Interest Rate Forecast Methods

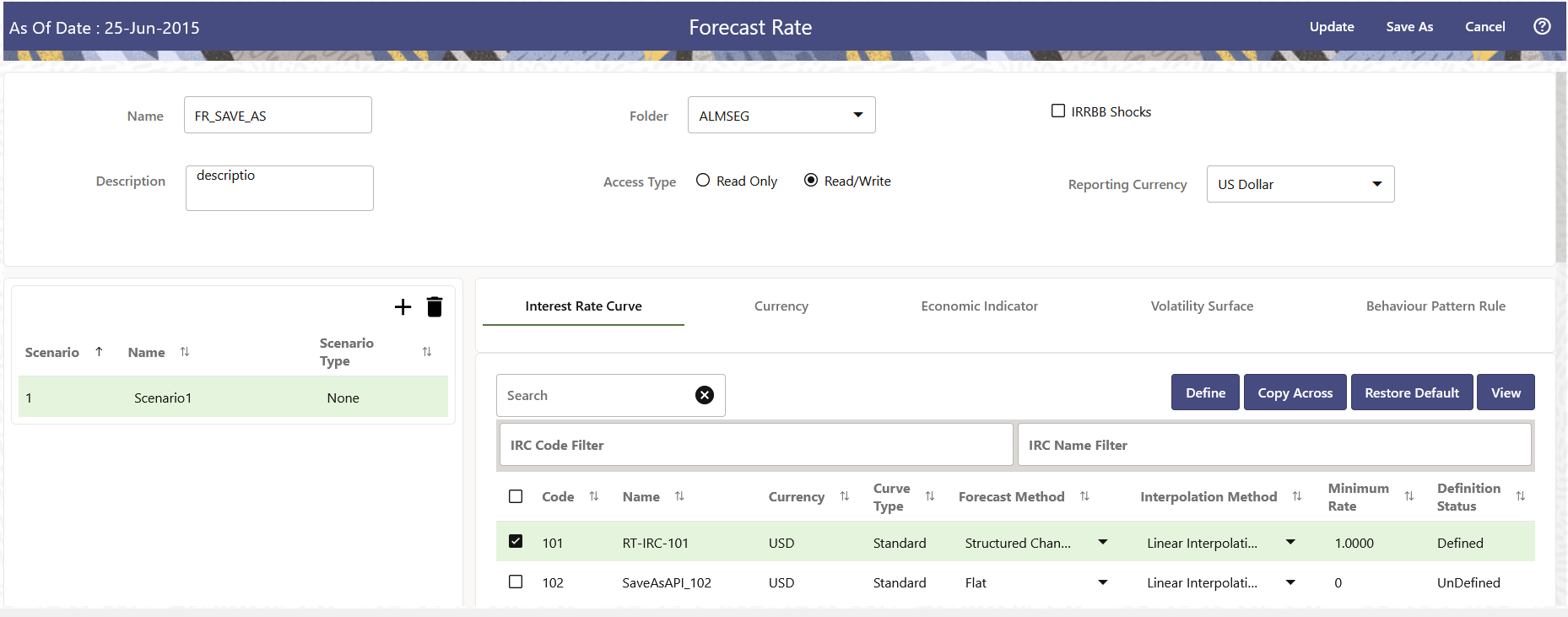

The IRCs for all active currencies are listed under Interest Rate Curve Section. The options under Interest Rate Curve Forecast Method provide multiple ways to model the effects on portfolio Cash Flows due to Interest Rate changes.

Figure 20-2 Interest Rate Curve Forecast Rates

You can define Interest Rate Forecast for the following methods:

Table 20-4 Forecast Rate rule – Methods and Descriptions

| Method | Description |

|---|---|

| Flat | Forecast no change in the Interest Rate for all dates beginning with the As-of Date. |

| Direct Input | Type Interest Rates directly for any modeling period or Interest Rate term. |

| Structured Change |

Forecast exchange rates as an incremental change from the previous period. Forecast rate changes in terms of absolute or percent change, for any modeling period or interest rate term, such as: +100 basis points on Day 1 -200 basis points over the first 6 months Yield curve rotation (short point decreasing, long point increasing). This option is available only in Asset Liability Management Cloud Service. |

| Implied Forward |

Forecast interest rates based on the yield-curve interest rates in effect at the as-of date and consistent with the modeling bucket definitions. This option is available only in Asset Liability Management Cloud Service. |

| Yield Curve Twist | Flatten or steepen the yield curve around a specific

point on the curve.

This option is available only in Asset Liability Management Cloud Service. |

| Change from Base |

Make incremental changes to an existing forecast scenario. This option is available only in Asset Liability Management Cloud Service. |

| IRRBB Standardized Approach Shocks |

Forecast an interest rate shock according to one of the BCBS IRRBB Standardized Approach shock specifications (Scenario-level specification). This option is available only in Asset Liability Management Cloud Service |

| IRRBB Enhanced Approach Shocks |

Forecast an interest rate shock according to user specifications that will flow into IRRBB Table B reporting. This option is available only in Asset Liability Management Cloud Service. |

For more information, see the Cash Flow Engine Reference Guide.

The following Interpolation Methods are available.

Table 20-5 Forecast Rate Rule – Interpolation Methods and Descriptions

| Method | Description |

|---|---|

| Linear Interpolation | Linear interpolation uses Linear Yield Curve smoothing. Linear Yield Curves are continuous but not smooth; at each knot point, there is a kink in the yield curve. You may not want to use a Linear Yield Curve with a model that assumes the existence of a continuous Forward Rate Curve, due to the nonlinear and discontinuous knot points of a Linear Yield Curve. |

| Cubic Spline of Yields |

A cubic spline is a series of third-degree polynomials that have the form:

y = a + bx + cx2 + dx3 These polynomials are used to connect the dots formed by observable data. The polynomials are constrained so they fit together smoothly at each knot point (the observable data point.) This means that the slope and the rate of change in the slope with respect to time to maturity have to be equal for each polynomial at the knot point where they join. If this is not true, there is a kink in the yield curve and they are continuous but not differentiable. Two more constraints make the Cubic Spline Curve unique. The first restricts the zero-maturity yield to equal the 1-day interest rate. The second restricts the yield curve at the longest maturity to be either straight (y"=0) or flat (y'=0). |

| Quartic Spline |

Quartic interpolation requires a minimum of 4 knot points. The quartic interpolation equation can be represented as:

Y = a + bX + cX2 + dX3 + eX4 The end knot points satisfy equations for one curve and all intermediate points satisfy two curves. Therefore, in a scenario with a minimum number of knot points, there are 6 equations. For n number of knot points, the number of equations is 2n-2. If n is the number of points to be interpolated, the order of the matrix to be formed is 5*(n-1) x 5*(n-1). The matrix is formed according to the following logic: The second derivative at the endpoints and the first derivative of the last point is Zero. At the points other than the endpoints, the value of the first derivatives, second derivatives, and the third derivatives of the function are equal. |

In looking up the Forecast Rates, the Cash Flow Engine (where necessary) performs an interpolation between yield curve term points. For example, in determining a three-month rate from a yield curve that contains only a one-month rate and a six-month rate, the Cash Flow Engine performs an interpolation to determine the implied three-month rate. The Interpolation method used is defined by the selected interpolation method for the Interest Rate Curve.

Forecast rates for 360 calendar months starting from As-of-Date are generated.

Following options are available for Interest Rate Curve Forecast Rule:

Define

-

Flat Method

- Select Interest Rate Curve using corresponding checkbox and select Forecast Method as Flat.

- Select the Interpolation method.

- Input Minimum Rate, if required.

- Click Define.

The status of the Interest Rate Curve is changed to Defined.

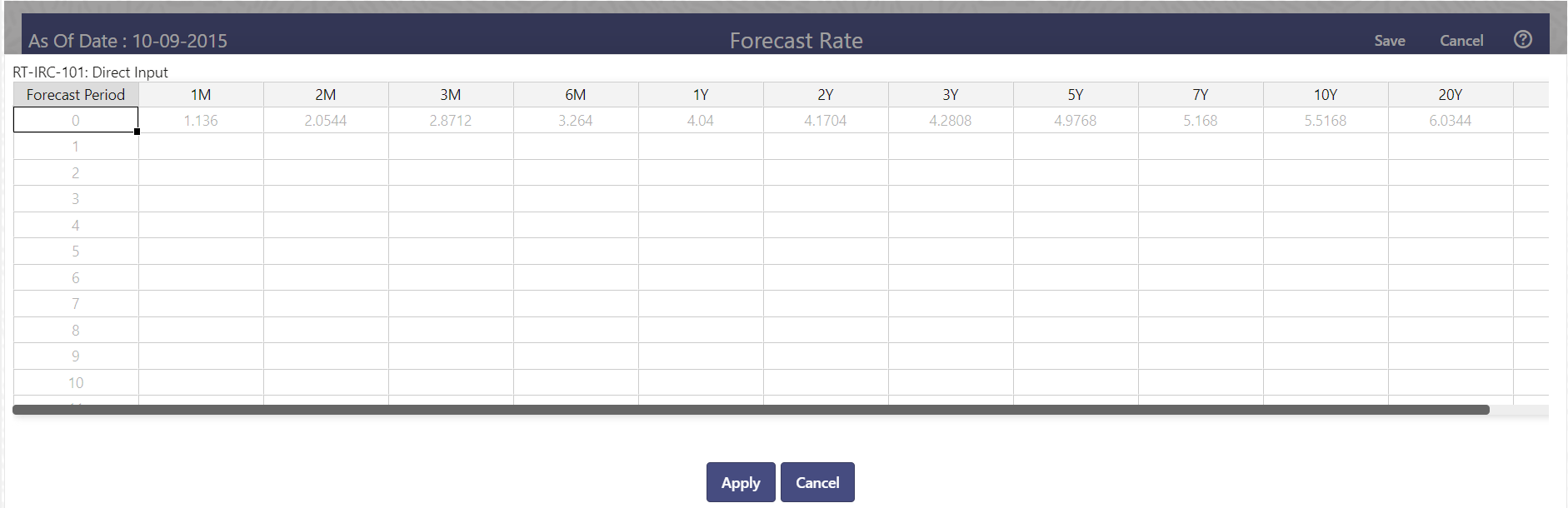

- Direct Input

- Select Interest Rate Curve using corresponding checkbox and select Forecast Method as Direct Input.

- Select the Interpolation Method.

- Input Minimum Rate, if required.

- Click Define.

The Direct Input window is displayed:

Figure 20-3 Direct Input

- Enter data and click Apply. Right click on data grid and select ‘Export to Excel’ to save visible data to excel file. You can also copy directly from the grid and paste data from an excel file to the grid.

- The status of the Interest Rate Curve is changed to Defined.

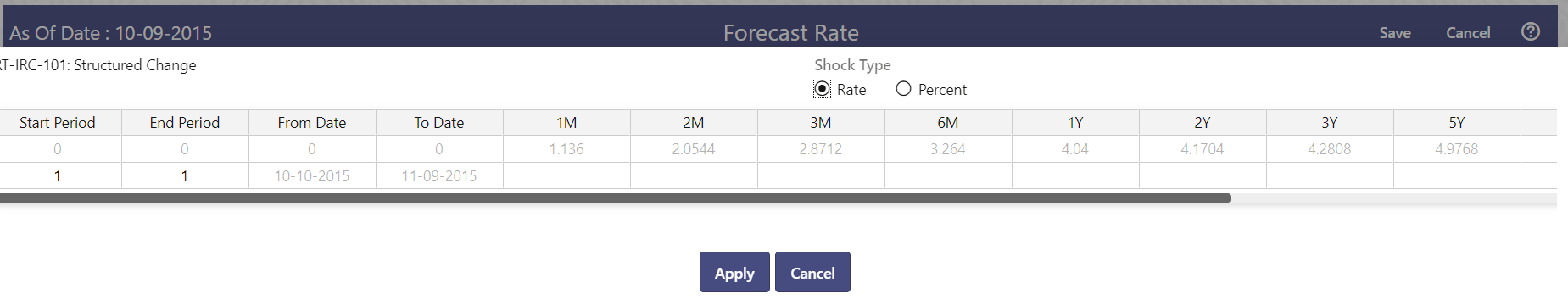

- Structured Change

- Select Interest Rate Curve using corresponding checkbox and select Forecast Method as Structured Change .

- Select the Interpolation Method.

- Input Minimum Rate, if required.

- Click Define.

The Structured Change window is displayed:

Figure 20-4 Structured Change

- Select the Shock Type as Rate or Percent. Shock Type as Rate designates to absolute rate change and Shock Type as Percent designates to percent rate change.

- Enter a shock amount to apply to the IRC in absolute rate or percentage change. Enter Start and End period from 1 to 360 months and corresponding shock amount to apply to the IRC. Right click on data grid to all more rows or delete rows. Use the Excel Import or Export feature to add the interest rate changes.

- Click Apply to save.

- The status of the Interest Rate Curve is changed to Defined.

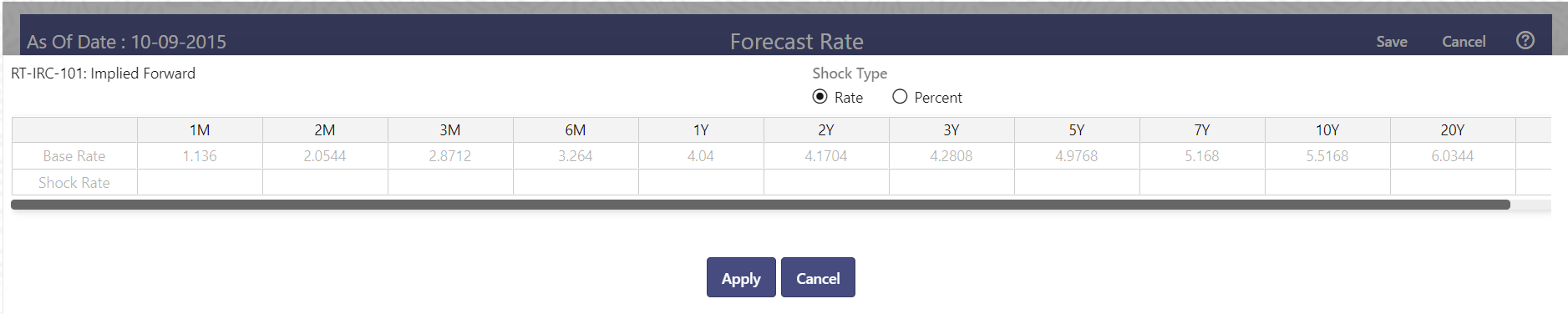

- Implied Forward

- Select Interest Rate Curve using corresponding checkbox and select Forecast Method as Implied Forward.

- Select the Interpolation Method.

- Input Minimum Rate, if required.

- Click Define.

The Implied Forward window is displayed:

Figure 20-5 Implied Forward

- Select the Shock Type as Rate or Percent. Shock Type as Rate designates to absolute rate change and Shock Type as Percent designates to percent rate change.

- Enter a shock amount to apply to the IRC in absolute rate or percentage change. If no change is required to the base curve, leave at 0.0, and click Apply.

- The status of the Interest Rate Curve is changed to Defined.

- Yield Curve Twist

- Select Interest Rate Curve using corresponding checkbox and select Forecast Method as Yield Curve Twist.

- Select the Interpolation Method.

- Input Minimum Rate, if required.

- Click Define.

The Yield Curve Twist window is displayed:

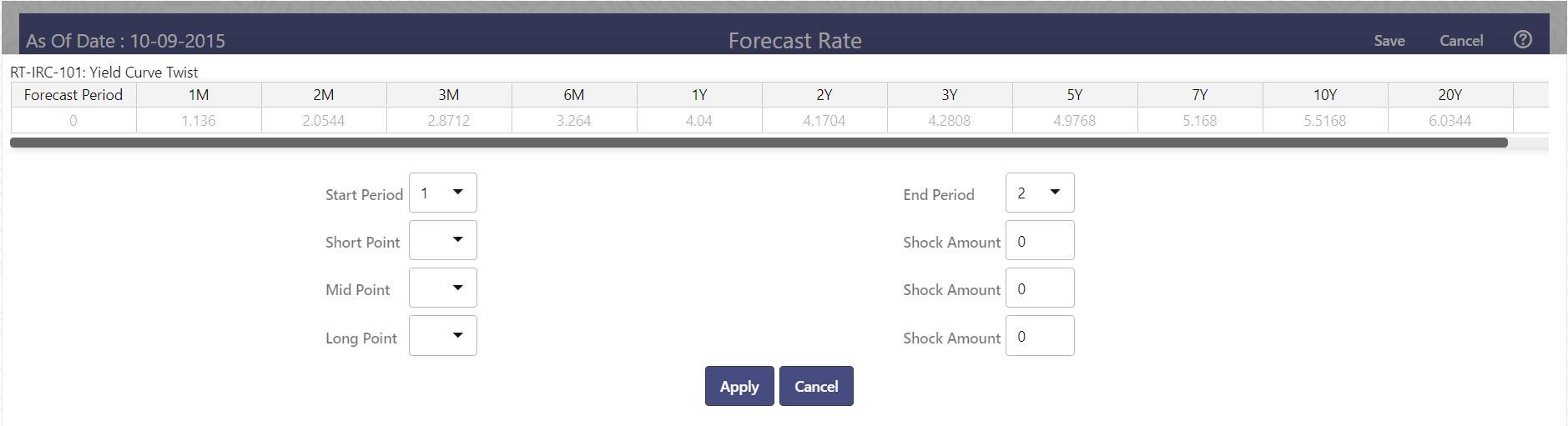

Figure 20-6 Yield Curve Twist

- Select Start and End Period. Start Period must 1 or higher while highest End Period can be 360.

- Select the tenors using the Short Point, Mid Point, and Long Point.

- Add the required shock amounts for each tenor. At runtime and display time, the rate changes are added to the as-of-date rates to create a future scenario.

- Click Apply.

The status of the Interest Rate Curve is changed to Defined.

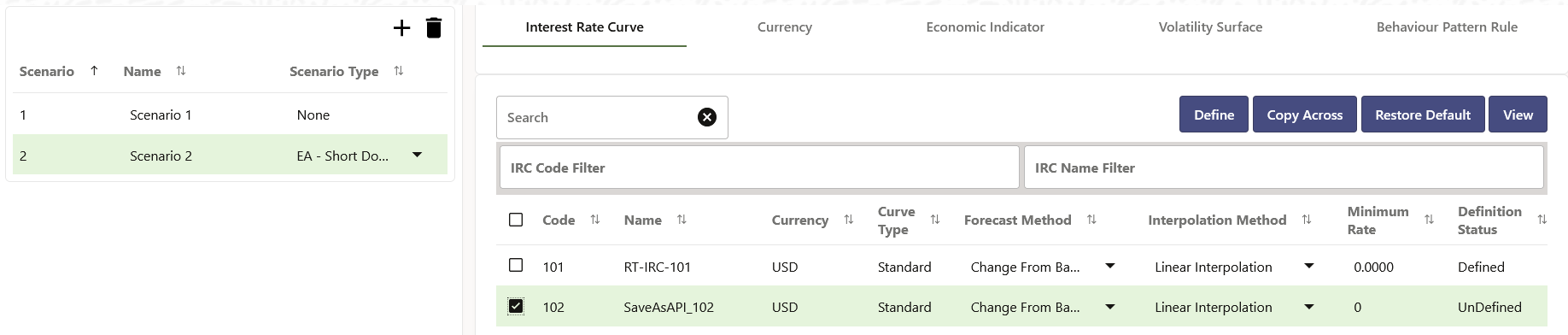

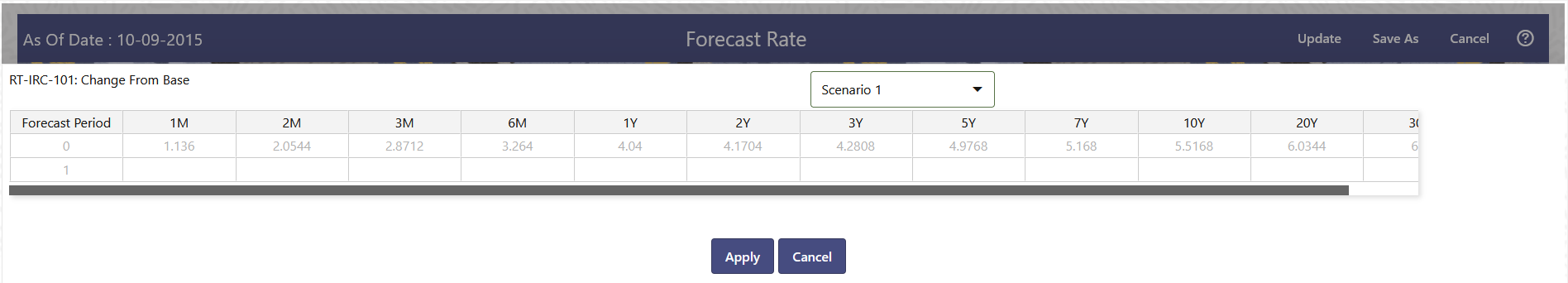

- Change From Base

Note:

This method is available from second scenario onwards.- Select Scenario 2 or higher as Scenario.

Figure 20-7 Change From Base

- Select Interest Rate Code using corresponding checkbox and select Forecast Method as Change from Base.

- Select the Interpolation Method.

- Input Minimum Rate, if required.

- Click Define. The Change From Base window is displayed.

Figure 20-8 Change From Base

- Scenario 1 is used as base scenario.

- Enter the Forecast Period from 1 to 360 months and the corresponding change amount to apply to the base forecastes IRC. Right click on data grid to all more rows or delete rows. Use the Excel Import or Export feature to add the interest rate changes.

- The status of the Interest Rate Curve is changed to Defined.

- Select Scenario 2 or higher as Scenario.

- Standardized Approach Shocks

Standardized Approach shocks are different than other Interest Rate Rules as these are applied at the scenario level instead of at the IRC level. When you create a new Forecast Rates rule, the default Scenario 1 is always the base scenario for Standardized Approach purposes and cannot have a Standardized Approach shock definition.

- In Forecast Rates window, select the IRRBB Shocks. This allows you to define either Standardized or Enhanced Approach Scenarios, or both for a single Forecast Rates Rule. Once a forecast rates rule is designated as IRRBB Shocks, this check box cannot be unselected unless there are no defined scenarios as either Standardized or Enhanced Approach scenario type.

- To apply a Standardized Approach scenario, click the Add Scenario.

- In the Add Forecast Rates Scenario section, select the Scenario Type to

apply the scenario. The following are the shock scenarios:

- Standardized Approach Shock - Parallel UP

- Standardized Approach Shock - Parallel DOWN

- Standardized Approach Shock - Short UP

- Standardized Approach Shock - Short DOWN

- Standardized Approach Shock - Flattener

- Standardized Approach Shock - Steppener

- Only one Standardized Approach shock can be applied to a single scenario, and no two SA shocks of the same type may be applied to the same Forecast Rates rule. All qualifying IRCs will inherit this SA shock and cannot be changed except for their interpolation method and minimum rate.

- Click Apply to make scenario as Standardized Approach shock.

- Enhanced Approach Shocks

Like Standardized Approach shocks, Enhanced Approach shocks are scenario-level rules, and Scenario 1 is always referred to as the Base scenario for reporting purposes. However, unlike Standardized Approach shocks, the Forecast method for each IRC is not pre-established. This means that users must define the Forecast method, interpolation method and minimum rate for all Interest Rates in each scenario. Once defined and processed, the results will flow through into the Table B reporting.

- In the Forecast Rates window, select the IRRBB Shocks. This allows you to define either Standardized or Enhanced Approach scenarios, or both for a single Forecast Rate rule. After a Forecast Rate rule is designated as IRRBB Shocks, this check box cannot be unselected unless there are no defined scenarios as either Standardized or Enhanced Approach Scenario Type.

- To apply an Enhanced Approach scenario, click the Add Scenario. The

following are the shock scenarios:

- Enhanced Approach Shock - Parallel UP

- Enhanced Approach Shock - Parallel DOWN

- Enhanced Approach Shock - Short UP

- Enhanced Approach Shock - Short DOWN

- Enhanced Approach Shock - Flattener

- Enhanced Approach Shock - Steppener

- Only one Enhanced Approach shock can be applied to a single scenario, and no two EA shocks of the same type can be applied to the same Forecast Rates rule. All IRCs in this scenario remain fully editable for the Forecast method, Interpolation method, and Minimum Rate.

- Click Apply to make the scenario as Enhanced Approach shock.

Copy Across

This allows you to copy Forecast Method and related details from one IRC to another.

For example, if you have 10 IRCs enabled in the application and you must input only one set of assumptions, then copy those assumptions across all enabled IRCs, instead of having to input 10 full sets, thereby saving a significant amount of input time.

Note:

You must select a defined IRC to Copy Across. For more information, see the Define section of Interest Rate Curve.

- Flat Method

- Select Interest Rate Curve using corresponding checkbox and select Forecast Method as Flat.

- Click Copy Across.

- Click Apply Copy Across.

- You can click Cancel Copy Across to cancel the Copy Across function.

- Structured Change

- Select Interest Rate Curve using the corresponding checkbox and select Forecast Method as Structured Change..

- Click Copy Across.

- Click Apply Copy Across.

- You can click Cancel Copy Across to cancel the Copy Across function.

- Implied Forward

- Select Interest Rate Curve using corresponding checkbox and select Forecast Method as Implied Forward.

- Click Copy Across.

- Click Apply Copy Across.

- You can click Cancel Copy Across to cancel the Copy Across function.

- Change From Base

- Select Interest Rate Curve using corresponding checkbox and select Forecast Method as Change From Base.

- Click Copy Across.

- Click Apply Copy Across.

- You can click Cancel Copy Across to cancel the Copy Across function.

Restore Default

Use this action to reset previously entered details to Undefined status.

- Flat Method

- Select Interest Rate Curve using corresponding checkbox and select Forecast Method as Flat.

- Click Restore Default.

- The status of the Interest Rate Curve is changed to Undefined.

- Direct Input

- Select Interest Rate Curve using corresponding checkbox and select Forecast Method as Direct Input.

- Click Restore Default.

- The status of the Interest Rate Curve is changed to Undefined.

- Structured Change

- Select Interest Rate Curve using corresponding checkbox and select Forecast Method as Structured Change.

- Click Restore Default.

- The status of the Interest Rate Curve is changed to Undefined.

- Implied Forward

- Select Interest Rate Curve using corresponding checkbox and select Forecast Method as Implied Forward.

- Click Restore Default.

- The status of the Interest Rate Curve is changed to Undefined.

- Yield Curve Twist

- Select Interest Rate Curve using corresponding checkbox and select Forecast Method as Yield Curve Twist.

- Click Restore Default.

- The status of the Interest Rate Curve is changed to Undefined.

- Change From Base

- Select Interest Rate Curve using corresponding checkbox and select Forecast Method as Change From Base.

- Click Restore Default.

- The status of the Interest Rate Curve is changed to Undefined.

View

After defining Forecast Method and other parameters for an IRC you can view the forecasted interest rates by clicking this button.

- Flat Method

- Select Interest Rate Curve using corresponding checkbox and select Forecast Method as Flat.

- Click View to see the output table.

- Direct Input

- Select Interest Rate Curve using corresponding checkbox and select Forecast Method as Direct Input.

- Click View to see the Output Table.

- Structured Change

- Select Interest Rate Curve using corresponding checkbox and select Forecast Method as Structured Change.

- Click View to see the Output Table.

- Yield Curve Twist

- Select Interest Rate Curve using corresponding checkbox and select Forecast Method as Yield Curve Twist.

- Click View to see the Output Table.

- Implied Forward

- Select Interest Rate Curve using corresponding checkbox and select Forecast Method as Implied Forward.

- Click View to see the Output Table.

- Change From Base

- Select Interest Rate Curve using corresponding checkbox and select Forecast Method as Change From Base.

- Click View to see the Output Table.