5.3.11.2 Implied Forward Rate Calculation

An Implied Forward is that rate of interest that is predicted to be the spot rate in the future.

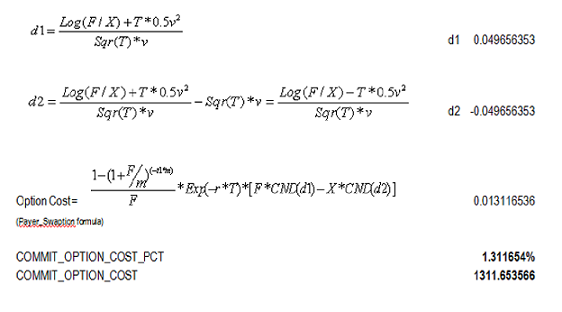

Figure 5-134 Implied Forward Rate Calculation Formula

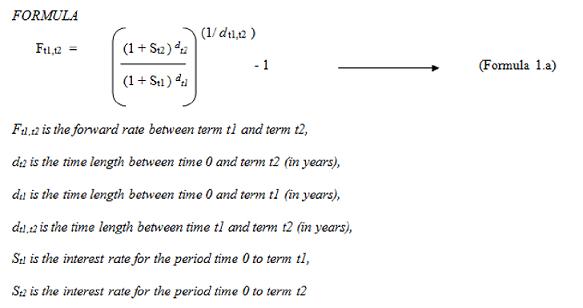

If 1 year TP Rate is 6.00% and 3 month TP Rate is 2.00% we can calculate the 3 months forward implied 9-month rate as follows:

Figure 5-135 3-month Forward Implied 9-month Rate Calculation Formula

Therefore, the market is implying that in 3 months, 9 month TP Rate will be 7.36%.

Rate Lock Option Cost Calculation: The Rate Lock Option Cost calculation uses a standard Black European swap pricing formula. This calculation is triggered by a Standard FTP Process and can be performed for both fixed-rate and adjustable-rate instruments. The following conditions must hold true for instrument records in the FSI_D_LOAN_COMMITMENTS table:

- commit_start_date <= as_of_date

- origination_date > as_of_date

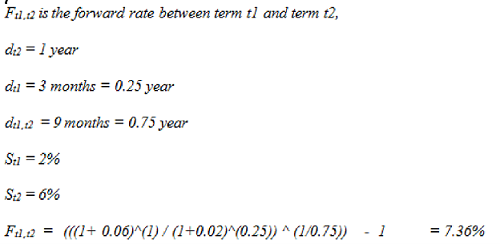

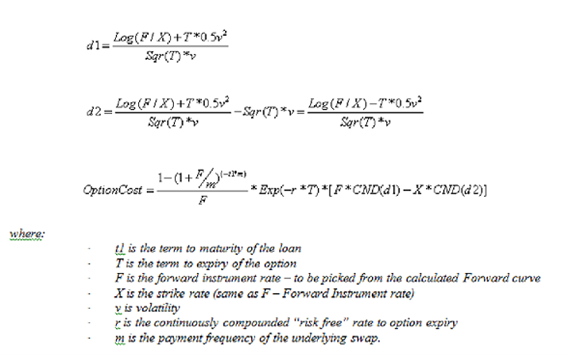

Figure 5-136 Black Formula for calculating Rate Lock Option Cost

Table 5-26 Example: Option Cost Calculation

| Loan Face value - ORG_BOOK_BAL | 10,000,000 | |

| Tenor of Loan - ORG_TERM & ORG_TERM_MULT | 5 | Years |

| Locked TP Rate - TRANSFER_RATE | 8.20% | |

| Rate Lock Commitment period - COMMIT_TERM & COMMIT_TERM_MULT | 90 | days |

| Principal Payment frequency - PRIN_PMT_FREQ | 6 | Months |

| Volatility | 20% | |

| Risk-free rate to Option Expiry | 4% |

Table 5-27 Required Inputs

| Term to maturity of the loan | t1 | 5 | years |

| Term to the expiry of the rate lock option | T | 0.2465753 | years |

| Strike rate - Locked TP Rate (Forward TP Rate as on Loan Origination) | X | 8.20% | |

| Volatility | |||

| Details for Volatility - From the historical volatility curve that is loaded in Rate Management by the user, pick Volatility% with | |||

| EFFECTIVE DATE = COMMIT_START_DATE and LOOKUP TENOR = Tenor of the Loan. In Release 6.0, 2 Dimensional Volatility curve was introduced with Contract term and Expiry term as the 2 dimensions. | v | 20% | |

| Payment frequency of the loan | m | 6 | months |

| Continuously Compounded TP rate to option expiry | r | 4.08% | (See the calculation (1) below) |

| Implied Forward TP rate | F | 8.20% | (See calculation (2) below) |

Table 5-28 Intermediate Calculations

| (1) Continuously Compounded TP rate to option expiry | r | 4.08% |

| (2) Implied Forward TP rate | ||

| (FDD v1.1 - Implied Forward Rate Calculation - Section 6.1.2.1) | ||

| Inputs required - (Terminology for these inputs is according to Section 6.1.2.1) | F | |

| dt1 - Commitment term of Rate Lock | 0.246575 | years |

| dt1,t2 - Tenor of Instrument | 5 | years |

| dt2- Time length between Commitment Start Date and Loan maturity | 5.246575 | Years |

| St1- Spot Interest Rate as on COMMIT_START_DATE for Commitment Term of the Rate Lock (COMMIT_MAT_DATE – COMMIT_START_DATE) | 4% | |

| St2- Spot Interest Rate as on COMMIT_START_DATE for Time length between Commitment Start Date and Loan maturity | 8% | |

| Implied Forward Rate, F (Formula given above in explanation) | 0.0820119 | 8.20% |

Option Cost Calculation

Figure 5-137 Option Cost Calculation Formula