8.4 Impact of Assumptions on Interest Cash Flows

In 2.0 the impact of business assumptions was only on principal cash flows. OFS LRM considers the impact on both principal and interest cash flows. This is treated in following three ways:

- When business assumption values are applied on both principal and interest cash flows.

- When assumption values are applied on principal cash flows only and interest is approximated.

- When interest is calculated and is not approximated.

When you select the approximate Interest parameter in the Run Definition window as Yes, then interest is approximated as explained below. If the parameter is selected as No, then the assumption values are applied on both principal and interest cash flows.

The following are the steps involved in approximating interest:

- Obtain the principal and interest cash flows under contractual terms.

- Bucket the contractual cash flows based on the time buckets selected while distinguishing between interest and principal cash flows in each time bucket.

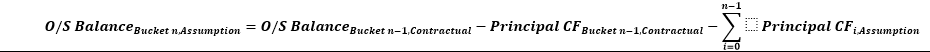

- Calculate the outstanding balance in each bucket under contractual terms. The outstanding balance in the first time bucket will be the EOP balance. The formula for calculating the outstanding balance for each subsequent bucket is as follows:

Here,

O/S Balance: Outstanding Balance

CF: Cash Flows

- Apply the business assumption to estimate principal cash flows. In case of balance based assumptions, this applies to the EOP balance. In case of cash flow based assumptions, this applies to the principal cash flows in a given bucket.

- Calculate the outstanding balance in each bucket under business-as-usual or stress terms. The outstanding balance in the first time bucket will be the EOP balance. The formula for calculating the outstanding balance for each subsequent bucket is as follows:

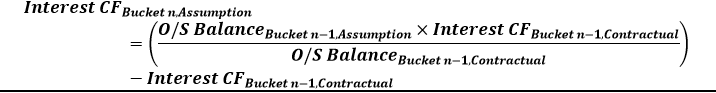

Calculate the proportionate impact on interest cash flows in each bucket under business-as-usual or stress terms as per the following formula:

- Calculate the total principal and interest cash inflows and outflows in each time bucket post assumption.

- Calculate the total inflows, outflows and net gap in each time bucket post assumption.

Note:

This computation is not applicable for the assumption types Rollover of Repos and Reverse Repos and Creation of Repos as the interest calculations are explicitly defined in these cases.The tables below explain the impact of assumptions on Interest Cash Flows. The standard time buckets are Overnight, 1-7 Days, 8-15 Days, 16-30 Days, 1-3 Months, 3-6 Months, 6-12 Months, and > 1 Year. All examples consider an EOP balance of 5000 for time deposits.

Example 1: Impact on Interest Cash Flows under Growth Assumption

In this case a growth of 10 % on the EOP balance is defined in the 8-15 Days bucket. The offset bucket for this growth is a single bucket at 3-6 months. The cash flows are as shown below. The numbers for Contractual Principal and Interest cash flow are examples. The rest of the rows are computed values as per equations provided earlier in this section.

Table 7-47 Impact on Interest Cash Flows under Growth Assumption

Condition Measure Cash Outflow Overnight 1-7 Days 8-15 Days 16-30 Days 1-3 Months 3-6 Months 6-12 Months > 1 Year Contractual Principal Cash Flow 221.00 195.00 244.00 283.00 163.00 263.00 257.00 3374.00 Interest Cash Flow 112.00 129.00 87.00 147.00 65.00 88.00 84.00 1477.42 O/S Balance 5000.00 4779.01 4584.00 4340.00 4057.00 3894.00 3631.00 3374.00 Business Assumption Principal Cash Flow -500.00 500 O/S Balance 5000.00 4779.00 4584.00 4840.00 4557.00 4394.00 3631.00 3374.00 Proportionate Interest Cash Flow 0.00 0.00 0.00 0.0 16.94 8.01 11.30 0 The assumption cash flows provide the impact of the assumption only and not the change in the original cash flows due to the assumption.

Example 2: Impact on Interest Cash Flows under Rollover Assumption

In this case a rollover of 10% is defined on the cash flows from the 1-7 Days bucket to the 3-6 Months bucket. The cash flows are as shown below. The numbers for Contractual Principal and Interest cash flow are examples. The rest of the rows are computed values as per equations provided earlier in this section.

Table 7-48 Impact on Interest Cash Flows under Rollover Assumption

Condition Measure Cash Outflow Overnight 1-7 Days 8-15 Days 16-30 Days 1-3 Months 3-6 Months 6-12 Months > 1 Year Contractual Principal Cash Flow 221.00 195.00 244.00 283.00 163.00 263.00 257.00 3374.00 Interest Cash Flow 112.00 129.00 87.00 147.00 65.00 88.00 84.00 1477.42 O/S Balance 5000.00 4779.00 4584.00 4340.00 4057.00 3894.00 3631.00 3374.00 Business Assumption Principal Cash Flow -19.50 19.50 O/S Balance 5000.00 4779.00 4603.50 4359.50 4076.50 3913.50 3631.00 3374.00 Proportionate Interest Cash Flow 0.00 0.00 0.0 0.37 0.66 0.31 0.44 0.00 Example 3: Impact on Interest Cash Flows under Run-off Assumption

In this case, a 10% EOP Balance Run-off is defined from the 3-6 Months bucket to the 1-7 Days bucket. The cash flows are as shown below. The numbers for Contractual Principal and Interest cash flow are examples. The rest of the rows are computed values as per equations provided earlier in this section

Table 7-49 Impact on Interest Cash Flows under Run-off Assumption

Condition Measure Cash Outflow Overnight 1-7 Days 8-15 Days 16-30 Days 1-3 Months 3-6 Months 6-12 Months > 1 Year Contractual Principal Cash Flow 221.00 195.00 244.00 283.00 163.00 263.00 257.00 3374.00 Interest Cash Flow 112.00 129.00 87.00 147.00 65.00 88.00 84.00 1477.42 O/S Balance 5000.00 4779.00 4584.00 4340.00 4057.00 3894.00 3631.00 3374.00 Business Assumption Principal Cash Flow 500.00 -500.00 O/S Balance 5000.00 4779.00 4084.00 3840.00 3557.00 3394.00 3631.00 3374.00 Proportionate Interest Cash Flow 0.00 0.00 0 -9.49 -16.94 -8.01 -11.3 0.00 When interest is calculated and is not approximated,

In case Include Interest Cash Flow is selected as Yes and Approximate Interest is selected as No, the application includes the interest cash flow. If you have selected cash flow type in dimension and node as Principal then assumption impacts only principal cash flows. If you have selected cash flow type in dimension and node as Interest then assumption impacts only Interest cash flows. In case you have not selected cash flow type in dimension, then assumption ignores the cash flow type. This means, it will include both principal and interest cash flows.

Note:

Interest cash flows occurring contractually are considered during calculations and the impact of assumptions on interest is calculated under BAU and stress conditions if the option ‘Yes’ is selected as part of the Include Interest Cash Flows field in the Run Definition window. Refer Defining a run.