervening Cash Flows (that is, zero-coupons).

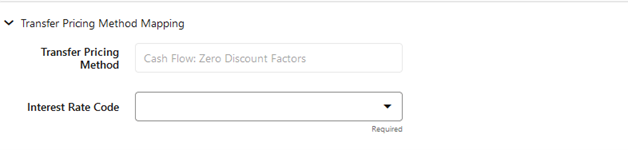

Figure 5-42 Cash Flow: Zero Discount Factors

The Treasury Discount Factor for any maturity (as well as all other rates quoted in the market) is always a function of the discount factors with shorter maturities. This ensures that no risk-free arbitrage exists in the market. Based on this concept, one can conclude that the rate quoted for fixed-rate amortizing instruments is also a combination of some set of market discount factors. Discounting the monthly Cash Flows for that instrument (calculated based on the constant instrument rate) by the market discount factors generates the par value of that instrument (otherwise there is arbitrage).

ZDF starts with the assertion that an institution tries to find a funding source that has the same principal repayment factor as the instrument being funded. In essence, the institution strip funds each principal flow using its funding curve (that is, the Transfer Pricing Yield Curve). The difference between the interest flows from the instrument and its funding source is the net income from that instrument.

Next, ZDF tries to ensure consistency between the original balance of the instrument and the amount of funding required at origination. Based on the Transfer Pricing Yield used to fund the instrument, the ZDF solves for a Single Transfer Rate that would amortize the funding in two ways:

- Its principal flows match those of the instrument.

- The Present Value (PV) of the funding cash flows (that is, the original balance) matches the original balance of the instrument.

ZDF uses zero-coupon factors (derived from the original transfer rates, see the example below) because they are the appropriate vehicles in strip funding (that is, there are no intermediate Cash Flows between the origination date and the date the particular Cash Flow is received). The zero-coupon yield curve can be universally applied to all kinds of instruments.

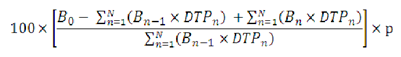

This approach yields the following formula to solve for a weighted average transfer rate based on the payment dates derived from the instrument's payment data.

Figure 5-43 Zero Discount Factors = y =

In this formula:

- B0: Beginning balance at the time, 0

- Bn-1: Ending balance in the previous period

- Bn: Ending balance in the current period

- DTPn: Discount factor in period n based on the TP yield curve

- N: Total number of payments from Start Date until the earlier of repricing or maturity

- p: Payments per year based on the payment frequency; (for example, monthly payments gives p=12)

This table illustrates how to derive Zero Coupon Discount factors from monthly pay Transfer Pricing Rates.

Table 5-11 Deriving Zero-Coupon Discount Factors: An Example

| Term in Months | (a) Monthly Pay Transfer Rates | (b) Monthly Transfer Rate: (a)/12 | (c) Numerator (Monthly Factor): 1+ (b) | (d) PV of Interest Payments: (b)*Sum((f)/100 to current row | (e) Denominator (1 - PV of Int Pmt): 1 - (d) | (f) Zero-Coupon Factor: [(e)/(c) * 100 |

|---|---|---|---|---|---|---|

| 1 | 3.400% | 0.283% | 1.002833 | 0.000000 | 1.000000 | 99.7175 |

| 2 | 3.500% | 0.292% | 1.002917 | 0.002908 | 0.997092 | 99.4192 |

| 3 | 3.600% | 0.300% | 1.003000 | 0.005974 | 0.994026 | 99.1053 |

Note:

For the ZDF method, the discount factor used for discounting cash flows is output as FE 490, after multiplied by 100.