8.2.1.4 Prepayment

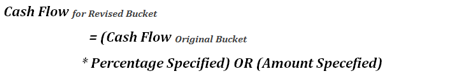

Prepayment is a situation where the customer repays the loan in part or full, at any time before the maturity of the loan. Prepayment would lead the bank to lose out on the interest component that it would have received if the loan was not pre-paid. Prepayment results in a cash inflow in a time bucket prior to the original time bucket and reduced cash inflow in the original time bucket. The percentage of prepayment is to be specified by you and the balance is payable only when it is due.

The prepayment supports prepayments on liabilities as well as assets in a single business assumption definition.

If a prepayment is specified on an asset or liability backed by collateral, the encumbrance period of the underlying collateral is re-calculated based on time bucket in which the asset or liability is completely paid up.

See Defining a New Business Assumption, for information on the steps involved in specifying this assumption.

The steps involved in applying the delay in cash flow timing assumption to cash flows are: