6.3.5 Catastrophe Tab

The Catastrophe tab includes reports that focus on the Key Performance Indicators for declared Catastrophe. The filters for this tab allow the report results to be focused on selected combinations for comparison and targeted analysis.

The filters include:

- Time

- Company

- Catastrophe

- Region

The various reports available under this tab are detailed in the following sections.

Catastrophe Net Losses Map

Figure 6-178 Catastrophe Net Losses Map

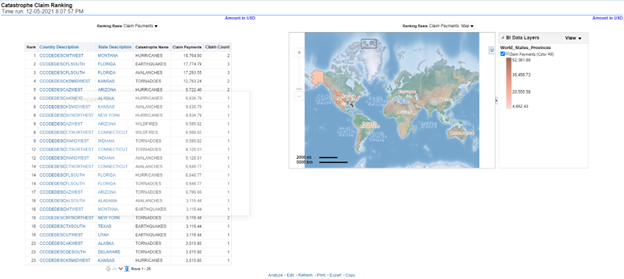

Catastrophe Claim Ranking

Figure 6-179 Catastrophe Claim Ranking

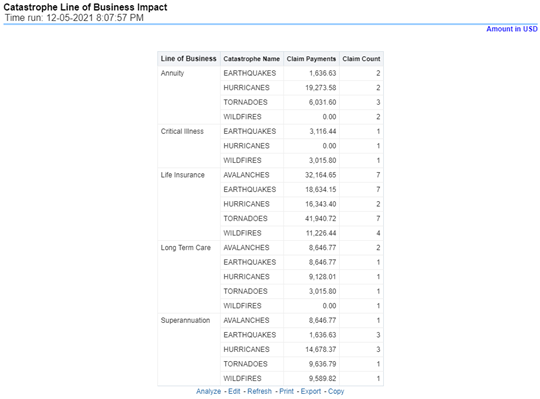

Catastrophe Lines of Business Impact

Figure 6-180 Catastrophe Lines of Business Impact

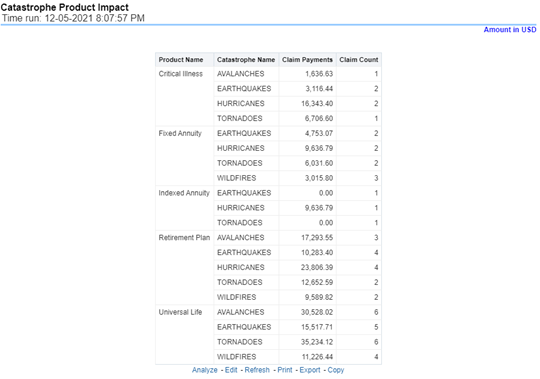

Catastrophe Product Impact

Figure 6-181 Catastrophe Product Impact

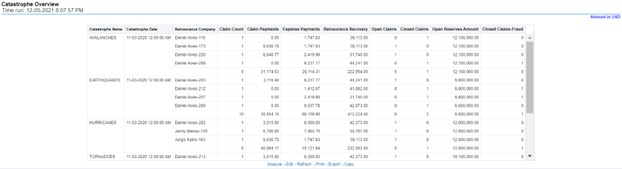

Catastrophe Overview

Figure 6-182 Catastrophe Overview

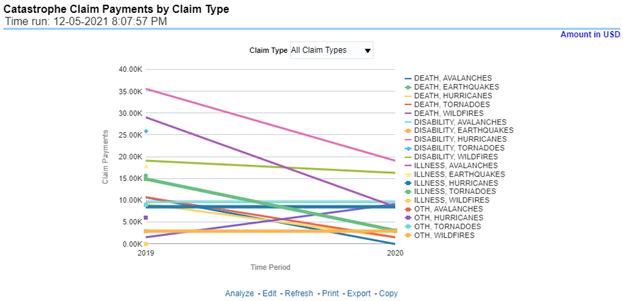

Catastrophe Claim Payments by Claim Type

Figure 6-183 Catastrophe Claim Payments by Claim Type

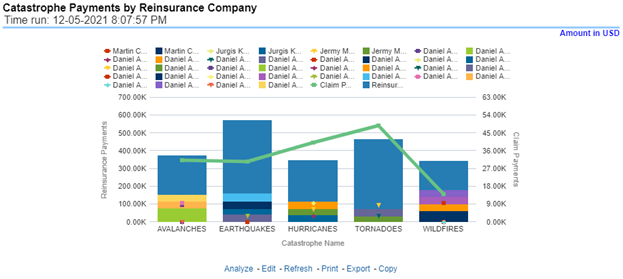

Catastrophe Payments by Reinsurance Company

Figure 6-184 Catastrophe Payments by Reinsurance Company

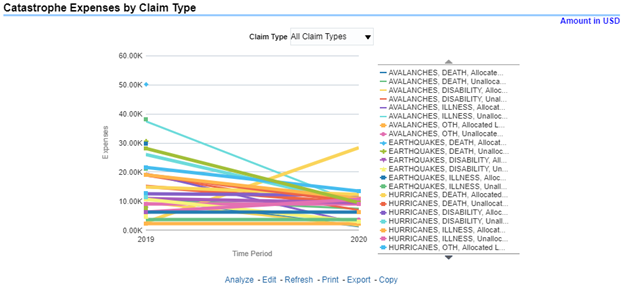

Catastrophe Expenses by Claim Type

Figure 6-185 Catastrophe Expenses by Claim Type

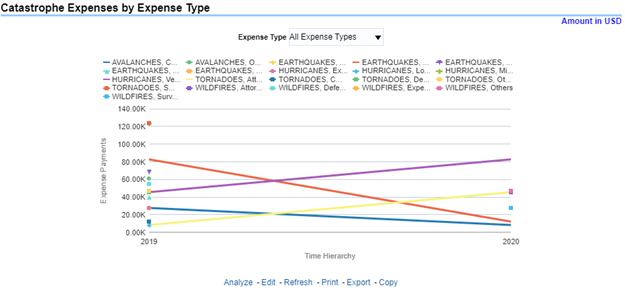

Catastrophe Expenses by Expense Type

Figure 6-186 Catastrophe Expenses by Expense Type

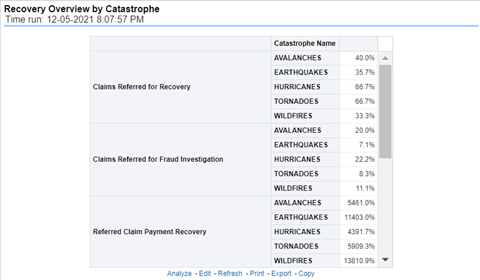

Recovery Overview by Catastrophe

Figure 6-187 Recovery Overview by Catastrophe

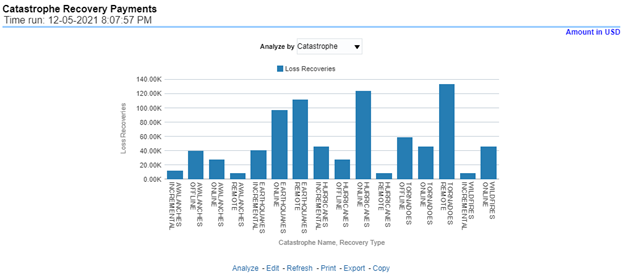

Catastrophe Recovery Payments

Figure 6-188 Catastrophe Recovery Payments

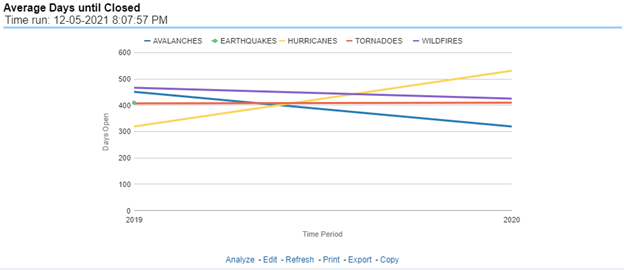

Average Days until Closed

Figure 6-189 Average Days until Closed

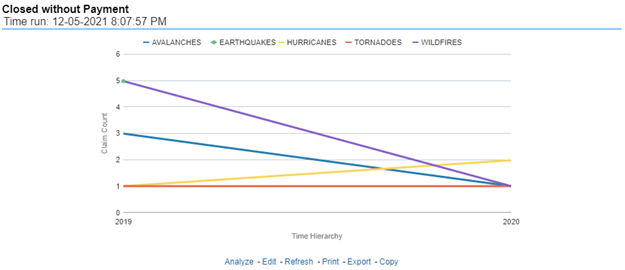

Closed Without Payment

Figure 6-190 Closed Without Payment

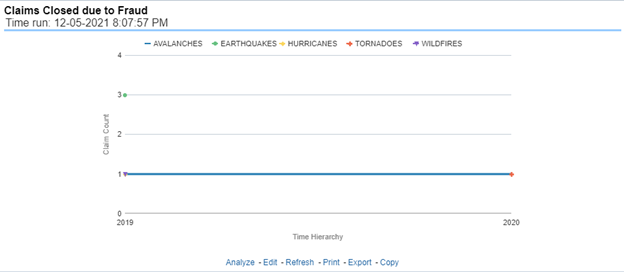

Claims Closed Due to Fraud

Figure 6-191 Claims Closed Due to Fraud

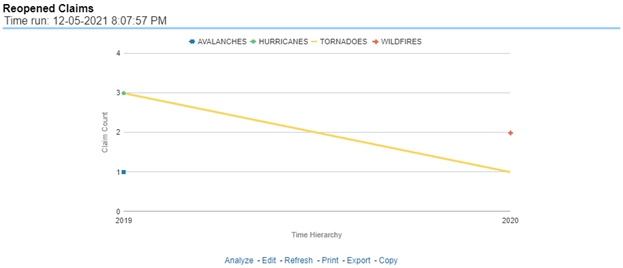

Reopened Claims

Figure 6-192 Reopened Claims

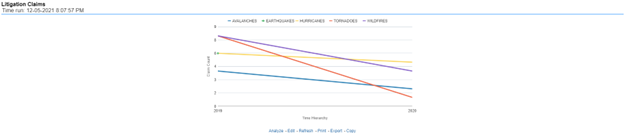

Litigation Claims

Figure 6-193 Litigation Claims