Defining Devolvement and Recovery Behavior Patterns

Devolvement and Recovery Behavior Patterns are commonly used for estimating Cash Flows associated with Letters of Credit and Guarantees. These product types are categorized as Off-Balance-Sheet Accounts. Users can assign expected maturity profiles to the related balances classifying them into appropriate categories of Sight Devolvement and Sight Recovery or Usance Devolvement and Usance Recovery. Sight Devolvement and Recovery are the most common types.

To define the Non-Performing Behavior Patterns, perform the following steps:

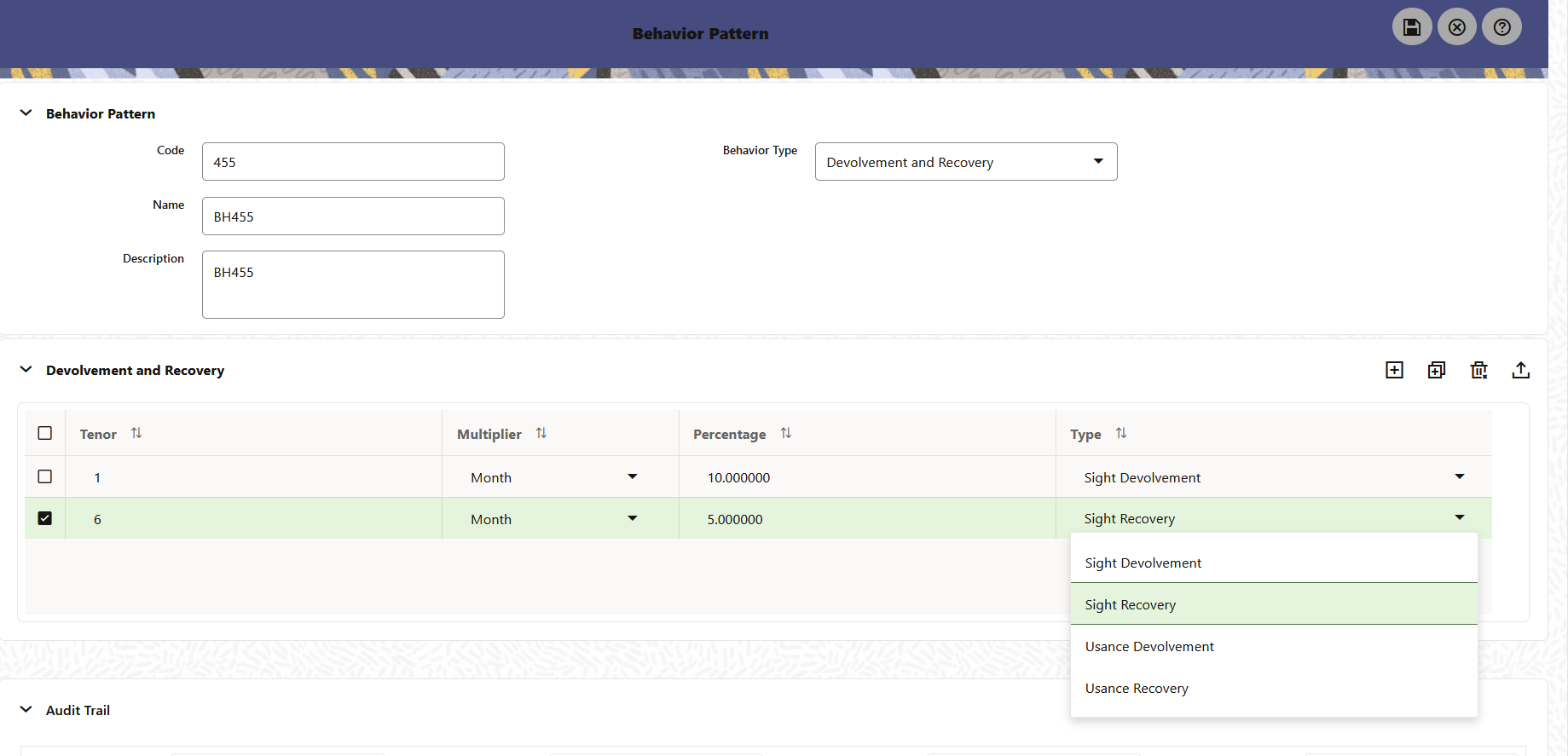

- In the Behavior Pattern Details Page, select Devolvement and Recovery as the Behavior Pattern Type.

- Click the Add icon to open the Non-Performing Behavior Patterns

Summary Page.

Figure 19-3 Behavior Pattern with Type as Devolvement and Recovery

- Enter or select the following details:

- Tenor: Specify the maturity tenor for the first maturity strip. For example, if “1 Day” is defined, then the applicable percentage of the balance will Runoff (mature) on the As-of-Date + 1 Day.

- Multiplier: The unit of time applied to the Tenor. The choices

are:

- Days

- Months

- Years

- Percentage: The relative amount of the Principal Balance that will mature on the date specified by the Tenor + Multiplier. The percentage amounts can exceed 100% for devolvement and recovery patterns.

- Type: This allows you to classify the Runoff based on the appropriate

type. The options are:

- Sight Devolvement: indicates the Beneficiary is paid as soon as the Paying Bank has determined that all necessary documents are in order. This is the preferred approach.

- Sight Recovery

- Usance Devolvement: Usance: is a period, which can be between 30 and 180 days after the bill of Lading Date.

- Usance Recovery

Note:

There is no difference in behavior from a Cash Flow perspective, but the Runoff Amount will be written to a Principal Runoff Financial Element corresponding to the selected Runoff Type.

- Click the Add icon to add additional payment strips to the Pattern and define appropriate assumptions for each strip.

- To delete a row, select the check box corresponding to the row(s) you want to remove and click the Delete icon.

- Click Save.

The Behavior Pattern is saved and the Behavior Pattern Summary Page is displayed.