4.3.13 Calculating Twenty-Four Month Look-back Amount

The application computes the 24-month look-back amount, to define outflows due to increased liquidity needs related to market valuation changes on derivatives as follows:

- The Mark-to-Market (MTM) value of collateral outflows and inflows due to valuation changes on derivative transactions are captured at a legal entity level. The values over a 24-month historical time window from the As of date are identified.

- The application computes the largest 30-day absolute net collateral flow

occurring within each rolling 30-day historical time window as follows:

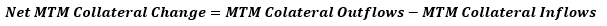

- The net Mark-to-Market collateral change is computed for each day

within a particular 30-day historical time window as follows:

Figure 3-20 Net MTM Collateral Change

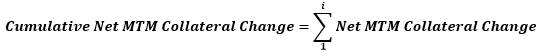

- The cumulative net Mark-to-Market collateral change is computed for

each day within a particular 30-day historical time window as follows:

Figure 3-21 Cumulative Net MTM Collateral Change

Where:

i: Each day within a particular 30-day historical time window.

n: Each 30-day historical time window.

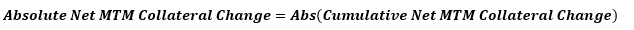

- The absolute net Mark-to-Market collateral change is computed for

each day within the rolling 30-day historical time window as follows:

Figure 3-22 Absolute Net MTM Collateral Change

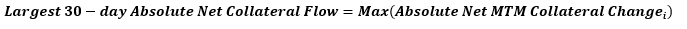

- The largest 30-day absolute net collateral flow occurring within the

rolling 30-day historical time window is identified as follows:

Figure 3-23 Largest 30-day Absolute Net MTM Collateral Change

Note:

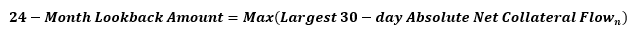

Steps (a) to (b) are repeated for each rolling 30-day historical time window. - The 24-month look-back amount is calculated as follows:

Figure 3-24 24-month Lookback Amount

Note:

- This calculation is done for each legal entity separately.

- The largest 30-day absolute net collateral flow is computed in 30-day blocks on a rolling basis. For example, the first 30-day block is As of Date to As of Date - 29; the second 30-day block is As of Date - 1 to As of Date - 30 and so on.

- The 24-month look-back amount is computed as the maximum of the largest absolute net collateral flow during all rolling 30-day periods in every 24 months.

The 24-month look-back calculations are illustrated in the following table, considering a 34-day historical time window instead of 24-months. This results in 5 rolling 30-day windows.

Table 3-5 Illustration: 24-month look-back calculations

Rolling 30-Day Period Day Market To Market Outflows Due To Derivative Transaction Valuation Changes (a) Market To Market Collateral Inflows Due To Derivative Transaction Valuation Changes (b) Net Market To Market Collateral Change (c = a – b) Cumulative Net Market To Market Collateral Change (d = Cumulative c) Absolute Net Market To Market Collateral Change [e = Abs (d)] As of Date to As of Date - 29 As of Date 65 14 51 51 51 As of Date - 1 65 9 56 107 107 As of Date - 2 74 83 -9 98 98 As of Date - 3 71 97 -26 72 72 As of Date - 4 84 89 -5 67 67 As of Date - 5 8 57 -49 18 18 As of Date - 6 40 59 -19 -1 1 As of Date - 7 42 87 -45 -46 46 As of Date - 8 100 6 94 48 48 As of Date - 9 41 30 11 59 59 As of Date - 10 45 9 36 95 95 As of Date - 11 9 32 -23 72 72 As of Date - 12 59 67 -8 64 64 As of Date - 13 61 10 51 115 115 As of Date - 14 22 36 -14 101 101 As of Date - 15 63 81 -18 83 83 As of Date - 16 36 3 33 116 116 As of Date - 17 61 22 39 155 155 As of Date - 18 94 37 57 212 212 As of Date - 19 3 18 -15 197 197 As of Date - 20 13 27 -14 183 183 As of Date - 21 24 56 -32 151 151 As of Date - 22 57 75 -18 133 133 As of Date - 23 66 87 -21 112 112 As of Date - 24 33 71 -38 74 74 As of Date - 25 29 30 -1 73 73 As of Date - 26 64 25 39 112 112 As of Date - 27 54 39 15 127 127 As of Date - 28 51 6 45 172 172 As of Date - 29 35 31 4 176 176 As of Date - 1 to As of Date - 30 As of Date - 1 65 9 56 56 56 As of Date - 2 74 83 -9 47 47 As of Date - 3 71 97 -26 21 21 As of Date - 4 84 89 -5 16 16 As of Date - 5 8 57 -49 -33 33 As of Date - 6 40 59 -19 -52 52 As of Date - 7 42 87 -45 -97 97 As of Date - 8 100 6 94 -3 3 As of Date - 9 41 30 11 8 8 As of Date - 10 45 9 36 44 44 As of Date - 11 9 32 -23 21 21 As of Date - 12 59 67 -8 13 13 As of Date - 13 61 10 51 64 64 As of Date - 14 22 36 -14 50 50 As of Date - 15 63 81 -18 32 32 As of Date - 16 36 3 33 65 65 As of Date - 17 61 22 39 104 104 As of Date - 18 94 37 57 161 161 As of Date - 19 3 18 -15 146 146 As of Date - 20 13 27 -14 132 132 As of Date - 21 24 56 -32 100 100 As of Date - 22 57 75 -18 82 82 As of Date - 23 66 87 -21 61 61 As of Date - 24 33 71 -38 23 23 As of Date - 25 29 30 -1 22 22 As of Date - 26 64 25 39 61 61 As of Date - 27 54 39 15 76 76 As of Date - 28 51 6 45 121 121 As of Date - 29 35 31 4 125 125 As of Date - 30 93 68 25 150 150 As of Date - 2 to As of Date - 31 As of Date - 2 74 83 -9 -9 9 As of Date - 3 71 97 -26 -35 35 As of Date - 4 84 89 -5 -40 40 As of Date - 5 8 57 -49 -89 89 As of Date - 6 40 59 -19 -108 108 As of Date - 7 42 87 -45 -153 153 As of Date - 8 100 6 94 -59 59 As of Date - 9 41 30 11 -48 48 As of Date - 10 45 9 36 -12 12 As of Date - 11 9 32 -23 -35 35 As of Date - 12 59 67 -8 -43 43 As of Date - 13 61 10 51 8 8 As of Date - 14 22 36 -14 -6 6 As of Date - 15 63 81 -18 -24 24 As of Date - 16 36 3 33 9 9 As of Date - 17 61 22 39 48 48 As of Date - 18 94 37 57 105 105 As of Date - 19 3 18 -15 90 90 As of Date - 20 13 27 -14 76 76 As of Date - 21 24 56 -32 44 44 As of Date - 22 57 75 -18 26 26 As of Date - 23 66 87 -21 5 5 As of Date - 24 33 71 -38 -33 33 As of Date - 25 29 30 -1 -34 34 As of Date - 26 64 25 39 5 5 As of Date - 27 54 39 15 20 20 As of Date - 28 51 6 45 65 65 As of Date - 29 35 31 4 69 69 As of Date - 30 93 68 25 94 94 As of Date - 31 51 97 -46 48 48 As of Date - 3 to As of Date - 32 As of Date - 3 71 97 -26 -26 26 As of Date - 4 84 89 -5 -31 31 As of Date - 5 8 57 -49 -80 80 As of Date - 6 40 59 -19 -99 99 As of Date - 7 42 87 -45 -144 144 As of Date - 8 100 6 94 -50 50 As of Date - 9 41 30 11 -39 39 As of Date - 10 45 9 36 -3 3 As of Date - 11 9 32 -23 -26 26 As of Date - 12 59 67 -8 -34 34 As of Date - 13 61 10 51 17 17 As of Date - 14 22 36 -14 3 3 As of Date - 15 63 81 -18 -15 15 As of Date - 16 36 3 33 18 18 As of Date - 17 61 22 39 57 57 As of Date - 18 94 37 57 114 114 As of Date - 19 3 18 -15 99 99 As of Date - 20 13 27 -14 85 85 As of Date - 21 24 56 -32 53 53 As of Date - 22 57 75 -18 35 35 As of Date - 23 66 87 -21 14 14 As of Date - 24 33 71 -38 -24 24 As of Date - 25 29 30 -1 -25 25 As of Date - 26 64 25 39 14 14 As of Date - 27 54 39 15 29 29 As of Date - 28 51 6 45 74 74 As of Date - 29 35 31 4 78 78 As of Date - 30 93 68 25 103 103 As of Date - 31 51 97 -46 57 57 As of Date - 32 12 31 -19 38 38 As of Date - 4 to As of Date - 33 As of Date - 4 84 89 -5 -5 5 As of Date - 5 8 57 -49 -54 54 As of Date - 6 40 59 -19 -73 73 As of Date - 7 42 87 -45 -118 118 As of Date - 8 100 6 94 -24 24 As of Date - 9 41 30 11 -13 13 As of Date - 10 45 9 36 23 23 As of Date - 11 9 32 -23 0 0 As of Date - 12 59 67 -8 -8 8 As of Date - 13 61 10 51 43 43 As of Date - 14 22 36 -14 29 29 As of Date - 15 63 81 -18 11 11 As of Date - 16 36 3 33 44 44 As of Date - 17 61 22 39 83 83 As of Date - 18 94 37 57 140 140 As of Date - 19 3 18 -15 125 125 As of Date - 20 13 27 -14 111 111 As of Date - 21 24 56 -32 79 79 As of Date - 22 57 75 -18 61 61 As of Date - 23 66 87 -21 40 40 As of Date - 24 33 71 -38 2 2 As of Date - 25 29 30 -1 1 1 As of Date - 26 64 25 39 40 40 As of Date - 27 54 39 15 55 55 As of Date - 28 51 6 45 100 100 As of Date - 29 35 31 4 104 104 As of Date - 30 93 68 25 129 129 As of Date - 31 51 97 -46 83 83 As of Date - 32 12 31 -19 64 64 As of Date - 33 34 36 -2 62 62

- The net Mark-to-Market collateral change is computed for each day

within a particular 30-day historical time window as follows:

The largest 30-day absolute net collateral flow for each rolling 30-day period and the 24-month look-back value (in this example, the 34-day look-back value) is computed as follows:

Table 3-6 Illustration continued: 24-month look-back calculations

| Rolling 30-Day Period | Largest 30-Day Absolute Net Collateral Flow [f = Max (e)] | 24 Month Look-back Value [Max (f)] |

|---|---|---|

| As of Date to As of Date - 29 | 212 | 212 |

| As of Date - 1 to As of Date - 30 | 161 | |

| As of Date - 2 to As of Date - 31 | 153 | |

| As of Date - 3 to As of Date - 32 | 144 | |

| As of Date - 4 to As of Date - 33 | 140 |