9.7.6.1 Executing a Contractual Run

To execute a Contractual Run, perform the following steps:

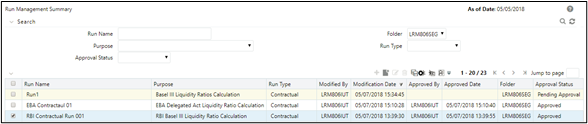

- Click Run Management on the LHS menu of the application to open the Run Management Summary window.

- Click

to select a contractual Run from the list of Runs and click

iconFigure 8-25 Run summary

Note:

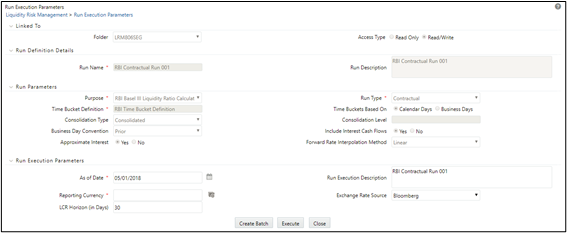

All fields except for Run execution parameters are non-editable fields for the selected Run.

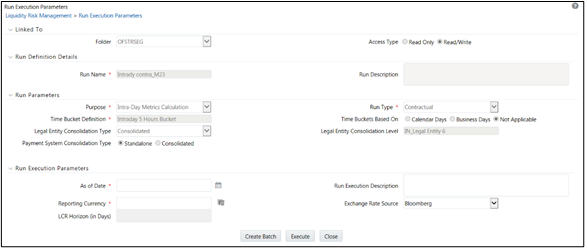

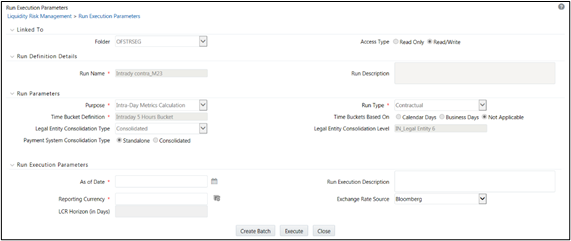

Figure 8-26 Run Execution Parameters

- When the Run type is selected as Contractual and the purpose is selected as Basel III Liquidity Ratios Calculation or Long Term Gap Calculation or U.S Fed Liquidity Ratio Calculation, EBA Delegated Act Liquidity Ratio Calculation, RBI Basel III Liquidity Ratio Calculation, BOT Liquidity Ratio Calculation, BNM Liquidity Ratio Calculation, MAS Liquidity Ratio Calculation in the Run Execution Parameters section,

- Click

to select the As of Date - Enter the Run Execution Description.

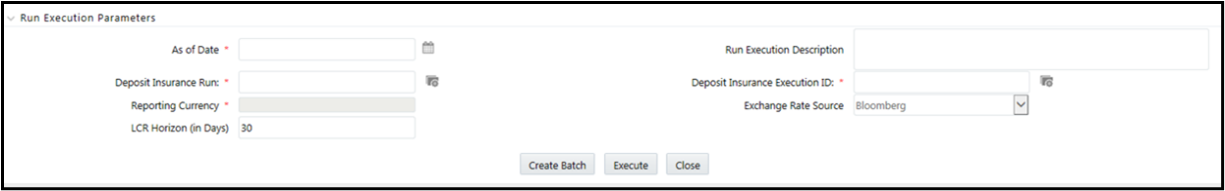

- Enter details in the fields Deposit Insurance Run and Deposit Insurance Execution ID. This is applicable only if selected run purpose is U.S Fed Liquidity Ratio Calculation, BNM Liquidity Ratio Calculation, or MAS Liquidity Ratio Calculation.

Figure 8-27 Run type

- Click

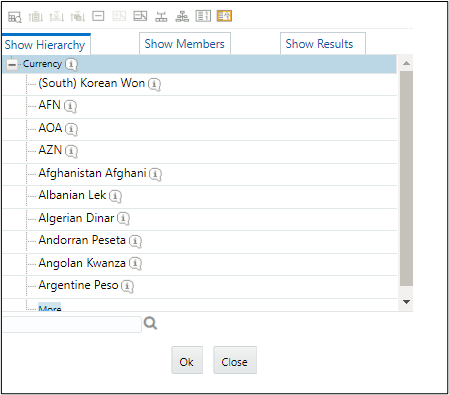

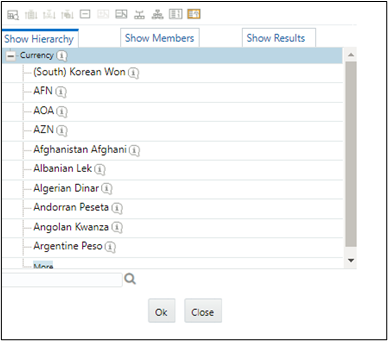

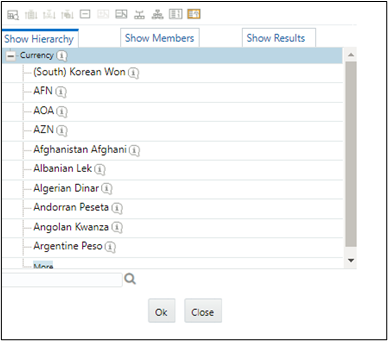

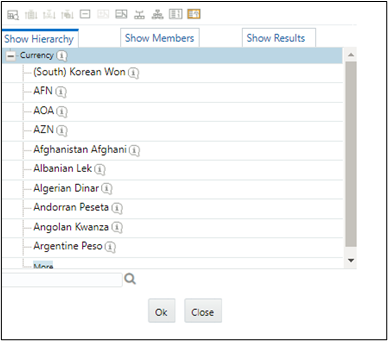

to select the Reporting Currency from the Hierarchy Browser and then click OK. Only a single selection is allowed here.Figure 8-28 Run Definition – Hierarchy Browser

- Select the Exchange Rate Source from the drop-down list.

- Enter the LCR Horizon (in days). The default value is 30. This applicable only when the purpose is selected as Basel III Liquidity Ratios Calculation or U.S Fed Liquidity Ratio Calculation.

- Click

- When the Run type is selected as Contractual and the purpose is selected as FR 2052 a Report Generation or FR 2052 b Report Generation, in the Run Execution Parameters section,

- Click

to select the As of Date - Enter the Run Execution Description.

- Click

to select the Reporting Currency from the Hierarchy Browser and then click OK.

- Select the Exchange Rate Source from the drop-down list.

- Click

- When the Run type is selected as Contractual and the purpose is selected as Intra-Day Metrics Calculation, in the Run Execution Parameters section:

Figure 8-29 Run Execution Parameters

- Click

to select the As of Date. - Enter the Run Execution Description.

- Click

to select the Reporting Currency from the Hierarchy Browser and then click OK

- Select the Exchange Rate Sourcefrom the drop-down list.

- Click

- When the Run type is selected as Contractual and the purpose is selected as Regulation YY Liquidity Risk Calculation, in the Run Execution Parameters section:

Figure 8-30 Run execution

- Click

to select the As of Date. - Enter the Run Execution Description.

- Click

to select the Reporting Currency from the Hierarchy Browser and then click OK.Figure 8-31 Show Hierarchy

- Select the Exchange Rate Source from the drop-down list.

- Enter the Buffer Horizon value in days.

- Enter the Stress Horizon value or click

to select from the available options. This field allows you to specify the value in terms of days and allows multiple horizons to be provided as an input.

- Click

- Execute the Run as per one of the following methods

- Click Create Batch to create batches for execution from the batch execution window.OR

- Click Execute to execute the Run from the Run Execution Parameters window itself.

- Click Close to return to the Run Management Summary window.

Note:

Run Execution Parameter Definition does not have an approval process.

- Click Create Batch to create batches for execution from the batch execution window.