34.1.1 Defining a Product

To define a product:

- Navigate to FTP Rate Card, and select Products to access the Products window.

- Click the Add icon to create a new product definition.

The definition of Product is a part of the Create or Edit Product Definition page. When you click Apply or Save on the Create Product Definition page, the product definition is saved and the Product will be displayed on the Product summary page.

Note:

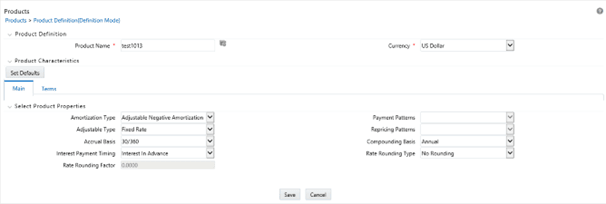

Only those Products, which are defined by the Administrator, will be included in the daily FTP Rate Card Process and similarly, only defined products will be available to end-users for Rate Card reporting.Figure 34-2 Product Definition screen

Prerequisites: Performing basic steps for creating or editing a Product.

Procedure: This table describes the key terms used for this Procedure.

Table 34-1 Fields and Descriptions from the Products summary page

Term Definition Product Provides a list of the leaf dimension members for the Product dimension selected in Application Preferences. Currency The corresponding currency of the instrument to be priced. Set Defaults Select the Set Defaults option, to restore default Product Characteristics. Main Tab Amortization Type Select the Amortization Type. This defines the method by which an account's principal and interest will be Amortized.

The Default Amortization Type is Non Amortizing.

Payment Patterns Optionally, select the Payment Pattern. This list is defined through the Payment Pattern user interface. Adjustment Type Select the Adjustment Type. This selection indicates if the product is a fixed-rate or adjustable-rate.

The Default Adjustment Type is Fixed Rate.

Repricing Patterns Optionally, select the Repricing Pattern. This list is defined through the Repricing Pattern user interface. Accrual Basis Select the Accrual Basis. The interest accrual is calculated on this basis.

The default value is Actual/Actual.

Compounding Basis Select the Compounding basis. This selection indicates the compounding frequency used to calculate the interest income. The compounding basis for the interest payments can be monthly, annually, simple, and so on.

The default value is Simple.

Interest Payment Timing Define the Interest Payment Timing. You can pay the interest in Advance, Arrears. The default value is Interest in Arrears. Rate Rounding Type Select the Rate Rounding Type to round off the Interest Rate. This selection indicates how the rate assigned to the product will be rounded.

The default value is No Rounding.

Rate Rounding Factor Enter the rate-rounding factor. If the Rate Rounding Type is Round Up, Round Down, or Round Nearest, then the rate-rounding factor determines the precision of the rounding. The possible range of values for this is 0.0000 – 9.9999.

The default value is 0.0000.

This option is not applicable if Rate Rounding Type is selected as No Rounding.

Term Tab Original Term Enter the Original Term to define the contractual term from the origination date. Note that it is possible to define more than one term for the selected product/currency. If more than one term is defined, then multiple records are created for pricing, i.e. one corresponding to each Product/Currency and Term. Payment Frequency Enter the payment frequency. This allows you to define the frequency of payment. Repricing Frequency Enter the Repricing Frequency to define the frequency of rate change of a product. Amortization Term Define the assumed term used for payment calculation purposes. This will be equal to the Original Term of the instrument. It should only be different in cases where the instrument does not fully Amortize over the life of the product. i.e. there is a lump sum payment due on the maturity date. Interest Rate Code Enter the Interest Rate Code to be used for finding the coupon rate on the product. Margin Enter the margin that is the contractual spread, which is added to the pricing index and results in the financial institution's retention (net) rate. Rate Set Lag Define the period by which repricing lags the current interest rate changes. The default value is 0 Months. Tease Period Define the Tease Date, that is when the Tease Rate (introductory rate) ends and the normal product rate begins.

The default value is 0 Months.

This entry is disabled, if the Adjustable Type (defined from Main Tab) is a Repricing pattern or fixed.

Tease Discount Enter the Tease Discount. The default value for tease discount is 0.0000. This entry is disabled if the Adjustable Type is a repricing pattern or fixed rate or if the teasing period is zero. Commitment Start Date The commitment start date defaults to the system date. Commitment Term Enter the commitment period term in Days. Based on this input the commitment end date is calculated. Commitment End Date The commitment end date is calculated automatically based on the commitment start date and commitment term.

<Enter a single subject here.>