8.2.3.2 Liability Run-off

When the markets are inaccessible to the banks due to several reasons, the cash flows continue to run-off contractually. However, no new business is allowed due to market inaccessibility. Banks are required to maintain a pre-defined levels of balance at all times. In some cases, due to market inaccessibility the balance goes down and banks are required to restore the balance to the pre-defined levels over a period of time, called the restoration period.

The steps for calculating cash flows based on the liability run-off business assumption are:

- Run-off the contractual cash flows till the end of the market inaccessibility period.

- The sum of cash outflows during the market inaccessibility period is computed.

- The balance to be maintained at the end of the portfolio restoration period is computed as follows:

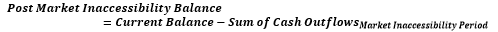

- The balance at the end of the market inaccessibility period is computed as follows:

- The total re-issue amount is computed as follows:

- If re-issue amount is positive,

- All contractual cash flows occurring after-market inaccessibility period is removed.

- The re-issue allocation days as the number of business days in the portfolio restoration period is calculated.

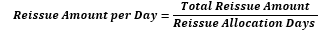

- The re-issue amount per business day is calculated as follows:

- The reissue amount per day as a cash inflow on each business day during the portfolio restoration period is posted.

- If re-issue amount is negative,

- If the outstanding contractual balance at the end of portfolio restoration period is greater than the post restoration target balance

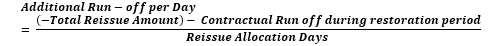

- The additional run off during per business day is computed as follows:

- The additional run off per day as cash outflow on each business day during the portfolio restoration period in addition to contractual cash outflow is posted.

- The additional run off during per business day is computed as follows:

- If the contractual balance at the end of portfolio restoration period is less than the post restoration target balance

- The contractual cash outflows on each business day following the market inaccessibility period, till the outstanding balance is equal to the post restoration target balance is posted.

- All contractual cash outflows after the day on which the outstanding balance is equal to the post restoration target balance is removed.

An illustration for Liability Run-off is as follows:

Table 7-16 Inputs

As of Date 13-Apr-14 EOP Balance 4698.24 Inaccessibility End Bucket 9-9 Day Restoration End Bucket 20-20 Day Minimum Balance 100 Restoration % 1% Table 7-17 Time Periods and Balances

Market Inaccessibility End Date 22-Apr-14 Restoration End Date 3-May-14 Market Inaccessibility Period 9 Portfolio Restoration Period 11 Contractual Cash Outflows during Inaccessibility Period 2321.93 Post Restoration Target Balance 100.00 Post Market Inaccessibility Balance 2376.30 Contractual Run-off during Restoration 2056.58 Post Restoration Outstanding Contractual Balance 319.72 Total Reissue Amount -2276.30 Reissue Allocation Days 8 Reissue Amount per Day 0.00 Additional Run-off per Day 27.47 The below example shows, the cash flows when re-issue amount is negative and post restoration outstanding contractual balance and post restoration target balance.

Table 7-18 Cash flow details

Inputs Calculation Calendar Date Contractual Cash Outflow Contractual Cash Inflow Day from As of Date Holiday Indicator Cumulative Cash Outflow (Post inaccessibility period) Post Assumption Cash Outflow Post Assumption Cash inflow 4/14/2014 919.85 0.00 1 0.00 919.85 0.00 4/15/2014 341.48 0.00 2 0.00 341.48 0.00 4/16/2014 320.37 0.00 3 0.00 320.37 0.00 4/17/2014 291.37 0.00 4 0.00 291.37 0.00 4/18/2014 131.73 0.00 5 0.00 131.73 0.00 4/19/2014 0.00 0.00 6 Y 0.00 0.00 0.00 4/20/2014 0.00 0.00 7 Y 0.00 0.00 0.00 4/21/2014 198.15 0.00 8 0.00 198.15 0.00 4/22/2014 118.98 0.00 9 0.00 118.98 0.00 4/23/2014 33.59 0.00 10 0.00 61.05 0.00 4/24/2014 295.54 0.00 11 33.59 323.00 0.00 4/25/2014 329.09 0.00 12 329.12 356.56 0.00 4/26/2014 0.00 0.00 13 Y 658.22 0.00 0.00 4/27/2014 0.00 0.00 14 Y 658.22 0.00 0.00 4/28/2014 440.79 0.00 15 658.22 468.25 0.00 4/29/2014 266.20 0.00 16 1099.01 293.66 0.00 4/30/2014 112.62 0.00 17 1365.20 140.08 0.00 5/1/2014 289.16 0.00 18 1477.82 316.63 0.00 5/2/2014 289.60 0.00 19 1766.98 317.06 0.00 5/3/2014 0.00 0.00 20 Y 2056.58 0.00 0.00 5/4/2014 0.00 0.00 21 Y 2056.58 0.00 0.00 5/5/2014 319.72 0.00 22 2056.58 0.00 0.00

- If the outstanding contractual balance at the end of portfolio restoration period is greater than the post restoration target balance