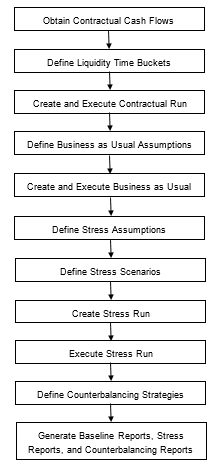

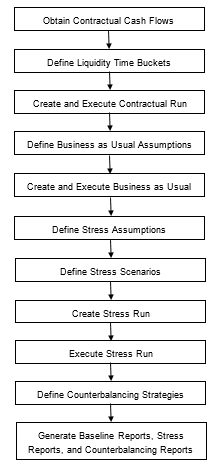

3.1 Process Flow

The application process flow is as follows:

Figure 2-1 LRS Process Flow

- Obtaining Contractual Cash Flows and Defining Liquidity Time Buckets: The process of liquidity risk management begins in LRM, after obtaining the contractual cash flows as a download from the ALM systems. If OFS ALM is installed, the required cash flows can be selected from the Application Preferences window of LRM. After selecting the contractual cash flows, liquidity time buckets must be defined. The liquidity buckets may be multi-level time buckets. The contractual cash flows should be bucketed, to calculate the liquidity gaps, ratios, and to perform other analysis. These can be estimated on a solo or consolidated basis.

- Executing Contractual Run: The Contractual Run is then executed. A Contractual Run does not anticipate any change from the normal behavior, and goes according to the contractual terms. For that, the cash flows are first converted to the local or reporting currency. Cash flows are then assigned to time buckets and liquidity gaps under contractual terms are estimated. Cash flows need to be aggregated, as they are large in number and it takes time to execute them individually. For example, during the Exadata tuning test that was conducted in October 2014, for OFS LRS, 20 billion cash flows were aggregated to 9 million cash flows. The Contractual Runs can be scheduled to run overnight, as and when data arrives from each Line of Business (LOB).

- Executing BAU Run: After the liquidity gaps are estimated under contractual terms, the changes in cash flows during the normal course of business due to consumer behavior, are estimated. This involves defining business assumptions based on multiple rules and specifying assumption values. For example, following is an assumption: “20% of retail loans with maturity less than 6 months are prepaid in the 1-month bucket”. Assumption values specified for each dimension member combination, is selected from pre-defined business hierarchies/dimensions. Once these assumptions are defined, they are grouped together and applied to contractual cash flows as part of the BAU Run or Baseline Run execution process. BAU runs are scheduled to run overnight as and when, data arrives from each LOB. The impact of these business assumptions on liquidity gaps, ratios, and other metrics is estimated.

- Executing Stress Run: The next step in the liquidity risk process is stress testing, which begins with defining stress values for business assumptions. A baseline rule is replaced by one or multiple stress rules to create stress scenarios. The stress scenario mapped to a Baseline Run, to generate a Stress Run. Stress values are specified for each dimension member combination, selected from pre-defined business hierarchies/dimensions. Stress runs are scheduled to run overnight, intra-day, or at any other frequency. The Stress Run is executed and the impact of the scenario on liquidity gaps, ratios, and other metrics is estimated.

- Counterbalancing Strategies: Once the Runs are executed, the liquidity gaps are analyzed to identify liquidity mismatches which could cause potential losses. These are managed by defining and applying counterbalancing strategies. Counterbalancing strategies can be applied to Contractual Runs, BAU Runs, and Stress Runs. Counterbalancing strategies are a combination of one or multiple counterbalancing positions which include sale of assets, creation or rollover of repos, new funding, and so on.

- LRS Reports: Finally, LRS generates reports such as Baseline reports, Stress reports, and Counterbalancing reports, that enable a detailed view of the liquidity risk metrics.