8.2.1.6 Rollover

Rollover refers to the rescheduling of a certain percentage of cash flows to a future time bucket. This occurs when an asset/liability is renewed for an additional term. The amount of cash flow rolled over is thus reduced/increased from the original time bucket and assigned to the new time bucket in the future.

The assumption specification and computation method for this sub category remain unchanged. This sub category allows rollovers to be specified even on repos, reverse repos and swaps. In case of rollover of swaps, the user is required to select the transaction legs option as two.

If a rollover is specified on an asset or liability that has underlying collateral, then the availability of the underlying should be determined. Only if the underlying collateral is available during the extended period, the assumption should be allowed to be saved

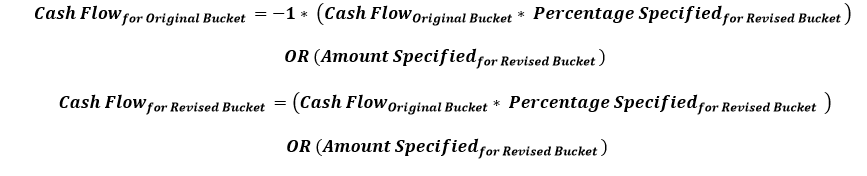

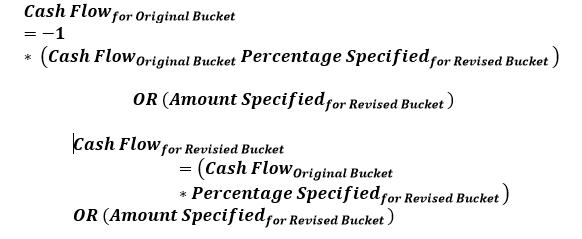

Rollover of assets impacts the inflow amount and rollover of liabilities impacts the cash outflow amount. The signage and computation depends on the product type selected. In a rollover assumption, cash flow movement happens from previous bucket/s to the forward buckets.

See Defining a New Business Assumption, for information on the steps involved in specifying this assumption.

The steps involved in applying the delay in cash flow timing assumption to cash flows are: