5.3.2 Key Facts Tab

The Key Fact tab includes Key Performance Indicator Reports for lines of businesses at the corporate level. The filters for this tab allow the report results to be focused on selected combinations for comparison and targeted analysis.

The filters include:

- Time

- Company

- Geography

- Lines of Business

The various reports available under this tab are detailed in the following sections.

Key Policy Performance Indicators

Figure 5-123 Key Policy Performance Indicators

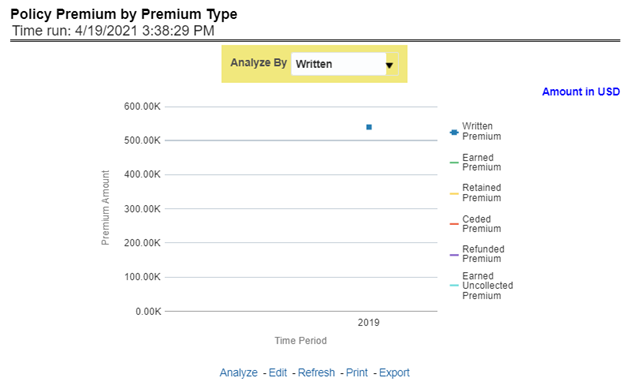

Policy Premium by Premium Type

Figure 5-124 Policy Premium by Premium Type

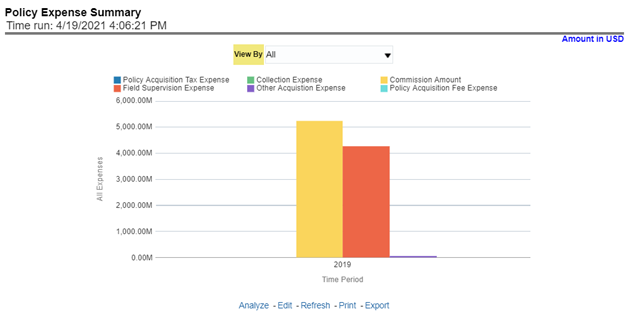

Policy Expense Summary

Figure 5-125 Policy Expense Summary

Policy Count by Policy Type

Figure 5-126 Policy Count by Policy Type

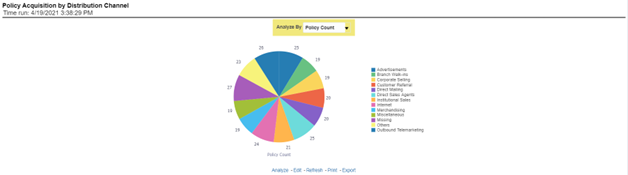

Policy Acquisition by Distribution Channel

Figure 5-127 Policy Acquisition by Distribution Channel

Policy Attrition - Company versus Insured

Figure 5-128 Policy Attrition - Company versus Insured

Policy Attrition by Reason

Figure 5-129 Policy Attrition by Reason

Policy Attrition By Distribution Channel

Figure 5-130 Policy Attrition By Distribution Channel

Policy Attrition By Billing Plan

Figure 5-131 Policy Attrition By Billing Plan

Cancellation Attrition Timing

Figure 5-132 Cancellation Attrition Timing