10.1.3.4 New Repos

This counterbalancing position type allows you to create new repo transactions by

selecting an existing asset. Creation of a new repo, results in a cash inflow on the

repo start date and a corresponding outflow at the repo maturity date specified as part

of the counterbalancing position. New repos can be created for the following types of

marketable instruments:

- Unencumbered securities (identified through encumbrance status)

- Securities for which the bank has re-hypothecation rights (indicator for re-hypothecation rights)

- No of Units to be Repo’d: This is the number of units of the asset to be repo’d.

- Haircut (in %): This is the haircut applied to calculate the repo value.

- Revised Inflow Bucket: This is the bucket where the inflows from the repo are received and the asset is encumbered i.e. repo start bucket.

- Revised Maturity Bucket: This is the time bucket in which the repo contract matures i.e. where the asset is received and cash is paid to the counterparty.

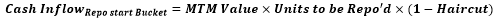

The cash flows on repo creation are calculated as follows:

- Cash inflows occurring in the repo start bucket are calculated as follows:

- Cash outflows to be posted to the revised maturity bucket are user specified.

- The underlying asset is encumbered i.e. encumbrance status is updated.

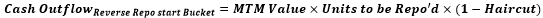

The cash flows on repo creation are calculated as follows:

- Cash outflows occurring in the reverse repo start bucket are calculated as

follows:

- Cash inflows to be posted to the revised maturity bucket are user specified.

Note:

- Revised maturity bucket cannot exceed maturity bucket of underlying security.

- All repo like instruments are supported as part of this counterbalancing action including repo’s, reverse repo’s, buy/sell backs and sell/buy backs.

- The units of the asset available to be repo’d depend on the repo limit that is specified. For instance, if the total units of Bond A held by a legal entity are 100 and a repo limit of 40% is specified, then only 40 units of Bond A are allowed to be repo’d while counterbalancing.

- If all available units of an asset are repo’d then it does not appear for selection in the Marketable Assets Browser.

- In case of partial repo, only the balance units/amount appears in the Units Available column for further counterbalancing actions (e.g. sale of marketable assets). If only some units of an instrument are repo’d, then it can be selected again for the purpose of repo provided the repo parameters differ (e.g. with a different haircut or time bucket).

- Exposure to an existing counterparty while creating new repos is allowed only up to the counterparty limit specified. For instance if the counterparty limit is specified as 1 Million for Counterparty X, the current exposure is 900000, then creation of new repo’s is allowed only up to an exposure of 100000 against Counterparty X.