33.3 Rate Management

As shown in the TP Process, the Rate Lock Option Cost calculation requires two inputs both of which come from the Rate Management > Interest Rates page.

- Discount Curve: This can be a standard Interest Rate Curve.

- Volatility Curve: This is a special form of Interest Rate Curve, where the volatility curve option has been selected.

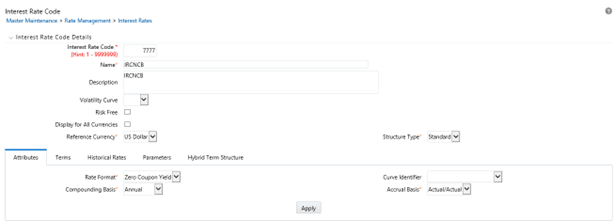

To set up a volatility curve, while defining a new Interest Rate Curve, select the checkbox – 'Volatility Curve'. This checkbox selection signifies that the curve will hold volatility rates. Select the Reference Currency of the IRC being created.

When 'Volatility Curve' is checked, the following fields are disabled and are not applicable:

- Compounding basis

- Accrual basis

- Rate Format

Figure 33-3 Interest Rate Code

Note:

In the moneyness dimension, associated with option volatility is not required, because Rate Lock Options are assumed to be granted at the money.The following steps are required to complete the setup of a volatility curve:

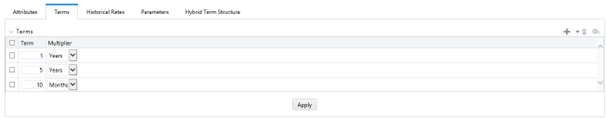

- Terms tab - Contract Term: Add rows and input terms for the

number of required Loan Terms. These are the maturity term of the loan. Select

APPLY to save the data.

Figure 33-4 Terms Tab – Contract Term

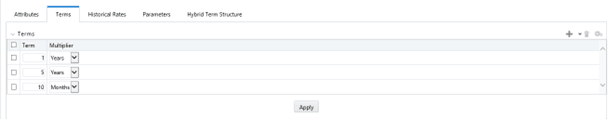

- Terms Tab – Expiration Term: Add rows and Input Terms for the

number of required Expiration Terms. These correspond to the number of Rate Lock

Terms offered. Select APPLY to save the data.

Figure 33-5 Terms Tab – Expiration Term

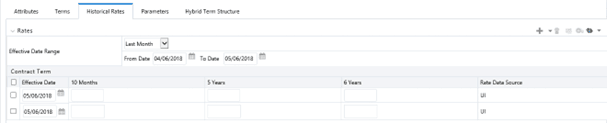

- Historical Rates tab: After defining and applying the

volatility curve dimensions, navigate to the Historical Rates tab and input the

volatility rates for each combination of the loan term and rate lock term and for

each effective date that you wish to store historical volatility data.

Figure 33-6 Historical Rates tab

Select Apply when finished to save the data.