10.1.3.3 Rollover of Existing Repos

This counterbalancing position type allows you to extend the maturity of an existing repo/reverse repo by rolling it over to a later time bucket. This results in rescheduling of cash outflows/inflows to a future date and reversal of cash outflows/inflows at the original maturity. This is applied at an individual instrument position level.

As part of this counterbalancing position, you are required to select an

existing repo and provide the following rollover parameters:

- Units to be Rolled Over: This is the number of units of the underlying asset that are to be rolled over.

- Revised Maturity Bucket: This is the new maturity bucket post rollover. Revised maturity bucket should be less than or equal to the maturity bucket of the underlying instrument.

- Haircut (in %): Provide the Haircut in %.

The cash flows on rollover of repos and similar instruments are calculated as follows:

- Original maturity bucket and maturity amount of the repo is identified.

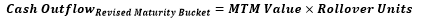

- Original cash outflows occurring in the original maturity bucket are reversed:

- Cash outflows to be posted to the revised maturity bucket are calculated as

follows:

The cash flows on rollover of reverse repos and similar instruments are calculated as follows:

- Original maturity bucket and maturity amount of the reverse repo is identified.

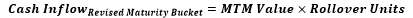

- Original cash inflows occurring in the original maturity bucket are reversed:

- Cash inflows to be posted to the revised maturity bucket are calculated as

follows:

Note:

- Revised maturity bucket cannot exceed maturity bucket of underlying security.

- All repo like instruments are supported as part of this counterbalancing action including repo’s, reverse repo’s, buy/sell backs and sell/buy backs.