8.2.1.3 Delinquency

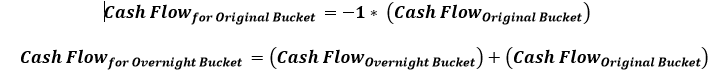

This assumption caters to the large and non large customers. This assumption is based on the anticipation of the bank that there can be an emergency loss due to delinquency of its customers which will affect the future cash flows. When a customer becomes delinquent, the cash flows of the delinquent buckets (as specified in percentage and amount) are moved to the overnight bucket. If you want to specify delinquency on large customers, then large customer dimension is selected; however the computation of cash flows is same for both large and non large customers. In a delinquency assumption, cash flow movement happens from forward bucket/s to the previous bucket (Overnight).

See Defining a New Business Assumption, for information on the steps involved in specifying this assumption.

The steps involved in applying the delay in cash flow timing assumption to cash flows are: