9.1.3.2.2 Business-as-Usual (BAU)

In BAU execution one or multiple business assumptions under normal conditions are applied to the contractual cash flows and the cash inflows and outflows are modified accordingly. A BAU Execution allows you to estimate and analyze the liquidity gaps under normal business conditions. The liquidity gap report (after BAU Execution) provides the liquidity status of the organization based on the impact of these business assumptions on the contractual cash flows. Additionally, liquidity ratios are estimated based on cash flows adjusted for normal conditions in accordance with the Basel III liquidity ratio guidelines prescribed by BIS (See section BIS Basel III Liquidity Ratios Calculation) as well as LCR based on US guidelines (See Liquidity Risk Regulatory Calculations for US Federal Reserve, in User Guide Release 8.0.8.0.0 on OHC documentation Library.)

The features of BAU Run are as follows:

- One or multiple business assumptions are applied to the cash flows and other interim metrics computed as part of the underlying contractual Run. These assumptions and defined as part of the Business Assumption window and selected in a BAU Run for execution.

- All BAU Run parameters are the same as those specified for the underlying contractual Run except for Assumptions Applied To.

- Assumptions are applied on original balance or cash flows or changing balance or cash flows across business assumptions based on user selection.

- Contractual Run is a pre-requisite for defining a BAU Run.

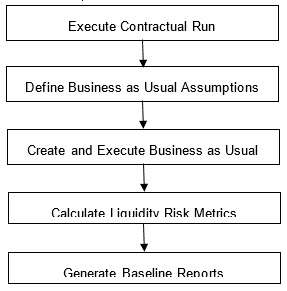

Figure 8-1 Process flow of a Business As Usual Run

- Executing BAU or Baseline Run: A Contractual Run is executed before the Business As Usual Run. Once the liquidity gaps are estimated under contractual terms, the changes in cash flows during the normal course of business due to consumer behavior are to be estimated. This involves defining business assumptions based on multiple rules and specifying assumption values. The assumptions include, drawdown, prepayments, rollovers, asset/liability book growth, run-offs, asset value changes, recovery from delinquent accounts, available stable funding factors, required stable funding factors, and so on. Assumption values specified for each dimension member combination, is selected from pre-defined business hierarchies/dimensions. Once these assumptions are defined, they are grouped together and applied to contractual cash flows as part of the BAU Run or Baseline Run execution process. The impact of these business assumptions on liquidity gaps, ratios, and other metrics is estimated.

- Baseline Reports: LRM generates the Baseline reports that enable a detailed view of the liquidity risk metrics.