8.2.1.7 Run-Off

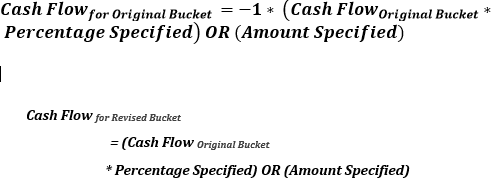

In a Run-off assumption the bank assumes that a certain percentage of deposits/liabilities will be withdrawn by their customers before the scheduled maturity of the deposit. This business assumption would result in an additional outflow in an earlier time bucket and a reduction in the contractual cash outflow in the original time bucket. The assumption can also be applied to assets as well, where the impact on cash flows will be opposite to that specified for deposits above.

The cash flow movement happens from forward bucket/s to the previous bucket/s since cash flows which were expected to be withdrawn at a future date are getting withdrawn as on date.

See Defining a New Business Assumption, for information on the steps involved in specifying this assumption.

The steps involved in applying the delay in cash flow timing assumption to cash flows are as follows: