7 Net Stable Funding Ratio Calculation

Net Stable Funding Ratio (NSFR) is one of the two minimum standards developed to promote funding and liquidity management in financial institutions. NSFR assesses the bank’s liquidity risks over a longer time horizon. Both the standards, complement each other, are aimed at providing a holistic picture of a bank’s funding risk profile, and aid in better liquidity risk management practices.

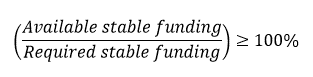

NSFR is defined as the amount of available stable funding relative to the required stable

funding. Available stable funding refers to the portion of capital and liabilities

expected to be reliable over the horizon of 1 year. Required stable funding refers to

the portion of assets and off balance sheet exposures over the same horizon. The NSFR

ratio is expected to be at least 100%.