8.2.3.1 Drawdown

The assumption types Drawdown of Unutilized Credit and Drawdown of Funding Line of Credit, have been merged as part of the drawdown sub category. The assumption specification and computation method for this sub category remain unchanged. This sub category allows drawdown to be specified on lines of credit extended as well as received by banks in a single business assumption.

There is an amount line given to the bank or received by the banks which are allowed to drawdown. This allows drawdown to be specified on lines of credit extended as well as received by Banks.

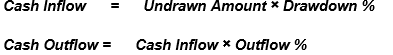

- Drawdown of Unutilized Credit: Banks generally allow its customers to withdraw a certain amount which is a percentage of the value specified as the limit. This business assumption is applied to the undrawn portion, the assumption being that certain portion of the undrawn amount is drawn by the customer at the specified time bucket thus leading to additional cash outflows. This assumption also allows you to specify the corresponding cash inflow for the specified cash outflow.

- Drawdown of Funding Line of Credit: Banks also receive lines of credit from other banks and financial institutions. The bank can drawdown these lines as per its requirement at any time during the tenure of the facility. A percentage of the total undrawn amount is assumed to be drawn down over each time bucket. Drawdown of funding line of credit results in cash inflow first and outflow at a later date. This assumption also allows you to specify the corresponding cash outflow for the specified cash inflow.

Additionally, this assumption allows you to specify the corresponding cash inflow for the specified cash outflow.

See Defining a New Business Assumption, for information on the steps involved in specifying this assumption.

The steps involved in applying the delay in cash flow timing assumption to cash flows are: