- User Guide

- Liquidity Coverage Ratio Calculation

- Process Flow

- Calculation of Twenty Four Month Look-back Amount

4.2.11 Calculation of Twenty Four Month Look-back Amount

The application computes the 24 month look-back amount, for the purpose of

defining outflows due to increased liquidity needs related to market valuation changes

on derivatives as per the procedure given below:

- The Mark-to-Market (MTM) value of collateral outflows and inflows due to valuation changes on derivative transactions are captured at a legal entity level. The values over a 24-month historical time window from the “as of date” are identified.

- The application computes the largest 30-day absolute net collateral flow occurring within each rolling 30-day historical time window as follows:

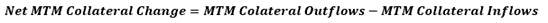

- The net Mark-to-Market collateral change is computed for each day within a

particular 30-day historical time window as follows:

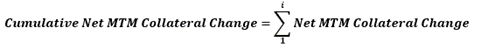

- The cumulative net Mark-to-Market collateral change is computed for each day

within a particular 30-day historical time window as follows:

Where,i : Each day within a particular 30-day historical time windown : Each 30-day historical time window - The absolute net Mark-to-Market collateral change is computed for each day

within the rolling 30-day historical time window as follows:

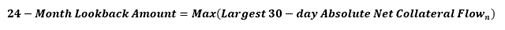

- The largest 30-day absolute net collateral flow occurring within the rolling

30-day historical time window is identified as follows:

Note:

Steps (1) to (4) are repeated for each rolling 30-day historical time window. - The 24-month look-back amount is calculated as follows:

Note:

- This calculation is done for each legal entity separately.

- The largest 30-day absolute net collateral flow is computed in 30 day blocks on a rolling basis that is first 30-day block is As of Date to As of Date - 29; second 30-day block is As of Date - 1 to As of Date - 30 and so on.

- The 24 month look-back amount is computed as the maximum of the largest absolute net collateral flow during all rolling 30-day periods in each 24 month period.

The 24-month look-back calculations are illustrated below considering a 34-day historical time window instead of 24-months. This results in 5 rolling 30-day windows.Table 3-1 24-month look-back calculations

Rolling 30-Day Period Day Mark-To-Market Collateral Outflows Due To Derivative Transaction Valuation Changes (a) Mark-To-Market Collateral Inflows Due To Derivative Transaction Valuation Changes (b) Net Mark-To-Market Collateral Change (c = a – b) Cumulative Net Mark-To-Market Collateral Change (d = Cumulative c) Absolute Net Mark-To-Market Collateral Change [e = Abs (d)] As of Date to As of Date - 29 As of Date 65 14 51 51 51 As of Date - 1 65 9 56 107 107 As of Date - 2 74 83 -9 98 98 As of Date - 3 71 97 -26 72 72 As of Date - 4 84 89 -5 67 67 As of Date - 5 8 57 -49 18 18 As of Date - 6 40 59 -19 -1 1 As of Date - 7 42 87 -45 -46 46 As of Date - 8 100 6 94 48 48 As of Date - 9 41 30 11 59 59 As of Date - 10 45 9 36 95 95 As of Date - 11 9 32 -23 72 72 As of Date - 12 59 67 -8 64 64 As of Date - 13 61 10 51 115 115 As of Date - 14 22 36 -14 101 101 As of Date - 15 63 81 -18 83 83 As of Date - 16 36 3 33 116 116 As of Date - 17 61 22 39 155 155 As of Date - 18 94 37 57 212 212 As of Date - 19 3 18 -15 197 197 As of Date - 20 13 27 -14 183 183 As of Date - 21 24 56 -32 151 151 As of Date - 22 57 75 -18 133 133 As of Date - 23 66 87 -21 112 112 As of Date - 24 33 71 -38 74 74 As of Date - 25 29 30 -1 73 73 As of Date - 26 64 25 39 112 112 As of Date - 27 54 39 15 127 127 As of Date - 28 51 6 45 172 172 As of Date - 29 35 31 4 176 176 As of Date - 1 to As of Date - 30 As of Date - 1 65 9 56 56 56 As of Date - 2 74 83 -9 47 47 As of Date - 3 71 97 -26 21 21 As of Date - 4 84 89 -5 16 16 As of Date - 5 8 57 -49 -33 33 As of Date - 6 40 59 -19 -52 52 As of Date - 7 42 87 -45 -97 97 As of Date - 8 100 6 94 -3 3 As of Date - 9 41 30 11 8 8 As of Date - 10 45 9 36 44 44 As of Date - 11 9 32 -23 21 21 As of Date - 12 59 67 -8 13 13 As of Date - 13 61 10 51 64 64 As of Date - 14 22 36 -14 50 50 As of Date - 15 63 81 -18 32 32 As of Date - 16 36 3 33 65 65 As of Date - 17 61 22 39 104 104 As of Date - 18 94 37 57 161 161 As of Date - 19 3 18 -15 146 146 As of Date - 20 13 27 -14 132 132 As of Date - 21 24 56 -32 100 100 As of Date - 22 57 75 -18 82 82 As of Date - 23 66 87 -21 61 61 As of Date - 24 33 71 -38 23 23 As of Date - 25 29 30 -1 22 22 As of Date - 26 64 25 39 61 61 As of Date - 27 54 39 15 76 76 As of Date - 28 51 6 45 121 121 As of Date - 29 35 31 4 125 125 As of Date - 30 93 68 25 150 150 As of Date - 2 to As of Date - 31 As of Date - 2 74 83 -9 -9 9 As of Date - 3 71 97 -26 -35 35 As of Date - 4 84 89 -5 -40 40 As of Date - 5 8 57 -49 -89 89 As of Date - 6 40 59 -19 -108 108 As of Date - 7 42 87 -45 -153 153 As of Date - 8 100 6 94 -59 59 As of Date - 9 41 30 11 -48 48 As of Date - 10 45 9 36 -12 12 As of Date - 11 9 32 -23 -35 35 As of Date - 12 59 67 -8 -43 43 As of Date - 13 61 10 51 8 8 As of Date - 14 22 36 -14 -6 6 As of Date - 15 63 81 -18 -24 24 As of Date - 16 36 3 33 9 9 As of Date - 17 61 22 39 48 48 As of Date - 18 94 37 57 105 105 As of Date - 19 3 18 -15 90 90 As of Date - 20 13 27 -14 76 76 As of Date - 21 24 56 -32 44 44 As of Date - 22 57 75 -18 26 26 As of Date - 23 66 87 -21 5 5 As of Date - 24 33 71 -38 -33 33 As of Date - 25 29 30 -1 -34 34 As of Date - 26 64 25 39 5 5 As of Date - 27 54 39 15 20 20 As of Date - 28 51 6 45 65 65 As of Date - 29 35 31 4 69 69 As of Date - 30 93 68 25 94 94 As of Date - 31 51 97 -46 48 48 As of Date - 3 to As of Date - 32 As of Date - 3 71 97 -26 -26 26 As of Date - 4 84 89 -5 -31 31 As of Date - 5 8 57 -49 -80 80 As of Date - 6 40 59 -19 -99 99 As of Date - 7 42 87 -45 -144 144 As of Date - 8 100 6 94 -50 50 As of Date - 9 41 30 11 -39 39 As of Date - 10 45 9 36 -3 3 As of Date - 11 9 32 -23 -26 26 As of Date - 12 59 67 -8 -34 34 As of Date - 13 61 10 51 17 17 As of Date - 14 22 36 -14 3 3 As of Date - 15 63 81 -18 -15 15 As of Date - 16 36 3 33 18 18 As of Date - 17 61 22 39 57 57 As of Date - 18 94 37 57 114 114 As of Date - 19 3 18 -15 99 99 As of Date - 20 13 27 -14 85 85 As of Date - 21 24 56 -32 53 53 As of Date - 22 57 75 -18 35 35 As of Date - 23 66 87 -21 14 14 As of Date - 24 33 71 -38 -24 24 As of Date - 25 29 30 -1 -25 25 As of Date - 26 64 25 39 14 14 As of Date - 27 54 39 15 29 29 As of Date - 28 51 6 45 74 74 As of Date - 29 35 31 4 78 78 As of Date - 30 93 68 25 103 103 As of Date - 31 51 97 -46 57 57 As of Date - 32 12 31 -19 38 38 As of Date - 4 to As of Date - 33 As of Date - 4 84 89 -5 -5 5 As of Date - 5 8 57 -49 -54 54 As of Date - 6 40 59 -19 -73 73 As of Date - 7 42 87 -45 -118 118 As of Date - 8 100 6 94 -24 24 As of Date - 9 41 30 11 -13 13 As of Date - 10 45 9 36 23 23 As of Date - 11 9 32 -23 0 0 As of Date - 12 59 67 -8 -8 8 As of Date - 13 61 10 51 43 43 As of Date - 14 22 36 -14 29 29 As of Date - 15 63 81 -18 11 11 As of Date - 16 36 3 33 44 44 As of Date - 17 61 22 39 83 83 As of Date - 18 94 37 57 140 140 As of Date - 19 3 18 -15 125 125 As of Date - 20 13 27 -14 111 111 As of Date - 21 24 56 -32 79 79 As of Date - 22 57 75 -18 61 61 As of Date - 23 66 87 -21 40 40 As of Date - 24 33 71 -38 2 2 As of Date - 25 29 30 -1 1 1 As of Date - 26 64 25 39 40 40 As of Date - 27 54 39 15 55 55 As of Date - 28 51 6 45 100 100 As of Date - 29 35 31 4 104 104 As of Date - 30 93 68 25 129 129 As of Date - 31 51 97 -46 83 83 As of Date - 32 12 31 -19 64 64 As of Date - 33 34 36 -2 62 62 The largest 30-day absolute net collateral flow for each rolling 30-day period and the 24 month look-back value (in this example, the 34 day look-back value) are computed as follows:Rolling 30-Day Period Largest 30-Day Absolute Net Collateral Flow [f = Max (e)] 24 Month Look-back Value [Max (f)] As of Date to As of Date - 29 212 212 As of Date - 1 to As of Date - 30 161 As of Date - 2 to As of Date - 31 153 As of Date - 3 to As of Date - 32 144 As of Date - 4 to As of Date - 33 140