5.4.1 Summary Tab

The Summary tab includes information at the corporate level. The information contained in the reports generated summarizes how the entire organization is performing.

The filters for this tab include:

- Time

- Company

- Catastrophe

- Geography

The various reports available for this tab are discussed in the following sections.

Key Claim Performance Indicators Flash

Figure 5-179 Key Claim Performance Indicators Flash

Claim Expenses Ratio

Figure 5-180 Claim Expenses Ratio

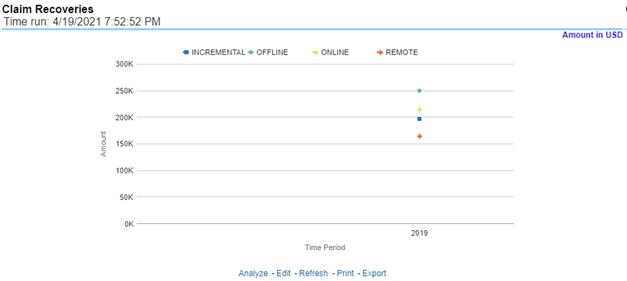

Claim Recoveries

Figure 5-181 Claim Recoveries

Claim Net Losses Map

Figure 5-182 Claim Net Losses Map

Claim Count Map

Figure 5-183 Claim Count Map

Top Ten Geographical Regions for Claim Payments

Figure 5-184 Top Ten Geographical Regions for Claim Payments

Top Ten Geographical Regions for Claims Reported

Figure 5-185 Top Ten Geographical Regions for Claims Reported

Claim Count

Figure 5-186 Claim Count

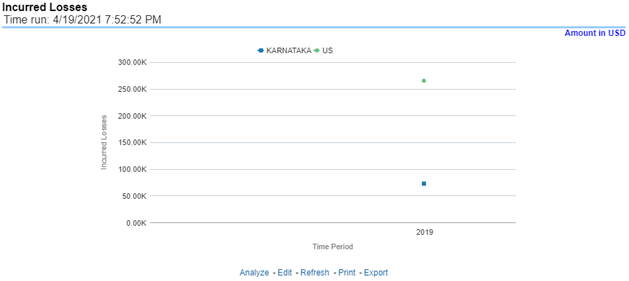

Incurred Losses

Figure 5-187 Incurred Losses

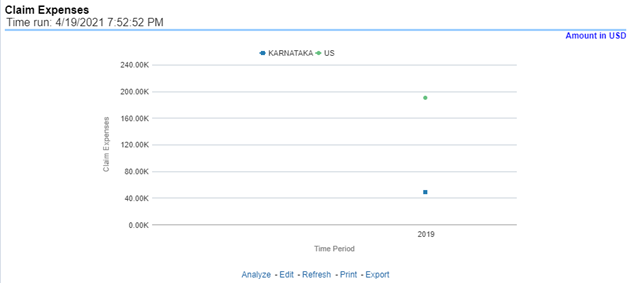

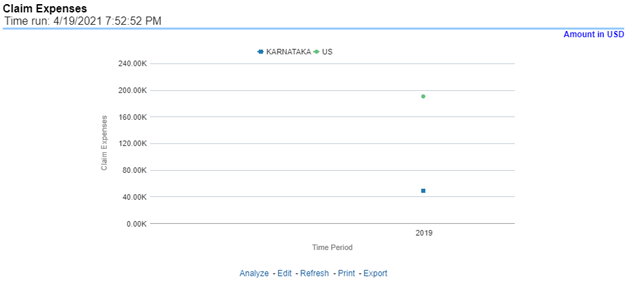

Claim Expenses

Figure 5-188 Claim Expenses

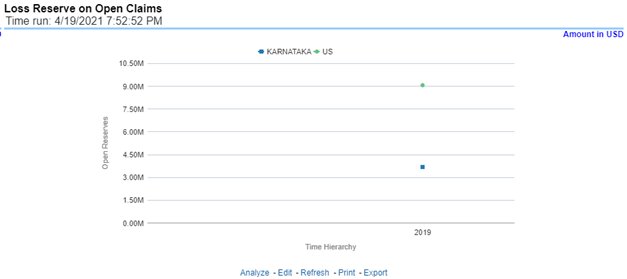

Loss Reserve on Open Claims

Figure 5-189 Loss Reserve on Open Claims

Combined Ratio

Figure 5-190 Combined Ratio

Loss Ratio

Figure 5-191 Loss Ratio

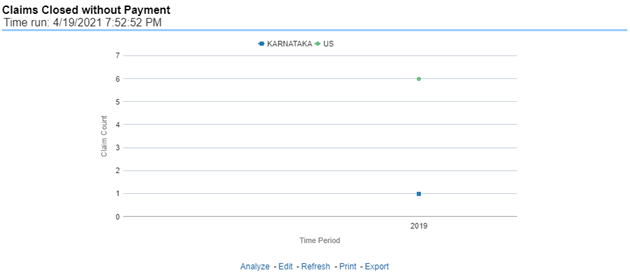

Claims Closed without Payment

This report is a line graph that illustrates the count of claims that were closed during the reporting period without any loss payments generated for the claim.

Figure 5-192 Claims Closed without Payment

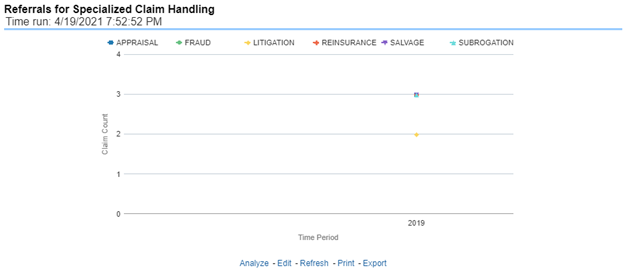

Referrals for Specialized Claim Handling

Figure 5-193 Referrals for Specialized Claim Handling

Specialized Claim Handling Recoveries

Figure 5-194 Specialized Claim Handling Recoveries