5.4.3 Lines of Business Tab

The Lines of business tab includes reports that focus on the Key Performance Indicators for each Line of business. The filters for this tab allow the report results to be focused on selected combinations for comparison and targeted analysis.

- Time

- Company

- Lines of Business

- Geography

The various reports available under this tab are detailed in the following sections.

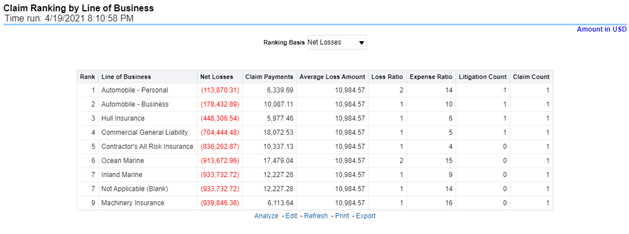

Claim Ranking by Lines of Business

Figure 5-201 Claim Ranking by Lines of Business

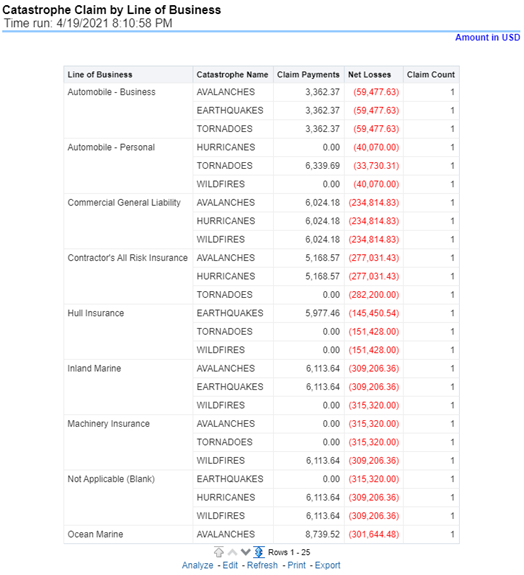

Catastrophe Claim by Lines of Business

Figure 5-202 Catastrophe Claim by Lines of Business

Lines of Business Loss Ratio

Figure 5-203 Lines of Business Loss Ratio

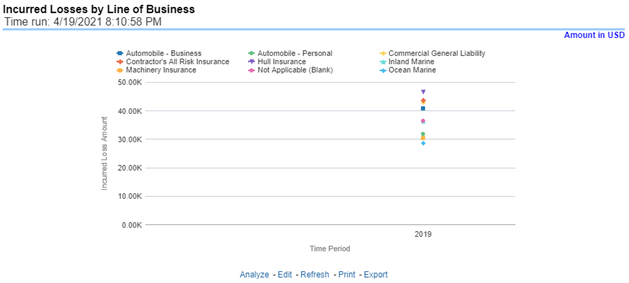

Lines of Business Incurred Loss

Figure 5-204 Lines of Business Incurred Loss

Claim Payments by Loss Type

Figure 5-205 Claim Payments by Loss Type

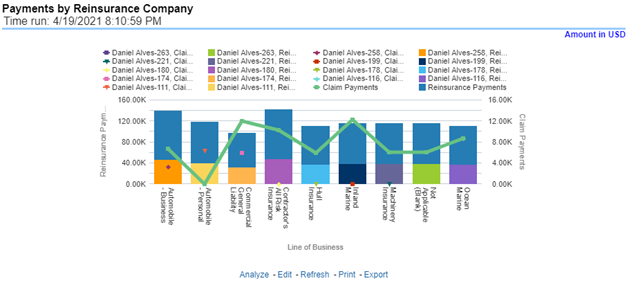

Payments by Reinsurance Company

Figure 5-206 Payments by Reinsurance Company

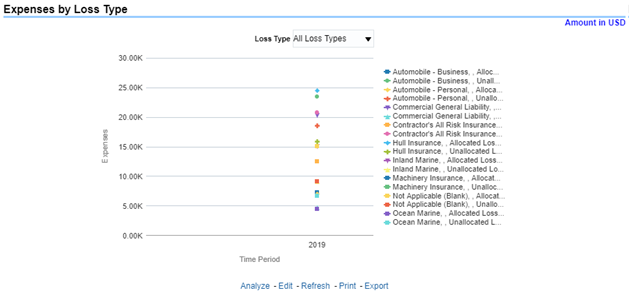

Expenses by Loss Type

Figure 5-207 Expenses by Loss Type

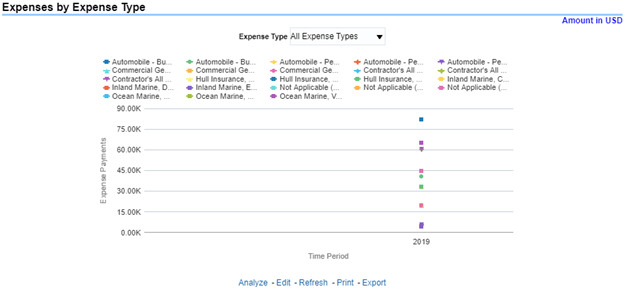

Expenses by Expense Type

Figure 5-208 Expenses by Expense Type

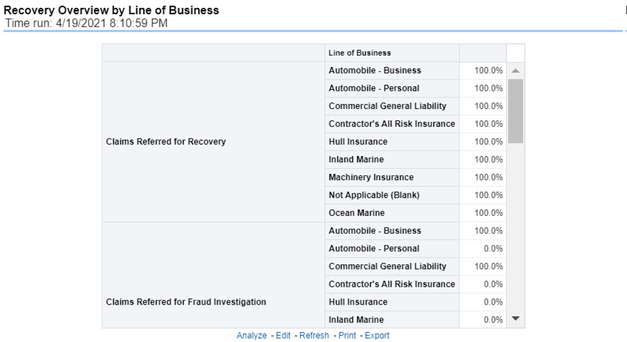

Recovery Overview by Lines of Business

Figure 5-209 Recovery Overview by Lines of Business

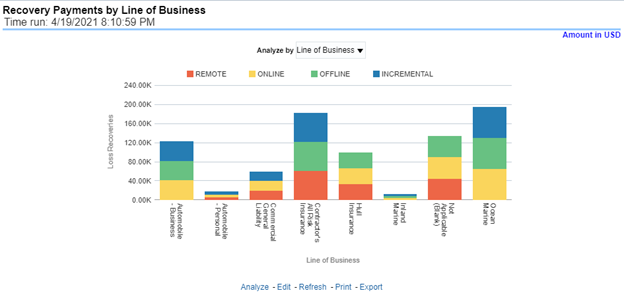

Recovery Payments by Lines of Business

Figure 5-210 Recovery Payments by Lines of Business

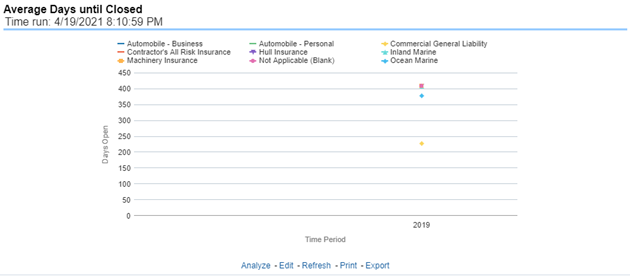

Average Days until Closed

Figure 5-211 Average Days until Closed

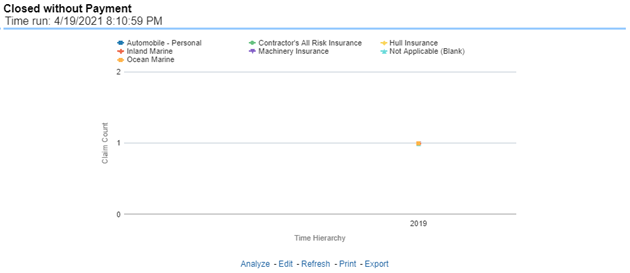

Claims Closed without Payment

This report is a line graph that illustrates the count of claims that were closed during the reporting period without any loss payments generated for the claim.

Figure 5-212 Claims Closed without Payment

Claims Closed Due to Fraud

Figure 5-213 Claims Closed Due to Fraud

Reopened Claims

Figure 5-214 Reopened Claims

Litigation Claims

Figure 5-215 Litigation Claims