15.2.2.3.4 Calculation of Adjusted Stock of HQLA

- Adjusted Stock of Level 1 Assets

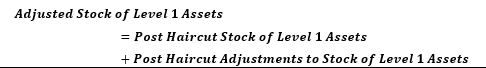

The formula for calculating adjusted stock of level 1 assets is as follows:

Figure 14-2 Formula for Adjusted Stock of Level 1 Assets

Note:

Adjustments relate to the cash received or paid and the eligible level 1 assets posted or received as collateral or underlying assets as part of a secured funding transaction, secured lending transaction, asset exchanges, or collateralized derivatives transaction. - Adjusted Stock of Level 2A Assets

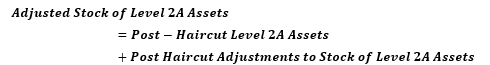

The formula for calculating adjusted stock of level 2A assets is as follows:

Figure 14-3 Formula for Adjusted Stock of Level 2A Assets

Note:

Adjustments relate to eligible level 2A assets posted or received as collateral or underlying assets as part of a secured funding transaction, secured lending transaction, asset exchanges, or collateralized derivatives transaction. - Adjusted Stock of Level 2B RMBS Assets

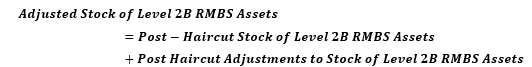

The formula for calculating adjusted stock of level 2B RMBS assets is as follows:

Figure 14-4 Formula for Adjusted Stock of Level 2B RMBS Assets

Note:

Adjustments relate to eligible level 2B RMBS assets posted or received as collateral or underlying assets as part of a secured funding transaction, secured lending transaction, asset exchanges, or collateralized derivatives transaction. - Adjusted Stock of Level 2B Non-RMBS Assets

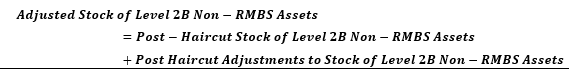

The formula for calculating adjusted stock of level 2B non-RMBS assets is as follows:

Figure 14-5 Formula for Adjusted Stock of Level 2B Non-RMBS Assets

Note:

Adjustments relate to eligible level 2B Non-RMBS assets posted or received as collateral or underlying assets as part of a secured funding transaction, secured lending transaction, asset exchanges, or collateralized derivatives transaction.