8.2.3.3 New Business

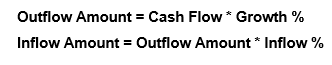

The new business assumption accounts for both the initial outflows as well as corresponding inflows occurring due to growth in the business represented by Leg 1 and Leg 2. This assumption also accounts for both the outflows and corresponding inflows occurring due to the growth in business represented by Leg 1 and Leg 2.

The New Business assumption category supports the following assumptions:

- Deposit Balance Growth (when Based on = Cash Flows)

- Asset Book Growth (when Based on = Cash Flows)

- Liability Book Growth (when Based on = Cash Flows)

- EOP Balance Growth of Assets (when Based on = EOP Balance)

- EOP Balance Growth of Liabilities (when Based on = EOP Balance)

The change is the earlier deposit balance growth assumption is now the new business assumption. In case you select the assumption type as Deposit Balance Growth, select Based On is selected as Cash Flows under this assumption.

The following five assumptions have been merged into a single assumption and this is how you can cater to each assumption:

- Deposit Balance Growth (Based on = Cash Flows) - Deposits balance refers to the cash in hand and the deposits maintained by the bank with other institutions including the central bank. Increase in deposit balance results in an increased cash inflow in the maturing time bucket.

Note:

Deposits Balance Growth can either be positive or negative. - Asset Book Growth (Based on = Cash Flows) - Asset book refers to the balances of loans and advances given by the bank. Increase in the asset balance results in an increased cash outflow in the selected time bucket and corresponding inflows in future time buckets. This assumption accounts for both the initial outflows as well as corresponding inflows occurring due to growth in the business represented by Leg 1 and Leg 2.

- Liability Book Growth (Based on = Cash Flows) - Liability Book Growth refers to the growth in the value of deposits which are maintained by the bank’s customers or borrowings that have been taken by the bank. The growth in the value of deposits results in an additional cash outflow in the maturing time bucket. This assumption also accounts for both the outflows and corresponding inflows occurring due to the growth in business represented by Leg 1 and Leg 2.

- EOP Balance Growth of Assets (Based on = EOP Balance) - EOP Asset Balance of Growth assumption estimates new businesses based on the EOP balance of assets. It accounts for both legs of the transactions, that is, inflows as well as outflows.

- EOP Balance Growth of Liabilities (Based on = EOP Balance) - EOP Liability Balance Growth assumption estimates new businesses based on the EOP balance of liabilities. It accounts for both legs of the transactions, that is, inflows and outflows.

See Defining a New Business Assumption, for information on the steps involved in specifying this assumption.

The steps involved in applying the delay in cash flow timing assumption to cash flows are as follows: