8.5 Cash Flow Assignment Methodologies

The complete list of cash flow assignment methods are as follows:

- Selected time bucket only.

- Equally to all time buckets up to and including the selected bucket.

- In decreasing order to all time buckets up to and including the selected bucket.

- In increasing order to all time buckets up to and including the selected bucket.

- In proportion to the bucket size.

Detailed in the following sections are illustrations for each cash flow assignment method. The standard Level 0 time buckets are Overnight, 1-7 Days, 8-15 Days, 16-30 Days, 1-3 Months, 3-6 Months, 6-12 Months, 1-5 years and > 5 Years. All examples consider an EOP balance of 500000 for time deposits.

- Selected Time Bucket

In this case, the assumption unit is applied to the cash flows and the assumption cash flows are mapped to the time bucket selected. If the assumption is not specified on Level 0 buckets, then the assignment to the lower buckets is done proportionately to the bucket size.

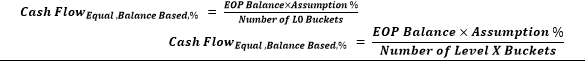

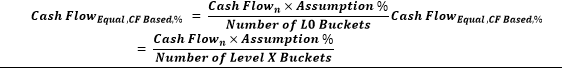

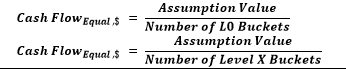

- Equal Assignment

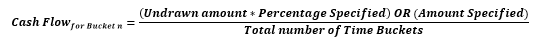

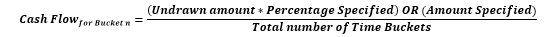

Here cash flows assigned to each bucket are up to the selected bucket. Assignments are made equally to the selected level and further assignment is done till the most granular level. The formulae under different conditions are as follows:

- EOP Balance Based Assumptions, Assumption Unit = Percentage

Where,

Level X Buckets: Higher granular buckets

Table 7-50 Equal Assignment under Balance Based Assumptions, %

Business Assumption Cash Flow Assignment Product From Bucket Run-off Contractual Cash Flow Time Bucket Revised Cash Flow Time Deposits 8-15 Days 5% 10000 Overnight – 2500

[= 10000 – {(500000*5%)/2}]

5000 1-7 Days – 7500

[= 5000 – {(500000*5%)/2}]

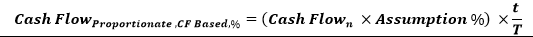

- Cash Flow Based Assumptions, Assumption Unit = Percentage

Where, n: Selected bucket

Table 7-51 Equal Assignment under Cash Flow Based Assumptions, %

Business Assumption Cash Flow Assignment Product Time Bucket Run-off Contractual Cash Flow Time Bucket Revised Cash Flow Time Deposits 8-15 Days 5% 10000 Overnight 9800

[= 10000 – {(8000*5%)/2}]

5000 1-7 Days 4800

[= 5000 – {(8000*5%)/2}]

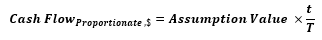

- Assumption Unit = Value

Table 7-52 Equal Assignment, Value

Business Assumption Cash Flow Assignment Product Time Bucket Run-off Contractual Cash Flow Time Bucket Revised Cash Flow Time Deposits 8-15 Days 3000 10000 Overnight 8500

[= 10000 – (3000/2)]

5000 1-7 Days 3500

[= 5000 – (3000/2)]

- EOP Balance Based Assumptions, Assumption Unit = Percentage

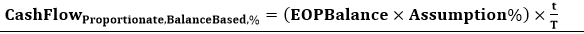

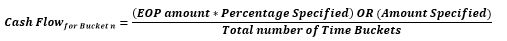

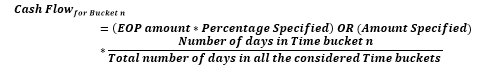

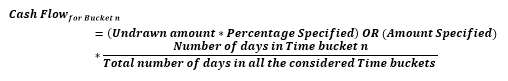

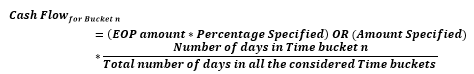

- Proportionate Assignment

Cash flows are assigned to each bucket up to the selected bucket in proportion to the bucket size. Assignments are made proportionately to the selected level and further assignment is done till the most granular level. The formulae under different conditions are as follows:

- EOP Balance Based Assumptions, Assumption Unit = Percentage

Where,

t: Number of days in the given Level X bucket

Table 7-53 Proportionate Assignment under Balance Based Assumptions, %

T: Total number of days up to the selected bucket Business Assumption Cash Flow Assignment Product Time Bucket Run-off Contractual Cash Flow Time Bucket Revised Cash Flow Time Deposits 8-15 Days 5% 10000 Overnight 10000

[= 10000 – {(500000*5%)*0/7]

5000 1-7 Days – 20000

[= 5000 – {(500000*5%)*7/7]

- Cash Flow Based Assumptions, Assumption Unit = Percentage

Table 7-54 Proportionate Assignment under Cash Flow Based Assumptions, %

Business Assumption Cash Flow Assignment Product Time Bucket Run-off Contractual Cash Flow Time Bucket Revised Cash Flow Time Deposits 8-15 Days 5% 10000 Overnight 10000

[= 10000 – {(8000*5%)*0/7}]

5000 1-7 Days 4600

[= 5000 – {(8000*5%)*7/7}]

- Assumption Unit = Value

Table 7-55 Proportionate Assignment, Value

Business Assumption Cash Flow Assignment Product Time Bucket Run-off Contractual Cash Flow Time Bucket Revised Cash Flow Time Deposits 8-15 Days 3000 10000 Overnight 10000

[= 10000 – (3000*0/7)]

5000 1-7 Days 2000

[= 5000 – (3000*7/7)]

- EOP Balance Based Assumptions, Assumption Unit = Percentage

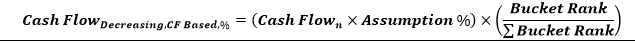

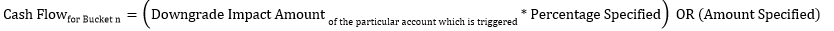

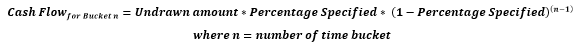

- Decreasing Assignment

Cash flows are assigned to each bucket up to the selected bucket in decreasing order based on ranks assigned to cash flows. Assignments are made in decreasing order to selected level and further assignment is done till the most granular level. The formulae under different conditions are as follows:

- EOP Balance Based Assumptions, Assumption Unit = Percentage

Where,

Bucket Rank: This is the rank assigned to each Level X bucket within the bucket set. The rank is assigned in decreasing order that is, 1 is assigned to the last bucket in the set, 2 is assigned to the previous bucket and so on.

Table 7-56 Decreasing Assignment under Balance Based Assumptions, %

Business Assumption Cash Flow Assignment Product Time Bucket Run-off Contractual Cash Flow Time Bucket Bucket Rank Revised Cash Flow Time Deposits 1-3 Months 5% 10000 Overnight 4 0

[= 10000 – (500000*5%)*4/10]

5000 1-7 Days 3 – 2500

[= 5000 – (500000*5%)*3/10]

8000 8-15 Days 2 3000

[= 8000 – (500000*5%)*2/10]

3000 16-30 Days 1 500

[= 3000 – (500000*5%)*1/10]

- Cash Flow Based Assumptions, Assumption Unit = Percentage

Table 7-57 Decreasing Assignment under Cash Flow Based Assumptions, %

Business Assumption Cash Flow Assignment Product Time Bucket Run-off Contractual Cash Flow Time Bucket Bucket Rank Revised Cash Flow Time Deposits 1-3 Months 5% 10000 Overnight 4 9880

[= 10000 – (6000*5%)*4/10]

5000 1-7 Days 3 4910

[= 5000 – (6000*5%)*3/10]

8000 8-15 Days 2 7940

[= 8000 – (6000*5%)*2/10]

3000 16-30 Days 1 2970

[= 3000 – (6000*5%)*1/10]

- Assumption Unit = Value

Table 7-58 Decreasing Assignment, Value

Business Assumption Cash Flow Assignment Product Time Bucket Run-off Contractual Cash Flow Time Bucket Bucket Rank Revised Cash Flow Time Deposits 1-3 Months 3000 10000 Overnight 4 8800

[= 10000 – (3000*4/10)]

5000 1-7 Days 3 4100

[= 5000 – (3000*3/10)]

8000 8-15 Days 2 7400

[= 8000 – (3000*2/10)]

3000 16-30 Days 1 2700

[= 3000 – (3000*1/10)]

- EOP Balance Based Assumptions, Assumption Unit = Percentage

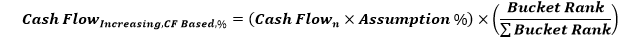

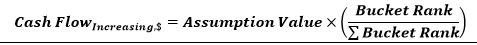

- Increasing Assignment

Cash flows are assigned to each bucket up to the selected bucket in increasing order based on ranks assigned to cash flows. Assignments are made in increasing order to the selected level and further assignment is done till the most granular level. The formulae under different conditions are as follows:

- EOP Balance Based Assumptions, Assumption Unit = Percentage

Where,

Bucket Rank: Rank assigned to each Level 0 bucket within the bucket set. The rank is assigned in increasing order i.e. 1 is assigned to the first bucket in the set, 2 is assigned to the next bucket and so on.

Table 7-59 Increasing Assignment under Balance Based Assumptions, %

Business Assumption Cash Flow Assignment Product Time Bucket Run-off Contractual Cash Flow Time Bucket Bucket Rank Revised Cash Flow Time Deposits 8-15 Days 5% 10000 Overnight 1 1666.67

[= 10000 – (500000*5%)*1/3]

5000 1-7 Days 2 – 11666.67

[= 5000 – (500000*5%)*2/3]

- Cash Flow Based Assumptions, Assumption Unit = Percentage

Table 7-60 Increasing Assignment under Cash Flow Based Assumptions, %

Business Assumption Cash Flow Assignment Product Time Bucket Run-off Contractual Cash Flow Time Bucket Bucket Rank Revised Cash Flow Time Deposits 8-15 Days 5% 10000 Overnight 1 9866.67

[= 10000 – (8000*5%)*1/3]

5000 1-7 Days 2 4733.33

[= 5000 – (8000*5%)*2/3]

- Assumption Unit = Value

Table 7-61 Increasing Assignment, Value

Business Assumption Cash Flow Assignment Product Time Bucket Run-off Contractual Cash Flow Time Bucket Bucket Rank Revised Cash Flow Time Deposits 8-15 Days 3000 10000 Overnight 1 9000

[= 10000 – (3000*1/3)]

5000 1-7 Days 2 3000

[= 5000 – (3000*2/3)]

Note:

If assumptions are specified on bucket levels other than Level 0, the assignment is done at the selected level and further assignment is done at the higher granular levels, using the same cash flow assignment methodology selected, till assignment has been made to Level 0 buckets. The only exception is the selected time bucket method where the cash flow is assigned proportionately to higher granular bucket levels based on the bucket size. Previously, the assignment to more granular levels was done equally.An illustration of assignment across multiple levels is provided in the following table. Suppose $1000 is assigned in increasing order to buckets at multiple levels. The assignment is done as follows:

Table 7-62 Cash Flow Assignment to Multiple Bucket Levels

Level 2 Bucket Rank Amount Assigned Level 1 Bucket Rank Amount Assigned Level 0 Bucket Rank Amount Assigned 1 – 3 Week 1 333.33

[= (1000*1/3)]

1 Week 1 111.11

[= (333.33*1/3)]

1 Week 1 111.11

[= (111.11*1/1)]

2 – 3 Week 2 222.22

[= (333.33*2/3)]

2 Week 1 74.07

[= (222.22*1/3)]

3 Week 2 148.15

[= (222.22*2/3)]

4 – 8 Week 2 666.67

[= (1000*2/3)]

4 – 5 Week 1 222.22

[= (666.67*1/3)]

4 Week 1 74.07

[= (222.22*1/3)]

5 Week 2 148.15

[= (222.22*2/3)]

6 – 8 Week 2 444.44

[= (666.67*1/3)]

6 Week 1 74.07

[= (444.44*1/6)]

7 Week 2 148.15

[= (444.44*2/6)]

8 Week 3 222.22

[= (444.44*3/6)]

- EOP Balance Based Assumptions, Assumption Unit = Percentage

- New Business

End of Period (EOP) Asset Balance of Growth assumption allows you to select the method for cash flow assignment. Various options for cash flow assignment available are as follows:

Decreasing – In decreasing order to all time buckets up to and including the selected time bucket.

Equal – Equally to all time buckets up to and including the selected time bucket.

Proportional – In proportion to the time bucket size.

Selected – Selected time bucket only.

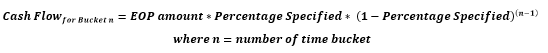

Decreasing Cash flow assignment is done using the following formula:

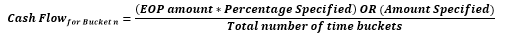

Equal cash flow assignment is done using the following formula:

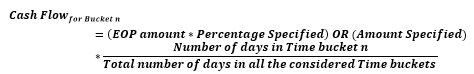

Proportional Cash flow assignment is done using the following formula:

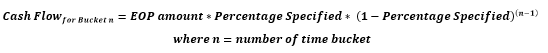

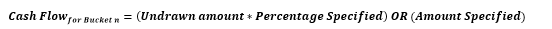

Selected Cash flow assignment is done using the following formula:

EOP Liability Balance Growth assumption allows you to select the method for cash flow assignment. Various options for cash flow assignment available are as follows:

- Decreasing – In decreasing order to all time buckets up to and including the selected time bucket.

- Equal – Equally to all time buckets up to and including the selected time bucket.

- Proportional – In proportion to the time bucket size.

- Selected – Selected time bucket only.

Decreasing Cash flow assignment is done using the following formula:

Equal Cash flow assignment is done using the following formula:

Proportional Cash flow assignment is done using the following formula:

Selected Cash flow assignment is done using the following formula:

- Drawdown

Funding Line of Credit allows you to select the method for cash flow assignment. This business assumption also allows you to select the method for cash flow assignment. Various options for cash flow assignment available are as follows:

- Decreasing – In decreasing order to all time buckets up to and including the selected time bucket.

- Equal – Equally to all time buckets up to and including the selected time bucket.

- Proportional – In proportion to the time bucket size.

- Selected – Selected time bucket only.

Decreasing Cash flow assignment is done using the following formula:

Equal Cash flow assignment is done using the following formula:

Proportional Cash flow assignment is done using the following formula:

Selected Cash flow assignment is done using the following formula:

Credit Line Draw down allows you to select the method for cash flow assignment. This assumption also allows you to specify the corresponding cash outflow for the specified cash inflow.

Various options for cash flows assignment available for this assumption are as follows:

- Decreasing – In decreasing order to all time buckets up to and including the selected time bucket.

- Equal – Equally to all time buckets up to and including the selected time bucket

- Proportional – In proportion to the time bucket size

- Selected – Selected time bucket only.

Decreasing Cash flow assignment is done using the following formula:

Equal Cash flow assignment is done using following formula:

Proportional Cash flow assignment is done using the following formula:

Selected Cash flow assignment is done using the following formula: