9.1.3.2.3 Stress Run

Stress testing is now an integral part of a bank’s risk measurement system and plays an important role in estimating the effects of potential financial crises on a bank’s operations. Stress testing, from a liquidity risk management perspective, refers to the process of assessing the liquidity position of a financial institution under adverse conditions. It involves defining stress assumptions and applying them to baseline results in order to obtain stressed results.

The application leverages the stress testing module of Oracle Financial Services Advanced Analytical Applications Infrastructure in order to carry out stress testing in an enterprise-wide consistent manner. Stress testing module is an integrated framework of OFSAAAI which supports the stress testing requirements across the entire suite of OFS analytical applications.

Stress Runs are defined as part of the Stress Testing module of OFSAAAI by selecting the baseline Run that is, the LRS BAU Run in the Stress Definition screen and replacing the BAU assumptions which are part of the baseline Run with stress business assumptions. Stress assumptions are business assumptions with adverse values and are defined as part of the Business Assumption screen of LRS. The replacement of BAU assumptions with the stress assumptions constitutes the stress scenario. Once defined and saved, the Stress Run can be viewed, approved and executed from the Run Management screen of LRS.

The Stress Run defined appears in the list of Runs in the Run Management Summary window. You can approve the definition and then execute it. BAU Run is a pre-requisite for defining stress Runs.

On execution, the stress business assumptions are applied to the contractual cash flows to assess the impact of the adverse scenario on the liquidity position of the institution.

Note:

Contractual and BAU Run are defined in the Run Management window and are automatically registered in OFSAAAI.

Stress Runs are defined in Stress Testing module of OFSAAAI and registered in OFSAAAI and appears in Run Management window. The stress Runs appear in Draft status with a Run type as Stress in the Run Management window of LRS. You are allowed to approve and execute these Runs.

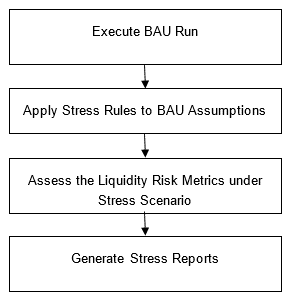

Figure 8-2 Process flow of a Stress Run

- Executing Stress Run: The Contractual Run is executed first. The BAU Run is executed next. For executing Stress Runs, the Contractual or BAU cash flows are stressed. A combination of stressed assumptions or a stress value of higher magnitude becomes a stress scenario. The values can be applied as absolute values or they can be percentages. The liquidity gaps under the given stress scenario are calculated. The impact of the stress scenario is assessed on Liquidity Coverage Ratio (LCR), Net Stable Funding Ratio (NSFR,) and Funding Concentrations.

- Stress Reports: LRS generates the Stress reports that enable a detailed view of the liquidity risk metrics like Liquidity gaps across time buckets, Cumulative gaps, Gaps across time, Comparison across scenarios , LCR, NSFR, Funding Concentrations, and so on.